Some projects are special. Some others are super special. This one is certainly a super special hidden gem that has not had the exposure of other, much less significant projects. Signum, the community-driven technology behind the cryptocurrency Signa (SIGNA), has been making significant strides recently. With the recent release of Signum-Node version 3.7.3 and the anticipation of the upcoming H2 upgrade, it’s an opportune moment to delve into the latest advancements and offerings of this multi-faceted platform. Signum is a member of the Blockchain Privacy, Security & Adoption Alliance (BPSAA).

Technical Enhancements: Signum-Node 3.7.3

The new Signum-Node version 3.7.3 represents a crucial step forward, especially in light of the challenges faced with the previous version, 3.7.2. The introduction of staking and liquidity pools, while innovative, had led to a slowdown in block synchronization, dropping to as low as 0.1 blocks per second in the worst cases.

However, the team’s proactive approach led to substantial improvements. Through rigorous write and read tests with both MariaDB and H2 databases, they achieved a monumental speed boost, ranging from 100x to 200x. This was accomplished by optimizing indices and tweaking the handling of indirect_incoming. The result was a dramatic reduction in synchronization time – from several days to less than 10 hours on MariaDB.

📢A new Signum-Node is out – version 3.7.3📢

— Signum (@signum_official) November 26, 2023

In preparation for the upcoming H2 upgrade, we reviewed the current performance of node 3.7.2.

Since the introduction of staking and liquidity pools, we saw some slowdown of block sync – worst case, down to 0.1 blocks per second.

We…

Market Developments: SIGNA/BTC Listing and Bittrex Closure

On the market front, SIGNA is expanding its reach with the recent announcement of its listing on XeggeX, set for November 26, 2023. This listing is expected to enhance SIGNA’s accessibility and liquidity.

Conversely, the impending closure of Bittrex by December 4, 2023, poses a challenge for Signa holders on the platform. Bittrex has urged users to withdraw their Signa balances as soon as possible, emphasizing the principle of “not your keys, not your coins.”

Smart Tokens & Autonomous Contracts

The Signum network is increasingly becoming a hub for tokenization, thanks to its robust transaction framework. It supports autonomous smart contracts, making it possible to create and execute code that is both unalterable and unstoppable. These Automated Transactions (AT), originally developed by CIYAM, are Turing-complete, opening a myriad of use cases.

What sets Signum’s smart contracts apart is their self-execution capability, a feature not commonly found in current smart contract technologies. This functionality allows for innovative applications like decentralized, trustless lotteries that operate autonomously at predetermined times.

For developers, Signum eases the entry into blockchain development with SmartJ – a tool for creating smart contracts in Java, eliminating the need to learn a new blockchain-specific language. The same is possible using SmartC. Just like SmartJ but in C coding language.

NFTs & Decentralized Marketplace

SignumArt, the first NFT portal on the Signum blockchain, provides an accessible platform for digital artists. It allows creators to upload, create collections, and sell their digital art through various methods like auctions and fixed-price offers. Signumart’s integration with the Signum XT wallet ensures a seamless and secure connection for transactions.

Beyond NFTs, Signum also offers SignumSwap, an on-chain decentralized marketplace for trading and managing Smart Tokens. This platform supports the creation of staking and liquidity pools, and it facilitates web3-Identity management through Signum Aliases. The XT-Wallet, a browser plugin, connects users directly to the blockchain for secure and efficient trading.

On-Chain-Data

Another outstanding feature of the Signum Blockchain platform is its ease of handling arbitrary data that can be permanently stored on the blockchain. Signum provides various native application scenarios, such as encrypted peer-to-peer communication, or the utilization of data in Aliases. The latter are personalized data containers whose content can be updated at the owner’s discretion. This offers intriguing use cases, such as resolving embedded URLs and/or wallet addresses using user-friendly names.

Furthermore, any data can be effortlessly attached to transactions. This makes it possible to use the blockchain platform for tracking and tracing purposes, for example, in supply chain solutions. Additionally, Signum’s user-friendly approach enhances the platform’s versatility and accessibility for a wide range of applications.

Environmentally Friendly

As one of the very few public blockchains, Signum utilizes hard drives for its mining process. In contrast to PoW (Proof of Work), where each block requires new energy-intensive calculations, Signum employs precomputed values stored on regular hard drives. The consequence of this approach is that the energy consumption per transaction is approximately 50,000 times lower than that of Bitcoin. In the context of the global sustainability debate, this represents a crucial aspect that cannot be emphasized enough. Signum’s environmentally friendly mining mechanism underscores its commitment to a more sustainable blockchain ecosystem.

Market Analysis

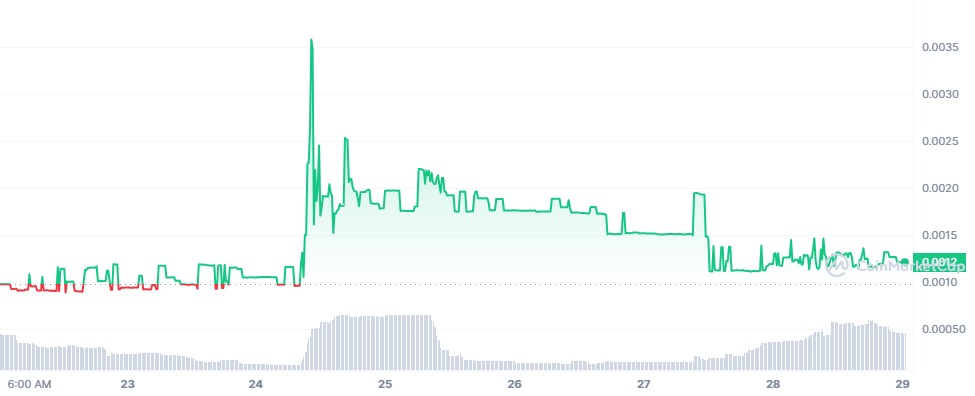

- Market Capitalization: As of now, SIGNA’s market cap stands at $3,209,205. Market capitalization is a critical indicator of a cryptocurrency’s market value, calculated by multiplying the current market price by the circulating supply. A market cap of just over $3 million places SIGNA in the small-cap tier of cryptocurrencies by market size.

- Circulating vs. Total Supply: The circulating supply of SIGNA is 2,129,891,582 coins, while the total supply is slightly higher at 2,161,492,205 coins. This small difference between circulating and total supply indicates that nearly all of the coins that will ever exist are already in circulation. This is important for potential investors to consider, as it means that there is limited potential for inflationary pressures due to new coins entering the market.

- All-Time High and Low: SIGNA’s all-time high was $0.01959, and its all-time low was $0.0003235. This wide range between the all-time high and low suggests significant volatility in its trading history. Such volatility is common in cryptocurrencies and can present both opportunities and risks for traders and investors.

- Current Price: The current price of SIGNA is $0.001507. This price is significantly below its all-time high, which could be viewed in different ways. For optimistic investors, this could be seen as a potential for growth if the coin were to approach or surpass its previous highs. For cautious investors, this could also indicate a lack of momentum.

- Price Analysis and Investor Sentiment: The current trading price, in comparison to its historical highs and lows, can also provide insights into investor sentiment and market trends. Market sentiment can shift rapidly, especially in the crypto space.

- External Factors and Ecosystem Development: The value and price of SIGNA are not only influenced by market dynamics but also by the development and adoption of the Signum ecosystem. Factors such as technological upgrades, partnerships, community engagement, and broader market trends in the cryptocurrency world can all have significant impact.

- Investment Considerations: For potential investors, it’s essential to consider the risk-to-reward ratio. The relatively low market cap and high volatility suggest a higher risk, but with potential high rewards if the token were to gain significant traction. However, such investments should be approached with caution and ideally, form a smaller part of a diversified investment portfolio.

SIGNA’s market dynamics suggest it is a smaller, more volatile cryptocurrency. However, it is a multi-faceted project with a lot of technology backing it up. And whilst its price history shows significant volatility, a common trait in smaller-cap cryptocurrencies, it falls under the high-risk, high-reward investment category.

Signum’s latest updates and offerings demonstrate its commitment to innovation and user-friendliness in the blockchain space. From technical enhancements in node performance to the expansion of market access and the development of unique smart contracts and NFT capabilities, Signum is positioning itself as a versatile and robust platform for the future of decentralized finance and digital assets. As the platform continues to evolve, it stands as a testament to the potential of community-driven technology in shaping the future of blockchain and cryptocurrency.

Author Profile

- Writing about markets and decentralized finance since 2018.

Latest entries

- June 25, 2025Global EconomicsThe Société Générale Raids: Anatomy of a Tax Fraud Scandal

- December 29, 2023CryptoConferences Shaping Crypto in 2023: Year in Review

- December 28, 2023CryptoCrypto 2023: Market Recap, Lawsuits, & NFT Cool-Down

- December 12, 2023Investment IdeasThe Misguided Vision of ‘Future Money’ in Crypto Projects