- The total crypto market cap declined by 10% in Q3 but was still up 35% year-to-date.

- Stablecoins’ market cap shrank by 3.8%, with TrueUSD being the notable gainer.

- Tokenized Treasury bills emerged as significant drivers of on-chain real-world assets, totaling $665 million

- Several lawsuits against people in the crypto industry were filed

Market Trends and Capitalization

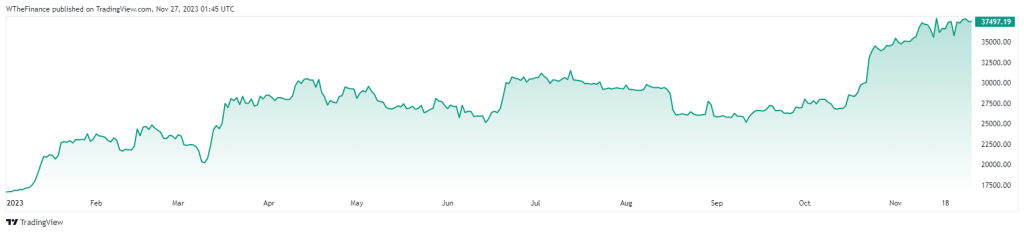

Cryptocurrency prices have generally trended higher in 2023, buoyed by an improved outlook for the U.S. economy and increased investor interest in Bitcoin. Looking back at 2023, the cryptocurrency markets witnessed significant events that shaped the landscape of digital assets. A notable market downturn occurred in mid-August, where Bitcoin‘s value dropped significantly, leading to a decrease in the overall market capitalization from $1.2 trillion to $1.1 trillion in a single day, indicative of a broader slowdown without any major market-related news

The third quarter of 2023 was a tumultuous period for the cryptocurrency market, with the total market capitalization witnessing a 10% contraction. Nevertheless, the year-to-date figures remained bullish, showing a 35% increase. This dip in Q3 was mirrored in the stablecoin market, where a general shrinkage of 3.8% was observed. Amidst this contraction, TrueUSD emerged as an outlier, registering growth against the tide.

#Crypto total market cap is at $1.4T!

— Dami-Defi (@DamiDefi) November 26, 2023

Up 75% in 2023 🔥.

Just shy of half of the 2021 bull run all time high. It's actually happening. pic.twitter.com/xaSiadpxGD

Bitcoin in 2023

In 2023, Bitcoin’s price experienced notable fluctuations, starting the year at $16,668 and soaring to over $37,000 towards the end of the year, with a high of $37,881 in November. This significant increase represents more than a 120% rise in value, indicating a robust recovery and growing investor confidence in the cryptocurrency. The rise is remarkable considering the broader financial context and the volatile nature of cryptocurrency markets. This surge in Bitcoin’s price reflects its growing acceptance and possible mainstream adoption, along with an overall bullish sentiment in the crypto market.

The buzz surrounding Bitcoin Spot Exchange-Traded Funds (ETFs) in 2023 has been significant, particularly in the United States. According to Coinbase, if approved, these ETFs could profoundly impact the cryptocurrency market by introducing it to new classes of investors. These include registered investment advisers (RIAs), retirement funds, and institutions that historically have had limited access to cryptocurrencies. David Duong, the head of institutional research at Coinbase, suggests that the introduction of Bitcoin Spot ETFs would not only enable new capital to access the crypto market but also improve liquidity and price discovery for all market participants.

Furthermore, the existence of such an investment vehicle meeting key regulatory and compliance requirements could lead to the development of new products, potentially multiplying crypto offerings for accredited investors and expanding adoption. Over time, this could significantly boost the total crypto market cap and lay the foundation for a more regulated environment with greater inclusion and material growth in demand. In the context of rising geopolitical tensions and economic dysfunction, as well as instability in traditional markets like U.S. Treasury bonds and the banking sector, Bitcoin and crypto ETFs are seen as attractive alternatives, providing a hedge against traditional financial system vulnerabilities.

