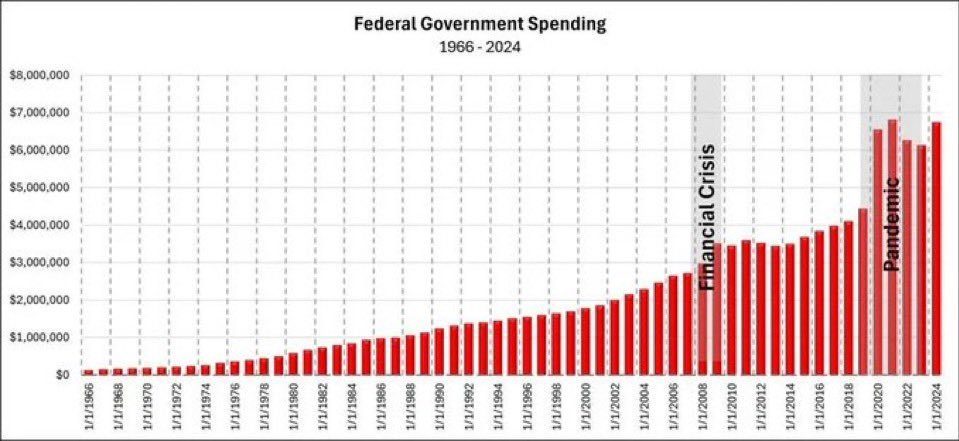

Recently, Elon Musk shared a chart on Twitter detailing U.S. government spending trends, sourced from the U.S. Treasury. The numbers highlight a dramatic increase in federal expenditures between 2019 and 2024. Thus painting a complex picture of America’s financial priorities.

But there is also some fascinating stuff to unfurl.

Total Spending Is Up, Way Up

There was a 51.8% increase in total government outlays, rising from $4.447 trillion in 2019 to $6.752 trillion in 2024. This dramatic boost reflects a period of unprecedented fiscal activity. Driven by both immediate crises and long-term structural trends, spending has been out of control as some claim. Even after adjusting for income growth, the $829 billion real increase highlights the sheer scale of government expansion during this period. A significant portion of this growth is fueled by mandatory spending programs, particularly Social Security and Medicare, which are essential for supporting an aging population but are also becoming increasingly costly due to demographic shifts and healthcare inflation. Additionally, rising interest payments on the national debt have further contributed to the surge in outlays, as higher borrowing costs compound the fiscal burden.

The COVID-19 pandemic played a pivotal role in accelerating this spending surge. In response to the economic and public health crisis, the federal government enacted massive stimulus packages, such as the CARES Act and the American Rescue Plan, which injected trillions of dollars into the economy. These measures included direct payments to individuals, expanded unemployment benefits, and support for businesses, alongside emergency funding for vaccine development, healthcare infrastructure, and state and local governments. While these interventions were critical for mitigating the immediate impacts of the pandemic, they also significantly expanded the federal budget, leaving a lasting imprint on government spending levels.

However, the structural drivers of this growth extend far beyond the pandemic and pose long-term challenges for fiscal sustainability. Aging populations are increasing the demand for entitlement programs like Social Security and Medicare, while healthcare inflation continues to outpace general inflation, driven by rising medical costs and technological advancements. At the same time, the accumulation of national debt and the associated rise in interest payments are creating a growing fiscal burden that will persist for years to come. These trends underscore the need for policymakers to address the underlying causes of spending growth, as failure to do so could lead to difficult trade-offs, such as cuts to other critical areas of the budget, higher taxes, or further increases in the national debt. Balancing these competing priorities will be essential for ensuring long-term fiscal stability.

Social Security & Medicare

Social Security and Medicare are the twin pillars of mandatory spending, and their growth is largely tied to the aging U.S. population. The Baby Boomer generation, which began retiring in large numbers in the 2010s, is driving up costs. Social Security’s 40% nominal increase and Medicare’s 34.3% rise highlight the unsustainable trajectory of these programs. Even after adjusting for inflation and income growth, their combined real growth of $301 billion signals a looming fiscal crisis. Without significant reforms, such as raising the retirement age, adjusting benefit formulas, or increasing payroll taxes, these programs will consume an ever-larger share of the federal budget. Possibly crowding out other priorities.

The 56.9% surge in Medicaid and health-related spending reflects both policy decisions and systemic issues in the U.S. healthcare system. The Affordable Care Act (ACA) expanded Medicaid eligibility, and the pandemic further increased enrollment as millions lost employer-sponsored insurance. Additionally, healthcare inflation continues to outpace general inflation, driven by rising drug prices, hospital costs, and the increasing prevalence of chronic diseases. The $330 billion real increase in this category underscores the urgent need for cost containment measures, such as price negotiations for prescription drugs or reforms to reduce administrative waste.

