Javier Milei swept into the Argentine presidency on a wave of libertarian rhetoric and promises to dismantle the very foundations of the nation’s long-standing economic dysfunctions. Campaigning on a platform that included abolishing the central bank and rejecting Argentina’s decades-old reliance on inflationary monetary policy, he painted himself as a staunch disciple of Austrian economics.

Yet, one year into his presidency, the economic data reveals a stark departure from his campaign ideals. Far from delivering a free-market miracle, Milei’s administration appears to be perpetuating, and in some cases accelerating, the policies he once vehemently criticized writes Saifedean Ammous, author of The Bitcoin Standard, in a post on Twitter.

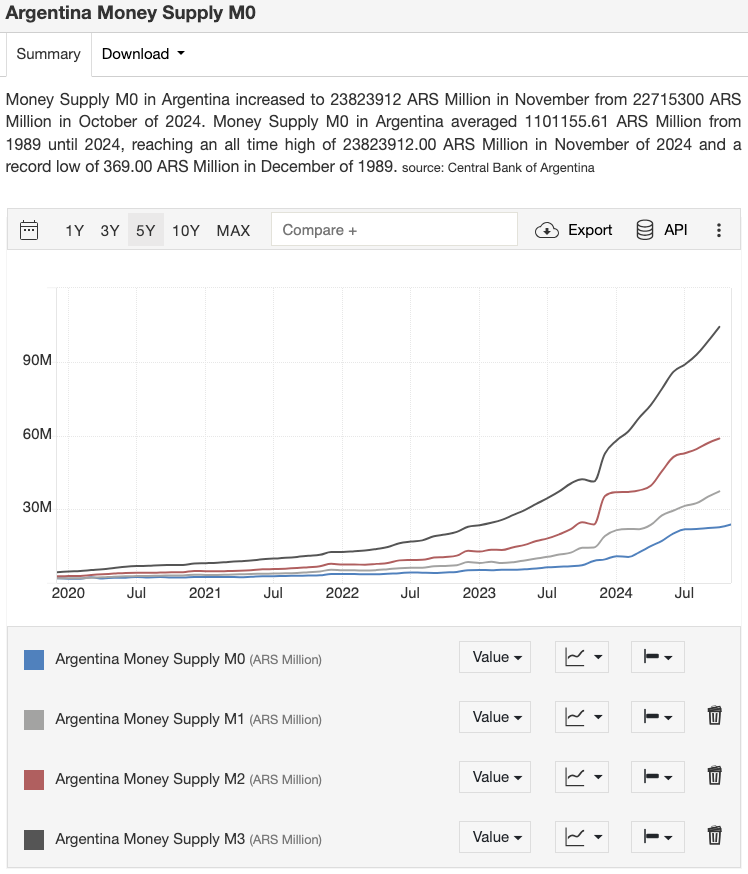

Ammous continues to highlight that despite people getting excited about the libertarian, under Milei’s leadership so far, Argentina’s money supply has expanded at rates that dwarf even the country’s infamously inflationary history. In 2024 alone, the money supply metrics have surged as follows:

- M0: 209%

- M1: 133%

- M2: 93%

- M3: 123%

These figures are staggering, particularly when compared to the already excessive compound annual growth rates of 50–90% during the four years prior to Milei taking office. Such rapid monetary expansion typically fuels inflation, erodes purchasing power, and exacerbates economic instability. Milei’s policies, intended to stabilize the economy, instead risk deepening Argentina’s reputation as a global monetary “basket case.”