Bitcoin Ventures into DeFi with BitVM

In 2023, the cryptocurrency world saw the introduction of BitVM, a novel Bitcoin script aimed at revolutionizing the way smart contracts are executed on the Bitcoin network. Developed by Bitcoin developer Linus, BitVM presents a new method to utilize complex smart contracts, potentially enabling more advanced applications. It’s a significant move that could increase Bitcoin’s scalability and transaction processing capabilities, with claims that Bitcoin might handle millions of transactions easily using BitVM.

BitVM operates through off-chain transactions, speeding up computations and saving space, akin to the Lightning Network. This method allows it to function seamlessly on the Bitcoin blockchain without requiring a soft fork, a major advancement considering the challenges faced in implementing past soft forks like Taproot. Despite its potential, BitVM has sparked debate within the crypto community, with some critics doubting its long-term viability and questioning its verification speed. The implementation of BitVM could also extend to Ethereum, indicating its broader applicability in the blockchain sphere.

Price of Bitcoin in 2023

Tokenized Treasury Bills

A new trend arose with tokenized Treasury bills, which became a considerable force in the on-chain real-world assets category, accumulating to $665 million. This indicates a growing intersection between traditional finance and decentralized technologies, reflecting a diversification in blockchain applications beyond just cryptocurrencies.

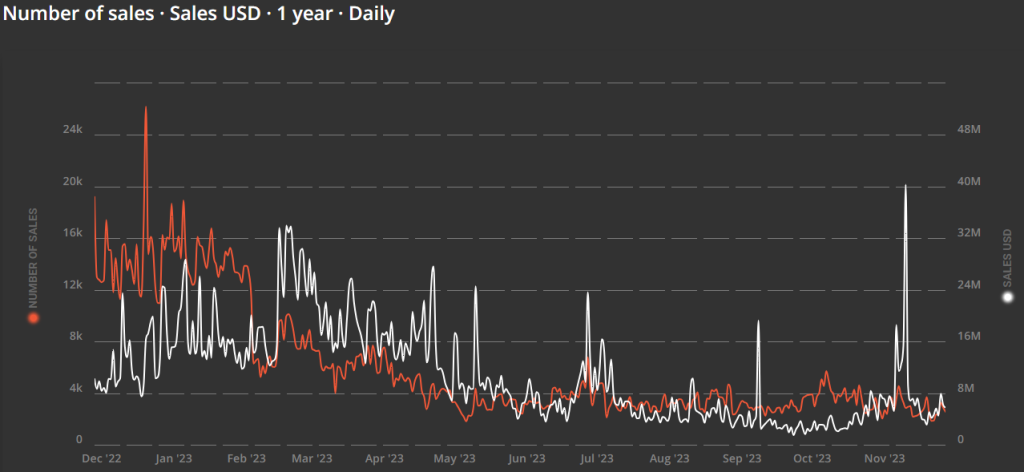

The NFT sector, which has been a hotbed of activity and speculation, saw trading volumes plummet by 55.6%. Ethereum managed to retain its dominance in this market despite the declining interest, suggesting a strong underlying commitment from its community and developers.

The centralized exchange landscape faced challenges as well, with spot trading volumes dropping by 20.1%. Binance, a leading exchange, experienced a significant reduction in market share due to increasing regulatory scrutiny. This highlights the mounting pressure crypto exchanges face from global financial watchdogs.

Decentralized exchanges were not spared from the downturn, experiencing a 31.2% decrease in spot trading volume. THORchain, however, recorded a surge in activity, attributed to illicit transfers through its network, while SushiSwap lost its position among the top 10 decentralized exchanges.

The events of Q3 2023 reflect the volatile nature of the crypto markets and signal a phase of reevaluation and adjustment as the industry navigates through regulatory changes, shifting investor interests, and the ongoing integration with traditional financial instruments.

Price of BNB in the last 5 Years

Stablecoins

The market for stablecoins, which are cryptocurrencies pegged to fiat currencies or other assets, shrank by 3.8% in Q3 2023. Notably, TrueUSD was the only gainer among the top 5 stablecoins during this period.

Tether’s USDT: Rising Dominance Amid Market Shakeup

- Market Share Increase: Tether’s USDT has seen its market share among stablecoins surpass 54%, the highest since late November 2021. This increase in dominance came primarily at the expense of Binance USD (BUSD), whose market cap fell sharply following regulatory pressures.

