The “Fake Satoshi” narrative has proven to be one of the most enigmatic and divisive storylines in the cryptocurrency world. Central to the discourse is the significance of digital signatures in the verification and validation of claims made in Bitcoin’s ecosystem. The narrative not only impacts the perception of Bitcoin but also adds a layer of risk that investors need to be wary of. Kara Szabo goes on to explain.

Understanding the Basics: Digital Signatures in Bitcoin

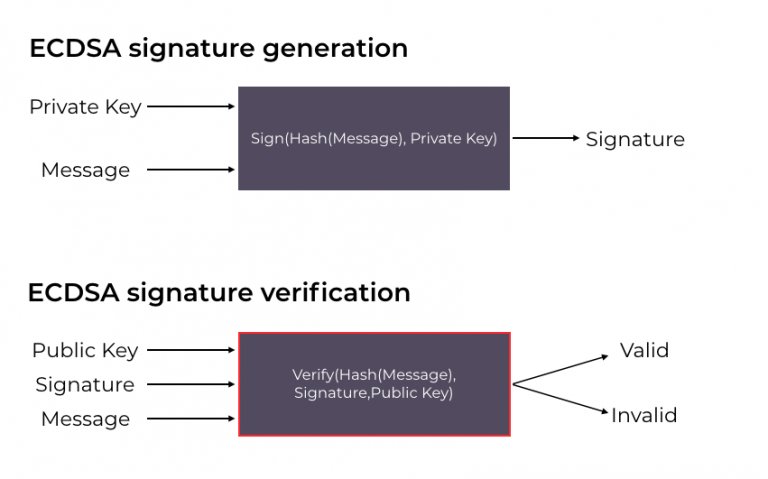

Before delving into the controversy, let’s establish a fundamental understanding of digital signatures in the world of Bitcoin. Digital signatures are cryptographic tools that serve as a method for verifying the authenticity and integrity of a message or transaction. They provide a level of trust in an environment where trust is paramount.

The Problem with “He Signed for Me”

The crux of the confusion stems from misunderstandings around what it means to “sign” a message in the context of Bitcoin. When someone claims, “he signed for me,” without providing concrete evidence in the form of a digital signature and plaintext, it undermines the foundational principles laid out by the real Satoshi Nakamoto. The architecture of Bitcoin is rooted in the elimination of the need for “trusted third parties.” Thus, claims without verifiable proof do more than just stir skepticism; they fundamentally go against the ethos of decentralized trust that Bitcoin was designed to uphold.

The Satoshi Nakamoto Principles

Satoshi Nakamoto, the pseudonymous creator of Bitcoin, emphasized the importance of minimizing reliance on “trusted third parties” in the cryptocurrency ecosystem. These third parties, in the context of Bitcoin, represent potential security vulnerabilities. Therefore, any claim of a Bitcoin transaction or message being signed without providing a digital signature and the accompanying plaintext directly contradicts the principles laid down by the real Satoshi Nakamoto.

The Gavin Andresen Incident

Let’s consider the example of Gavin Andresen, one of the initial Bitcoin developers. He reportedly travelled to London to witness a signing ceremony, allegedly as proof of someone’s claim to be Satoshi Nakamoto. Had a verifiable digital signature along with the corresponding plaintext message been provided, Andresen would not have had to take such drastic measures.

Moreover, even witnessing the signing process in person could not ensure the integrity of the verification. Software downloaded to generate the signature could be manipulated. Backdoored software can produce validation messages that seem genuine but are actually deceptive. Even if one insists on software being downloaded from a specific domain, vulnerabilities like rerouting attacks from a fraudulent Wi-Fi hotspot can compromise the process. It’s basic computer science, and it’s perplexing to think that someone claiming to be Satoshi would ignore such fundamental flaws.

The Vulnerabilities of Trusting Without Evidence

Trusting someone who claims to have signed a message, even on a freshly installed machine, can be fraught with risks. This is because generating a signature requires software, and this software can potentially contain backdoors that manipulate the signature validation process. Even if you insist that the software be downloaded from a specific domain, determined individuals can employ rerouting attacks from fake Wi-Fi hotspots, compromising the entire validation process.