Public Debt: Borrowing Against the Future

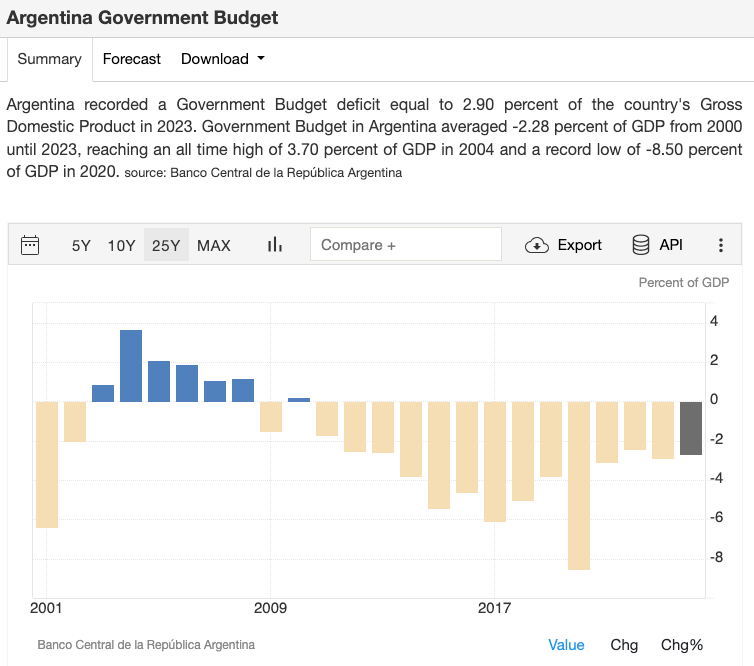

In his first six months, Milei’s administration added $72 billion to Argentina’s already ballooning public debt, increasing the total from $370 billion to $442 billion. A 19.4% increase in half a year. This surge in borrowing allowed for short-term improvements in certain economic indicators, but at a steep cost. Financing growth through debt and money printing is a well-worn path in Argentine politics, one that shifts the burden to future generations through exorbitant interest payments and inevitable crises.

Milei’s reliance on debt directly contradicts his libertarian principles. Austrian economists like Ludwig von Mises and Murray Rothbard advocate for sound money and fiscal discipline, but Milei has instead chosen to perpetuate the cycle of borrowing and inflation that has plagued Argentina for decades.

Broken Promises on the Central Bank

One of Milei’s most striking campaign promises was to abolish the central bank, which he described as the root cause of Argentina’s inflationary woes. Yet, upon assuming office, he abandoned this pledge, citing political challenges and short-term pain as reasons for delaying action. Instead of dismantling the central bank, Milei has allowed it to expand the money supply at an unprecedented rate, sowing the seeds for future currency crises.

This retreat from reform reveals a deeper contradiction in Milei’s governance: while championing free-market ideals, he has embraced the same statist rhetoric used by his predecessors to justify inflationary policies. The refusal to address the central bank’s insolvency only prolongs the inevitable reckoning, as Argentina’s monetary base becomes increasingly fragile.

A cornerstone of Austrian economic thinking is the principle of allowing bad debts to clear through default, rather than perpetuating unsustainable obligations. Milei, however, has refused to default on Argentina’s public debt, choosing instead to pursue further borrowing to meet existing obligations. While a default would have caused short-term economic pain, it could have freed Argentines from the burden of generational debt slavery to international creditors and the IMF.

By avoiding default, Milei has kept Argentina locked in a cycle of dependency, prioritizing foreign creditors over domestic stability. His government’s decision to pursue more IMF loans suggests a continuation of the very policies he denounced on the campaign trail.

Tax Increases: A Betrayal of Libertarian Principles

Another glaring contradiction is Milei’s decision to raise taxes to fund government borrowing. Increasing taxes is fundamentally at odds with Austrian economics, which emphasizes minimizing state intervention in the economy. These tax hikes further burden an already struggling population, undermining Milei’s claim to be a champion of free markets and individual liberty.

Perhaps the most symbolic decision of Milei’s administration was shipping Argentina’s remaining 61 tons of gold reserves to London in search of yield. Historically, gold has been a monetary asset free of counterparty risk, serving as a safeguard against inflation and financial instability. By pawning off this politically neutral reserve, Milei has left Argentina with little more than an ever-growing pile of liabilities. This move completes the inflationary legacy of General Juan Domingo Perón, who began depleting Argentina’s gold reserves in the mid-20th century, setting the stage for decades of economic calamity.