- Market Capitalization Growth: USDT’s market capitalization grew by approximately $5.3 billion in 2023 to $71.6 billion, marking significant expansion amidst a shifting stablecoin landscape. USDT remains the most traded cryptocurrency, surpassing even Bitcoin in terms of 24-hour trading volume.

Circle’s USD Coin (USDC): Fluctuations & Strategic Moves

- Market Performance and Price Dip: USDC’s market cap stands at $24.64 billion, with a 24-hour trading volume of $2.97 billion. Despite being a fully backed stablecoin, USDC experienced a price dip under 90 cents amid market stress caused by the collapse of Silicon Valley Bank, where Circle held a portion of USDC’s cash reserves. This event led to temporary depegging and liquidation of USDC futures.

- Stablecoin’s Utility and Partnerships: USDC offers a range of use cases, including hedging against volatility, fast international remittances, and interoperability across blockchains. Notably, Coinbase acquired a minority stake in Circle in August 2023, enhancing its position in the stablecoin market. USDC also entered partnerships with major financial players like Visa and Mastercard.

Overall Market Context

- Stablecoins as Crypto Economy Backbone: Stablecoins have become integral to the crypto economy, facilitating trading and transactions between fiat and digital assets. The market has experienced ballooning growth, reaching a peak market cap of $188 billion in May 2022.

NFTs & Decentralized Finance (DeFi)

The trading volume for Non-Fungible Tokens (NFTs) dropped significantly by 55.6% in Q3 2023, reflecting dwindling interest across various blockchain platforms. Despite this decrease, Ethereum maintained its dominance in the NFT market.

The rise of Decentralized Finance (DeFi) continued to be a key growth driver for the U.S. cryptocurrency market. DeFi applications, which operate on blockchain technology to enable peer-to-peer transactions without intermediaries, have the potential to disrupt traditional financial services.

Regulatory Environment

The regulatory environment in the U.S. remained complex, with overlapping jurisdictions and different interpretations of cryptocurrencies as securities or commodities. Some progress has been made toward clarifying the legal framework, which is essential for the growth and adoption of cryptocurrencies. However, the steps taken so far are very short of a final solution.

Crypto Hacks 2023

The year 2023 witnessed some of the largest crypto hacks in the industry’s history, highlighting the ongoing security challenges in the decentralized finance (DeFi) and cryptocurrency sectors.

- Euler Finance Hack: The largest hack occurred at Euler Finance on March 13, with the attacker siphoning close to $197 million. This incident marked a significant vulnerability exploitation in Euler’s donate function contract, although most of the stolen funds were later returned by the hacker.

- Multichain Hack: The cross-chain bridge protocol Multichain experienced a major security breach on July 7, resulting in losses exceeding $125 million. This hack, either a direct attack or a rug pull, was noted as one of the biggest crypto hacks on record.

- Atomic Wallet Hack: In June, Atomic Wallet users lost $100 million in crypto to a hack linked to the North Korea-associated Lazarus Group. This heist is notable for its connection to international cybercrime and its impact on a non-custodial crypto wallet.

- CoinEx Hack: Hong Kong-based CoinEx exchange suffered a security breach due to compromised private keys, resulting in the theft of over $70 million in tokens. The exchange is actively working on a solution, including building a new wallet architecture, to restore functionality and reimburse affected users. Despite the substantial loss, CoinEx assures that the stolen amount is a small fraction of its total assets and commits to fully compensating users for their losses.

- Curve Finance Hack: Curve Finance faced several exploits in July, leading to a total loss of $61 million from multiple trading pools. The initial exploit on July 30 was followed by a series of attacks exploiting various Curve trading pools.

- Kyber Network Hack: Kyber Network, known for its on-chain liquidity protocol, faced a significant challenge when its KyberSwap Elastic smart contracts were exploited on November 22, 2023, at 10:54 PM UTC. Attackers executed complex on-chain actions, manipulating the smart contracts and illicitly withdrawing about $54.7 million from user funds. This incident marks one of the most severe setbacks for Kyber Network since its establishment in 2017.