Defense Spending Not Keeping Pace with Inflation

Defense spending has grown modestly in nominal terms (27%), but its real growth of just 5.1%, and a slight decline when adjusted for income growth, suggests that it is not keeping pace with inflation or the overall expansion of the budget. This is notable given rising geopolitical tensions with China, Russia, and other adversaries. The shrinking share of defense spending relative to other priorities raises questions about the U.S.’s ability to maintain its global military dominance while addressing domestic needs. Future budgets may face tough trade-offs between national security and social programs.

Veterans Affairs Shows Huge Leap in Support

The 65% increase in Veterans Affairs spending reflects a growing recognition of the costs associated with caring for post-9/11 veterans, many of whom are now aging into higher-cost medical care. The real growth of 37.5% highlights the government’s commitment to expanding healthcare access, mental health services, and disability benefits for veterans. However, this growth also underscores the long-term costs of military conflicts, as the U.S. continues to provide for those who served in Iraq, Afghanistan, and other theaters.

Income Security & Welfare Decline

The decline in real spending on income security programs, such as SNAP, SSI and unemployment benefits is surprising. Given the economic turbulence of recent years. While nominal spending increased, the 2.2% decline after adjusting for income growth suggests that these programs are not keeping pace with inflation or the needs of low-income Americans. This trend may reflect political resistance to expanding welfare programs or a shift in priorities toward other areas like healthcare and education. However, it also raises concerns about the adequacy of the social safety net, particularly during periods of economic uncertainty.

Education Spending Surges, But Still Low

Education spending more than doubled in nominal terms, with a real increase of 88.3%. This reflects a growing emphasis on addressing student debt, expanding access to higher education, and investing in workforce training. However, education still represents a small fraction of the federal budget, highlighting the challenges of competing with mandatory spending programs like Social Security and Medicare. The $125 billion real increase is a step in the right direction, but it may not be enough to address systemic issues like rising tuition costs and disparities in K-12 funding.

Infrastructure Investment Grows

The 42.7% increase in infrastructure spending is a positive development, but it remains a relatively small portion of the budget. The Biden administration’s infrastructure initiatives, such as the Infrastructure Investment and Jobs Act, have boosted funding for transportation, broadband, and clean energy projects. However, the modest 19% real growth suggests that progress is slow, and more investment may be needed to modernize the nation’s aging infrastructure. The challenge lies in balancing immediate needs with long-term projects that require sustained funding.

Interest Payments on Debt

The explosion of interest payments on the national debt is perhaps the most alarming trend. The 134.6% nominal increase and 95.6% real surge reflect the combined impact of rising debt levels and higher interest rates. The U.S. is now spending more on interest than on national defense, a stark reminder of the fiscal risks posed by mounting debt. As the Federal Reserve continues to combat inflation with higher rates, the cost of servicing the debt will only increase. This creates a vicious cycle: higher interest payments reduce the funds available for other priorities, potentially leading to more borrowing and even higher debt.

What This Means for the Future

The federal budget has grown dramatically since 2019, with major expansions in Social Security, healthcare, and interest payments on debt. Defense spending has grown more slowly, while welfare programs have seen only minor increases. The sharp rise in interest costs signals potential long-term fiscal challenges, as servicing debt consumes an ever-larger portion of taxpayer dollars.

Looking ahead, these numbers raise key questions:

- Can the U.S. sustain this level of spending?

- Will interest costs crowd out other priorities?

- And how will lawmakers address the growing national debt?

One thing is certain: with the 2024 election approaching, expect government spending to be a central issue in political debates. Whether these numbers indicate necessary investments or reckless fiscal expansion depends on who you ask. But the data makes one thing clear. America’s budget priorities are shifting, and the consequences will be felt for decades to come.

Author Profile

- I have been writing articles about finance, the stock market and wealth management since 2008. I have worked as an analyst, fund manager and as a junior trader in 7 different institutions.

Latest entries

- June 4, 2025NewsWireHow Webmasters Are Paying the Price for the AI Boom

- April 24, 2025NewsWireCapital One-Discover Merger Reshaping the Credit Card Industry

- April 15, 2025NewsWireMichael Saylor’s Strategy New $286 Million Bitcoin Purchase

- February 14, 2025NewsWireBreaking Down the U.S. Budget