Satoshi’s Principles: A Reminder

It is crucial to remember that Satoshi Nakamoto, the visionary behind Bitcoin, would never endorse or engage in verification processes that rely on unverified third parties or introduce vulnerabilities into the system. Such practices run contrary to the core principles of Bitcoin, which emphasize decentralization, trustlessness, and security.

The Case of the @satoshi Twitter Account

In 2018, a Twitter account claiming to be Satoshi Nakamoto posted a signature that was said to be tethered to block 9. However, the critical component of the plaintext was absent. This blatant omission not only raised red flags but also demonstrated an alarming lack of understanding of how digital signatures work in the cryptocurrency community.

Digital signatures are a staple in cryptographic systems for a reason: they offer a robust method for authenticating the origin and integrity of a message. The absence of the accompanying plaintext with a digital signature makes it nearly impossible to validate the message, thus making it easy to deceive the public.

Community Reactions

The debate surrounding the role of digital signatures in Bitcoin has always been contentious, as evidenced by the diverging viewpoints within the community. BSVSimp argues that digital signatures fundamentally exist to verify identity, echoing the importance of Dr. Craig Wright needing to sign to prove his claims. On the other hand, Anthony refutes the possibility of Dr. Wright signing anything, citing courtroom admissions that even “faketoshi” himself cannot sign. This notion is further amplified by Chick Counterfly, who suggests that if the community around Craig Wright genuinely understood the nature of digital signatures, his following would diminish.

At this point I think Dr Craig should try to locate the drive with his private keys that he stomped on even if that means excavating his local landfill. We are talking billions here!#BSV

— BSV Social Impact (@bsvsimp) October 6, 2023

According to Frank Rundatz, the Bitcoin whitepaper emphasizes ownership rather than mere possession, noting that the term “owner/ownership” appears 19 times, while “possession” does not appear at all. The whitepaper explicitly states that digital signatures provide “strong control of ownership,” lending weight to the argument that digital signatures are not just about identity verification but also ownership control. Andy Bay extends this thought by explaining that a Bitcoin represents a sequence of “encrypted proofs of ownership,” namely digital signatures. He compares the “public key” to a “Bitcoin address,” serving as a location for others to send Bitcoin, underlining the multi-faceted role digital signatures play in the ecosystem.

Digital signatures serve multiple functions within the Bitcoin landscape, identity verification, as pointed out by BSVSimp, and proof of ownership, as emphasized by Frank Rundatz and Andy Bay. The debate does not merely revolve around the capacity to sign but also speaks to broader implications concerning understanding and trust within the Bitcoin community. Chick Counterfly’s comment highlights the peril of misunderstanding these core principles, as it could mislead a segment of the community and potentially impact the credibility and growth of the ecosystem.

The Saga Goes On

From an investment perspective, controversies like the Fake Satoshi saga create unnecessary volatility and risk in an already speculative market. Such incidents bring into question the reliability of not just the involved parties but also the larger crypto ecosystem. They spotlight the critical need for education on the rudimentary principles of blockchain technology, including the proper use and verification of digital signatures.

The widespread misunderstanding of digital signing weakens public confidence in the very technologies promising to revolutionize financial systems. It’s imperative for both investors and technologists to grasp the inherent value of the secure, verifiable methods established in blockchain systems like Bitcoin. Anything less not only undermines the credibility of claims made but also weakens the structural integrity of the financial systems that rely on this groundbreaking technology.

In conclusion, the Fake Satoshi saga serves as a case study of how the misunderstanding of fundamental aspects like digital signatures can wreak havoc in the blockchain ecosystem. While it’s tempting to get swept up in the mystique and drama, it is prudent for stakeholders to return to basics. Vigilance, verification, and an understanding of Bitcoin’s foundational principles are the best defenses against deception and risk in this new frontier of finance.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- June 30, 2025NewsWireBank Savings at Risk: The Dark Side of EU’s Savings Standard

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class