- CoinsPaid Hack: CoinsPaid fell victim to a sophisticated social engineering attack by hackers linked to the Lazarus Group in July, resulting in the loss of $37.3 million. This attack involved a long-term campaign culminating in a malicious software download

- Bitrue Hack: In April, Singapore-based Bitrue’s hot wallet was compromised, leading to a loss of $23 million, which the company claimed was less than 5% of its reserves

- GDAC Hack: South Korean crypto exchange GDAC suffered a hot wallet attack in April, losing about 23% of its holdings, amounting to $13.9 million.

- Yearn Finance Hack: The DeFi protocol Yearn lost $11.5 million in April due to a vulnerability in an old version of one of its contracts. This was not Yearn’s first encounter with security issues, as it had lost $2.8 million to a different vulnerability in 2021.

- MyAlgo Hack: In February, a hacker exploited a compromised API key to insert malicious code into Algorand web wallet MyAlgo’s contracts, stealing $9.2 million and a significant amount of user data, including private keys and passwords.

The Faketoshi Saga

The “Faketoshi” saga, involving Craig Wright and his claims of being Satoshi Nakamoto, the pseudonymous creator of Bitcoin, took a dramatic turn in 2023. Christen Ager-Hanssen, the former CEO of nChain, a company closely associated with Wright, resigned amid serious allegations against Wright. Ager-Hanssen accused Wright of fraudulent activities, including falsifying documents to mislead judicial bodies and courts into believing he is Satoshi Nakamoto.

Ager-Hanssen‘s departure followed the submission of a whistleblowing report known as the Fairway Brief. This report led to his dismissal and the suspension of the entire management team involved in the whistleblowing. He cited intimidation and victimization by Calvin Ayre and his Fairway Family Office AG as reasons for these actions. The allegations raised serious questions about the governance and ethical practices within nChain.

Additionally, Ager-Hanssen’s allegations included a conspiracy to defraud nChain’s shareholders, orchestrated by a significant shareholder. He also raised concerns about the governance of nChain, claiming that the chairman took instructions from shadow directors and suggesting a termination of Dr Craig Wright’s association with the company.

This situation has significant implications for nChain’s governance, legal standing, and operational integrity. Stefan Matthews, who co-founded nChain, has been appointed as the acting CEO, marking a strategic move to bring stability to the company amid these tumultuous developments.

The Faketoshi saga serves as a cautionary tale for the cryptocurrency industry, highlighting the need for robust governance structures, ethical practices, transparency, and accountability within the sector.

In-Depth Analysis of Major Cryptocurrency Legal Cases in 2023

The year 2023 has been marked by several high-profile legal cases in the cryptocurrency world, each underscoring the complex interplay between digital assets, regulation, and legal accountability.

In a regulatory context, the Commodity Futures Trading Commission (CFTC) filed a record 96 enforcement actions in 2023, with more than half related to digital asset commodities, leading to penalties exceeding $4.3 billion. High-profile cases included actions against major exchanges and Ponzi schemes, as well as a notable litigation victory against a DAO. The CFTC’s whistleblower program played a significant role, awarding nearly $350 million to informants aiding in these enforcement actions.

The series of incidents and regulatory responses showcase a year where the crypto markets continued to mature, facing challenges and adapting to an environment increasingly under the scrutiny of financial watchdogs.

1. Alex Mashinsky and Celsius Network

Case Overview: Alex Mashinsky, founder of Celsius Network, was arrested in July 2023 amid allegations of misleading investors and manipulating the CEL token. His arrest followed the bankruptcy declaration of Celsius, a major event in the crypto industry.

Key Issues:

- Investor Misleading & Token Manipulation: The charges suggest that Mashinsky may have provided false or misleading information to investors about Celsius’s financial health and possibly manipulated the price of the CEL token.

- Impact of Bankruptcy: Celsius’s bankruptcy highlighted the risks associated with crypto lending platforms and raised questions about the management and transparency of such companies.

2. Do Kwon and TerraUSD Collapse

Case Overview: Do Kwon, the South Korean entrepreneur behind the $40 billion collapse of TerraUSD, faces extradition to the US or South Korea following a court ruling in Montenegro. Kwon was apprehended in June 2023 with a forged passport.