Short-Term Gains, Long-Term Pain

Milei’s policies have created a veneer of economic improvement, but this illusion is unsustainable. Borrowing and printing money may temporarily boost growth, reduce poverty, and stabilize unemployment, but the long-term consequences will be devastating. Inflation will inevitably spiral out of control, and debt repayments will strain future budgets, leaving Argentina vulnerable to yet another financial crisis.

Milei’s first year in office offers a sobering lesson: libertarian rhetoric alone is insufficient to enact meaningful change. True reform requires the courage to endure short-term pain for long-term stability. Abolishing the central bank and defaulting on unsustainable debt would have been politically difficult but economically transformative. Instead, Milei has chosen to perpetuate the very policies he once condemned, leaving Argentina no closer to escaping its cycle of inflation and crisis.

Bitcoin: The Missed Alternative

Milei’s failure to deliver on his promises underscores the need for decentralized alternatives like Bitcoin, which cannot be manipulated by governments or central banks. A Bitcoin-based economy would protect Argentines from inflation and debt slavery, offering a path to true financial sovereignty. Instead, Milei’s policies have strengthened trust in Argentina’s broken financial system, delaying the adoption of viable alternatives.

Saifedean Ammous did not hold back in his criticism of Javier Milei’s recent attacks on Austrian economist Hans-Hermann Hoppe, calling them both baseless and hypocritical. Ammous highlights that Hoppe’s argument about advocating for shutting down the central bank and defaulting on unsustainable debt, represents a textbook libertarian solution to Argentina’s economic woes. Instead of engaging with Hoppe’s ideas substantively, Milei resorted to ad hominem attacks, labeling Hoppe an “idiot” who doesn’t understand economics.

Ironically, as Ammous points out, Milei himself ran on a campaign that echoed Hoppe’s stance, making his current defense of central banking and inflation all the more contradictory. Rather than providing an economic rationale for his about-face, Milei invoked a political argument, claiming that the short-term costs of abolishing inflationary policies were politically untenable. A stance Ammous derides as recycled Keynesian rhetoric.

Ammous also critiques Milei’s insinuation that his position as a political leader gives him a superior grasp of economics compared to academics like Hoppe. For Ammous, such claims ring hollow, particularly given Milei’s track record in office: doubling the money supply in a year and burdening Argentina with $72 billion of debt in just six months. These measures, Ammous notes, could be enacted by “any random 16-year-old” with access to a central bank and no regard for long-term consequences.

He calls on Milei to reconcile his campaign rhetoric with his actions in office. Was his pre-election stance on closing the central bank a genuine conviction or merely opportunistic pandering? To Ammous, Milei’s behavior increasingly mirrors the inflationist politicians he once railed against, raising questions about his commitment to the libertarian ideals he championed during his rise to power.

About Hans-Hermann Hoppe

Hans-Hermann Hoppe is a prominent German-American economist, philosopher, and political theorist known for his work in Austrian economics and libertarian thought. He is a senior fellow at the Ludwig von Mises Institute and an influential proponent of anarcho-capitalism, a system advocating for the elimination of the state in favor of private, voluntary governance based on property rights and free-market principles. Hoppe’s work is widely recognized for its intellectual rigor and its sometimes-controversial conclusions, particularly within the realm of libertarianism.

About Saifedean Ammous

Saifedean Ammous is a prominent economist and author best known for his influential book, The Bitcoin Standard: The Decentralized Alternative to Central Banking. A leading advocate for Bitcoin and Austrian economics, Ammous explores the implications of sound money and critiques inflationary monetary policies in both his writings and public lectures. His work connects modern cryptocurrency principles with the historical legacy of gold and other hard assets, offering a compelling argument for Bitcoin as a tool for economic freedom.

Educated in economics and engineering, Ammous holds a Ph.D. from Columbia University and has served as an academic and consultant, furthering discussions on free-market economics and decentralized financial systems. His sharp critiques of government-controlled monetary systems and unwavering support for Bitcoin have positioned him as a respected and sometimes polarizing figure in both economic and cryptocurrency circles.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- June 30, 2025NewsWireBank Savings at Risk: The Dark Side of EU’s Savings Standard

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class