- Marco Bianchi’s fear game

- Calvin Ayre’s greed

- Conspiracy to defraud question

- Full transcript at the end of the article

In a recent development Christen Ager-Hanssen, an entrepreneur and notable figure in the industry, has come forward with new allegations of a conspiracy to defraud shareholders. The allegations are directed at key figures within nChain, including Stefan Matthews, Calvin Ayre, and Marco Bianchi.

The Tape Recording: A Promise of Revealing Insights

Ager-Hanssen has announced the imminent release of a tape recording dated 12th September, in which he is purported to discuss an alleged fraudulent license agreement with Stefan Matthews. The tape recording is expected to shed light on behind-the-scenes machinations involving well-known industry figures, offering a potentially unprecedented look into corporate conduct within nChain.

In this insightful alleged recording, Stefan Matthews and Christen Ager-Hanssen dive deep into the concealed realities of corporate boardrooms and nChain in particular. They discuss the different tactics and strategies that come into play in creating deals and agreements, highlighting the discrepancies usually overlooked by board members due to the allure of apparent but misleading gains. Boardroom dynamics often involve manipulation of the spotlight, keeping significant items hidden to gain an upper hand. Is it really beneficial to compromise the comprehension of agreements for the sake of immediate profits?

You will have to listen to it yourself to draw conclusions.

They allegedly discuss the importance of reading the fine print and the potential repercussions of glossing over it. The issue extends beyond the seemingly straightforward loan agreements to the inflated lines of credit used as a pawn in boardroom dynamics. An enlarged ego, too, has a role to play in these corporate power dynamics. The over-inflation of numbers to portray a false image of significance can lead to potential challenges that just might destroy it all.

Transcript Highlights

00:00:00: Discussion about an undisclosed business

00:01:25: Critique of a previous business agreement

00:02:12: Consequences of a $100 million loan agreement

00:03:03: Disagreements with Marco Bianchi

00:04:01: Concerns about Marco Bianchi

00:05:09: Comparison of a problematic situation to magnesium burning

00:05:42: Conspiracy to defraud accusation

00:06:09: Talk about removing certain people from their roles

00:07:03: Talking about Jürg Hunziker’s change in behavior

00:07:37: Getting rid of the family office

00:08:17: Speculating on going rogue

00:09:01: Discussion about Marco Bianchi’s Fear game

00:10:00: Calvin Ayre’s Greed discussion

00:10:16: Debate about Nicolas Wellinger’s behavior and ambitions

Listen to the Audio

This is the tape recording from 12th September 2023 of me confronting Stefan Matthews @TurkeyChop with serious allegations that @CalvinAyre executed a Conspiracy to Defraud shareholders in nChain @nChainGlobal. Stefan gives his clear and unfiltered opinion about what I’m… pic.twitter.com/VDWLRxr9ea

— Christen Ager-Hanssen (@agerhanssen) October 3, 2023

Key Players Under the Spotlight

Of particular interest are the individuals named by Ager-Hanssen. Calvin Ayre, already a divisive figure in the cryptocurrency landscape, is implicated alongside Marco Bianchi. Additionally, the tape recording mentions two other noteworthy individuals: Nicolas Wellinger and Jürg Hunziker. Wellinger and Hunziker are both independent board members of nChain; Hunziker also serves on the board of Julius Baer, a renowned Swiss banking group.

Implications for Shareholders & the Industry

If Ager-Hanssen’s allegations hold weight, they could have severe repercussions not only for the accused but also for nChain, its shareholders and the BSV blockchain ecosystem. The integrity of governance mechanisms within the company, as well as the legitimacy of its past financial transactions, would be cast into doubt. Shareholders might find themselves questioning the trustworthiness of the company’s leadership, a scenario that could lead to volatile stock performance and legal repercussions.

The Conundrum of Proof & Public Perception

While the upcoming release of the tape recording has generated buzz and speculation, its veracity and impact remain to be seen. Even if the recording delivers on its promise, proving allegations of a conspiracy to defraud shareholders would necessitate a rigorous legal process. Furthermore, the court of public opinion could be just as consequential; the episode has the potential to tarnish reputations and introduce a narrative of distrust around nChain and its affiliates.

A Test for Corporate Governance and Regulatory Oversight

The allegations also pose a critical test for governance frameworks and oversight mechanisms, both within nChain and in the wider cryptocurrency industry. A scandal of this nature exposes vulnerabilities and challenges the efficacy of existing safeguards against fraud and corporate misconduct. There have been plenty of examples of bad corporate governance in the near past including Celsius, FTX and Sam Bankman-Fried as well as Terra Luna.