Key Issues:

- Alleged Fraud: The collapse of TerraUSD, a stablecoin, sent shockwaves through the crypto market. Kwon faces charges related to fraudulent activities associated with the token’s collapse.

- International Jurisdiction: The case highlights the global reach of cryptocurrency regulation and the complexity of international legal proceedings in the crypto domain.

3. Sam Bankman-Fried and FTX

Case Overview: Samuel Benjamin Bankman-Fried, founder of the FTX cryptocurrency exchange, was convicted in 2023 for numerous felonies. Once celebrated as a crypto icon, his downfall was a significant blow to the industry’s reputation.

Key Issues:

- Range of Felonies: The charges against SBF (as he is popularly known) may include fraud, misappropriation of funds, and other serious financial crimes.

- Impact on the Crypto Industry: SBF’s fall from grace and the collapse of FTX have raised serious questions about regulatory oversight and the ethical standards within the crypto industry.

4. SafeMoon Executives Charged

Case Overview: SafeMoon’s founder Kyle Nagy and top executives Braden John Karony and Thomas Smith were charged with securities fraud, wire fraud, and money laundering. They allegedly diverted investor funds for personal use.

Key Issues:

- Misuse of Investor Funds: The charges suggest a severe breach of trust, with executives allegedly using investor money for personal luxuries.

- Regulatory Oversight: The case underscores the need for greater regulatory oversight in the crypto industry to protect investors from fraudulent schemes.

5. Kristijan Krstic’s Extradition and Charges

Case Overview: Serbian national Kristijan Krstic was extradited to the US to face charges in two separate indictments for his role in cryptocurrency and binary options schemes, defrauding investors of over $70 million.

Key Issues:

- Global Fraud: Krstic’s case illustrates the international nature of cryptocurrency fraud and the challenges in prosecuting such crimes across borders.

- Investor Protection: The case highlights the importance of international cooperation in protecting investors and bringing perpetrators to justice.

6. Justin Sun & Celebrity Endorsements

Case Overview: The SEC charged Justin Sun and his companies with unregistered sales and fraudulent market manipulation of TRX and BTT tokens. Celebrities were also charged for illegal touting of these tokens without disclosing compensation.

Key Issues:

- Market Manipulation & Fraud: The charges against Sun involve serious allegations of market manipulation and fraud, pointing to a lack of transparency and ethical practices.

- Celebrity Endorsements: The involvement of celebrities in promoting crypto tokens without proper disclosures raises concerns about misleading marketing practices in the crypto space. A list of celebrities charged can be found below:

- Jake Paul

- Lindsay Lohan

- DeAndre Cortez Way (Soulja Boy)

- Michele Mason (Kendra Lust)

- Miles Parks McCollum (Lil Yachty)

- Austin Mahone

- Shaffer Smith (Ne-Yo)

- Aliaune Thiam (Akon)

These cases represent a crucial turning point for the cryptocurrency industry, highlighting the need for robust regulatory frameworks, ethical practices, and investor protection. They underscore the challenges of balancing innovation with accountability in the rapidly evolving digital asset landscape.

The year 2023 marked a period of growth, adaptation, and significant regulatory developments in the cryptocurrency market. Despite facing challenges such as market volatility and regulatory complexities, the industry saw advancements in areas like tokenized assets and DeFi.

The impact of COVID-19 further accelerated the adoption and acceptance of cryptocurrencies, making them a more integral part of the global financial landscape. As the industry continues to evolve, it remains poised for further growth and innovation, albeit with an ongoing need for clarity in regulatory frameworks.

Author Profile

- Writing about markets and decentralized finance since 2018.

Latest entries

- December 29, 2023CryptoConferences Shaping Crypto in 2023: Year in Review

- December 28, 2023CryptoCrypto 2023: Market Recap, Lawsuits, & NFT Cool-Down

- December 12, 2023Investment IdeasThe Misguided Vision of ‘Future Money’ in Crypto Projects

- December 11, 2023CryptoExploring Signum’s Latest Innovations: A Comprehensive Look