In a recent revelation that is sending ripples across the cryptocurrency ecosystem, crypto venture capital firm Primitive Ventures has alleged that Justin Sun, the founder of TRON and a controversial figure in the crypto world, may be $2.4 billion short on user funds collected by his exchange, Huobi, which has now been rebranded as HTX.

The Gravity of the Situation

The gravity of this claim cannot be understated, as it introduces a new dimension of risk and uncertainty into the already volatile landscape of cryptocurrency trading platforms. $2.4 billion is not merely a staggering amount but also represents the trust and investment of countless users who have chosen Huobi/HTX as their trading platform.

The Recent Hack

Cryptocurrency trading platform HTX recently fell victim to a cyber attack that led to the disappearance of 5,000 ether, equivalent to approximately $7.9 million. Justin Sun, an advisor to HTX, confirmed the security breach via Twitter. In his announcement, Sun sought to allay customer concerns by stating, “HTX has fully compensated for the losses sustained during the cyber attack and has efficiently rectified all ensuing issues.”

Justin Sun further contextualized the scale of the loss, noting that the stolen ether constitutes a relatively minor portion compared to the $3 billion in assets currently managed on behalf of HTX users. He also emphasized that the lost funds equate to roughly a fortnight’s revenue for the platform.

This cybersecurity incident follows closely on the heels of the platform’s rebranding from its original name, Huobi, to HTX. With the rebrand, the exchange aims to augment user engagement and is planning to apply for additional licenses across multiple jurisdictions in the future.

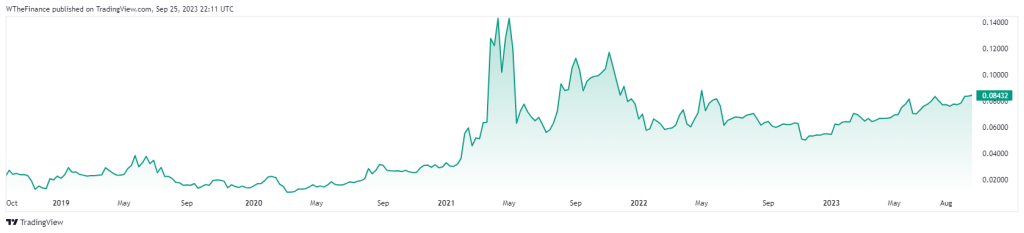

TRX USDT Chart

Concerns Around Regulatory Oversight & User Trust

This situation calls into question the level of oversight that exists within cryptocurrency exchanges, highlighting the apparent lack of regulatory scrutiny that allows for such massive financial gaps to go unnoticed—or at least undisclosed—for an extended period. Equally concerning is the impact this revelation could have on user trust. In a space where trust is a valuable but fragile commodity, news of such a considerable deficit in user funds can cast a long-lasting shadow on both Huobi and Justin Sun, while also leaving thousands of users wondering about the safety of their investments.

Questions Raised for the Wider Cryptocurrency Market

The implications of Primitive Crypto’s allegations stretch far beyond just Huobi and Justin Sun; they cast a spotlight on the operational integrity of other exchanges and cryptocurrency ventures as well. For investors, this serves as a glaring reminder that due diligence is not just advisable but crucial in ensuring that their investments are secure. For regulators, this incident could potentially act as a catalyst to expedite the implementation of more stringent regulatory frameworks for cryptocurrency exchanges.

Next Steps & Repercussions

As of now, both the crypto community and financial regulators are awaiting further details and official statements to substantiate Primitive Crypto’s allegations. Should these claims prove accurate, the consequences for Justin Sun and the HTX exchange could range from legal actions and hefty fines to a potential collapse, given the magnitude of the financial gap.

In conclusion, the allegations from Primitive Crypto serve as a cautionary tale highlighting the urgent need for robust governance and oversight in the cryptocurrency landscape. It remains to be seen how this situation unfolds, but one thing is certain—the ripple effects of this $2.4 billion deficit will be felt across the broader cryptocurrency market for some time to come.

Author Profile

- Ex-community moderator of the Banano memecoin. I have since been involved with numerous cryptocurrencies, NFT projects and DeFi organizations. I write about crypto mainly.

Latest entries

- June 6, 2025NewsWireElon Musk to Decommission SpaceX Dragon after Trump Threat

- December 9, 2024Stock MarketMaster the Time Value of Money Financial Concept

- November 18, 2024Stock MarketFinancial Ratios Guide to Measuring Business Performance

- November 11, 2024NewsWireLabour’s UK Budget: A Fiscal Smirk of Contempt for Working People