The Days Ahead: Uncertainty & Close Scrutiny

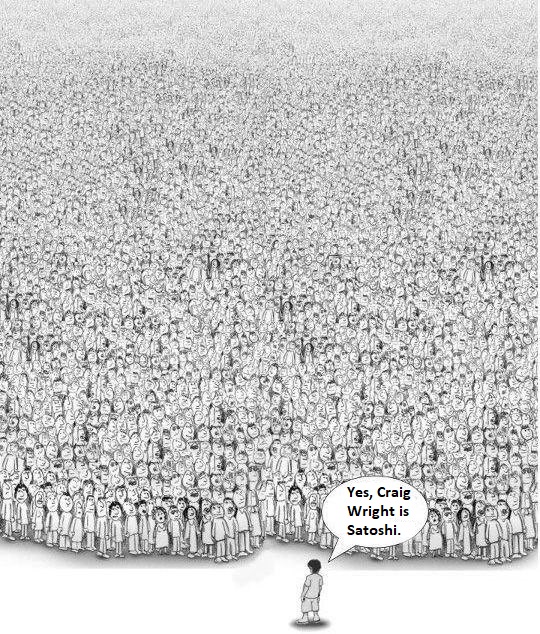

It is useful to note that despite the allegations even Ager-Hanssen is not entirely sure that Craig Wright is not Satoshi after making the following statement: “No one can know for sure whether Craig is Satoshi or not.. I think he probably was involved with the original group that was Satoshi… If Craig signs then I believe he is Satoshi.”

As the blockchain community awaits the release of the tape recording, stakeholders are bracing for its potential ramifications. The incident serves as a stark reminder of the operational risks embedded within the rapidly evolving world of blockchain technology and cryptocurrency.

Regardless of the outcome, Christen Ager-Hanssen’s allegations mark a significant moment, one that invites greater scrutiny into the complexities and potential pitfalls of this burgeoning sector.

The Full Transcript

Stefan Matthews : Not as diligent on things that he might otherwise be in other boardrooms because he’s got an enormous upside in that’s.

Christen Ager-Hanssen: True. Yes.

Stefan Matthews : And Jürg’s not young.

Christen Ager-Hanssen: Those L tips, if he really did understand that license agreement, he will understand they are worthless. That’s why I don’t think he ever read it because the written resolution doesn’t reflect the underlying agreement. Because Marco was very smart, he moved away these things. It’s in the license. If you take the loan agreement, it looks like a straightforward loan.

It’s not, is it? Controlling it was really, I have to say $100 million for $100 million that we never asked for.

Stefan Matthews: Yeah. And we never asked for it. Calvin wanted it in there. It wasn’t Marco that wanted it, it was Calvin that wanted it because he wanted to blow the number up over 500 and he wanted to bundle it. And I was on this f***g interview with him, with this chick from New York and she goes so Calvin, what’s the breakdown?

Christen Ager-Hanssen: What’s the breakdown?

Stefan Matthews: He didn’t want to answer that question because he can’t answer that question.

Christen Ager-Hanssen: No, he can’t.

Stefan Matthews: Because if you answer the question fully, people look at it and go this is all f***g fluffy shit.

Christen Ager-Hanssen: Yeah.

Stefan Matthews: It’s a license agreement that really means nothing. It’s $100 million dollar line of credit that no one intended on using. But now Andy’s opened the fucking door because he’s drawing down $12 million of it, which is now causing Marco a problem.

Christen Ager-Hanssen: Yeah.

Stefan Matthews: Be careful what you f***g wish for, boys, because it might come back to buy. You throw in 100 million dollar line of credit to puff up your chest and make yourself look good and the next thing you know you got to write out a check for twelve.

Christen Ager-Hanssen: But I don’t think Yuri, you know.

Stefan Matthews: I threw a tantrum. I threw a tantrum at Marco. That’s why Calvin second last meeting we had at his house talked about remember, he said, and he specifically was talking to me about my position continually being diluted and that’s not fair because I threw a f***g tantrum at Marco because I said you’re f***g manipulating all this f***g shit and you’re doing all this shit. Every time I turn around I’m being deluded by this, that something else and it’s all to Calvin. And the family office benefit wouldn’t f***g be here if it wasn’t for me.

Sometimes I do these things to find out where the smoke goes.

Christen Ager-Hanssen: But you’ve been living in this system for a while, so you know how to operate it.

Stefan Matthews: Yeah, I threw a bone at Nico, but it hasn’t no, the other week when he was there telling me about his new f***g job so I threw a couple of taglines in there and I thought, this will take about 12 hours. And I’ll have Marco on the phone.

Christen Ager-Hanssen: Because this guy is a snake. He’s probably worse, f***g worse than Marco.

Stefan Matthews: Because when Marco got on the phone. If he got on the phone, I would have told him to get f***d. And then I would add Calvin. And that was at that point I was going to say to Calvin, mate, remember, you f***g told me, don’t ask me how, don’t ask me when. But this is a mistake.

And this guy, this guy is high on himself. Not good.

Christen Ager-Hanssen: He’s not good for us.

Stefan Matthews: And you’re allowing the family office to put him in a position which amplifies his defects.

Christen Ager-Hanssen: I don’t understand who you can be so stupid to implement it. Like you write down that service agreement.

Stefan Matthews: Nico is Calvin’s new shiny thing. These new shiny things, like yeah, they don’t last. They don’t last. And sometimes I’ve been around Kelvin long enough to know, unless it’s really affecting me, there’s no point taking a fight against it. Because it’s like ever seen magnesium burn in a laboratory?

Christen Ager-Hanssen: Gone there’s no idea. Taking a fight.

Stefan Matthews: Sometimes you got to, but more often than not, just let the magnesium burn itself out.

Christen Ager-Hanssen: But the problem is, I don’t want to go into I can use a very simple word, legal word on what Marco is doing. Do you know what it’s called?

Stefan Matthews: No.

Christen Ager-Hanssen: Conspiracy to defraud.

Stefan Matthews: Let me put it to you this way. If there’s 500 million, a billion, any f***g number on the table, then is the time to talk to Kelvin privately. If we want to do these deals and we want to play the big boys game, you can’t have the f***g small boys running around the place pretending to play business.

Christen Ager-Hanssen: I want to get rid of them this way.

Stefan Matthews: But that’s the time to get rid of them.

Christen Ager-Hanssen: I know.

Stefan Matthews: Not now.

Christen Ager-Hanssen: No, I know.

Stefan Matthews: Let them play.

Christen Ager-Hanssen: No, they’re harmless.

Stefan Matthews: You know why they’re harmless? Because they’re dumb.

Christen Ager-Hanssen: They don’t understand the business.

Stefan Matthews: They don’t understand the business. I’m about to put a little bit of pressure on Robert, but if you watch him split, he’ll crack in half.

Christen Ager-Hanssen: Seriously.

Stefan Matthews: You know what’s going to happen inside of three or four months? I bet the family office will come back and say, Robert’s got so many other things to do in other areas and he will go because he won’t be able to stand the not.

Christen Ager-Hanssen: I agree with you regarding Jurg. I agree because I’ve seen a change in behavior. Yeah.

Stefan Matthews: Jürg’s just gone into a holding and he’s waiting.

Christen Ager-Hanssen: He doesn’t even want to see him play low.

Stefan Matthews: What you don’t see, that’s what he does.

Christen Ager-Hanssen: He doesn’t want to go. But in my world either, Marco dealt with him, which he may have done, which I don’t think, because I just think he keeps the door open. Jurge keeps the door open.

Stefan Matthews: Yeah, he does.

Christen Ager-Hanssen: But you know what? I know exactly how to get rid of that family office.

Stefan Matthews: Incline.

Christen Ager-Hanssen: It’s a matter of time. I mean we need to do it because we are not compliant with having them there. We are not following the rules.

Stefan Matthews: For me, that family office is a liability. I feel them. They’re a liability to the business.

Christen Ager-Hanssen: They’re a f***g danger to the business and we are not compliant. We can’t even put in compliant rules. How the f**k should we do that?

Stefan Matthews: You imagine the f***g damage I could do if I went rogue?

Christen Ager-Hanssen: I know.

Stefan Matthews: Think about that they don’t ever think I’m going to go rogue.

Christen Ager-Hanssen: No, but think about it. If we just you and me and so Far went up to Calvin and told him the danger song. You think that tableau is off our back? Cost them. F**k.

Christen Ager-Hanssen: I tell you, wait till Marco’s gone. Timing.

Stefan Matthews: It’s like there’s one thing that Calvin reacts to. And Marco plays the fear game as well as anyone.

Christen Ager-Hanssen: But you know what he plays? He played the option game. So he is always you know what? Exactly how it works. He has Calvin.

Christen Ager-Hanssen: Calvin, the only thing he knows, because of his attention span. He knows how to hedge. So hedging this alternative, there’s always a hedge. That’s his weakness too. Because I will always look for the hedge.

And then you know what you’re looking for.

Stefan Matthews: Well, one of his biggest hedges was the 300 million dollar pledge.

Christen Ager-Hanssen: Yeah.

Stefan Matthews: Because he’s not dumb. He knows there’s a cliff face over there. