Bitcoin has transcended its origins as a niche digital currency to become a key new force in global finance. Its decentralized nature, capped supply, and potential as a hedge against inflation have attracted not only individual investors but also institutional players. Now increasingly, government entities are also entering the game. The latest development in this evolving story is the emergence of state-level initiatives in the United States to establish Bitcoin strategic reserves.

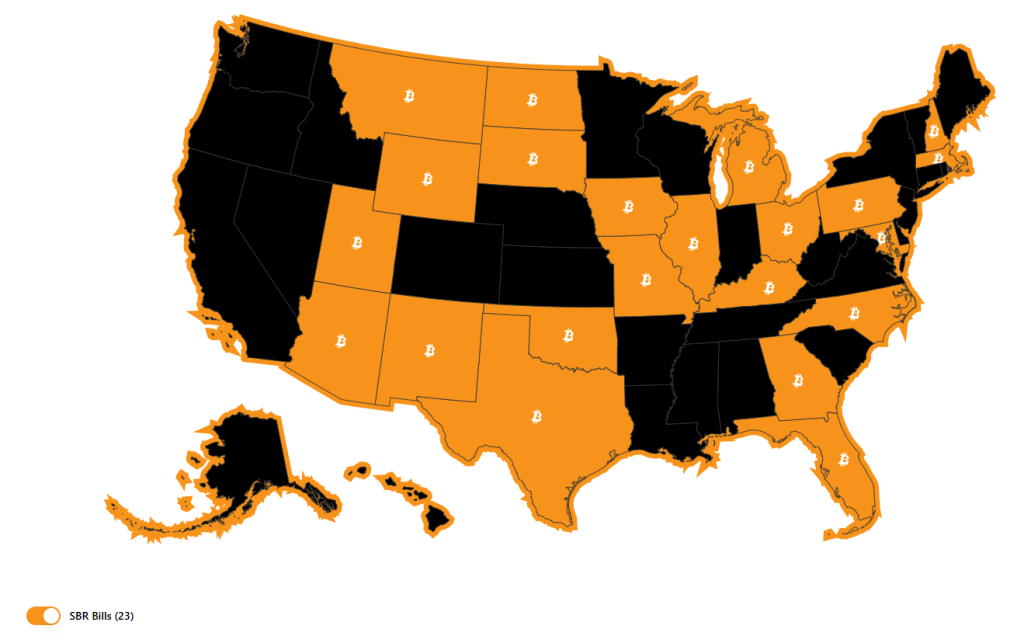

With 21 states reportedly front-running former President Donald Trump’s proposed Strategic Bitcoin Reserve, the movement is gaining significant momentum. Among these states, Georgia has recently filed for a Bitcoin Strategic Reserve Bill, while Texas has taken a proactive stance, with its governor publicly tweeting about the initiative and setting a formal hearing date. These developments signal a profound shift in how governments perceive and interact with digital assets.

The concept of a Bitcoin strategic reserve is not merely a symbolic gesture; it represents a strategic financial maneuver in an era of economic uncertainty. By holding Bitcoin as part of their reserves, states aim to diversify their assets and protect against the devaluation of traditional fiat currencies. This approach mirrors the rationale behind holding gold reserves, but with the added advantages of Bitcoin’s portability, divisibility, and ease of transfer.

For states like Texas and Georgia, which are known for their pro-business and innovation-friendly policies, embracing Bitcoin is a natural extension of their commitment to fostering economic resilience and technological advancement. Texas, in particular, has positioned itself as a hub for Bitcoin mining, leveraging its abundant energy resources to support the network. The state’s governor has been vocal about the potential benefits of a Bitcoin reserve, framing it as a forward-thinking strategy to safeguard state finances and attract investment.

The broader implications of this trend are profound. As more states explore the possibility of integrating Bitcoin into their financial systems, the federal government may face increasing pressure to adopt a cohesive regulatory framework for digital assets. The decentralized nature of Bitcoin challenges traditional financial systems, and its adoption at the state level could pave the way for a more inclusive and resilient economic infrastructure.

However, this shift is not without challenges. Volatility, regulatory uncertainty, and security concerns remain significant hurdles. Nonetheless, the growing interest in Bitcoin reserves underscores a recognition of its potential to reshape the financial landscape. As states like Georgia and Texas lead the charge, the movement toward Bitcoin adoption at the governmental level may well mark the beginning of a new era in monetary policy and economic strategy.

The push for Bitcoin strategic reserves by 21 U.S. states reflects a broader acknowledgment of the currency’s potential to serve as a viable financial asset. With Georgia and Texas at the forefront, this trend highlights the evolving relationship between governments and digital currencies. But it’s not just the USA that is investing in Bitcoin. In some of the latest news, Abu Dhabi’s sovereign Wealth Fund bought $436m Bitcoin through ETFs just in the first quarter of 2025.

As the world grapples with economic instability and the limitations of traditional financial systems, Bitcoin offers a compelling alternative. Whether this movement will inspire a nationwide shift remains to be seen. We can now safely say that Bitcoin is no longer just a speculative asset. It is becoming a cornerstone of modern financial strategy.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- June 30, 2025NewsWireBank Savings at Risk: The Dark Side of EU’s Savings Standard

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class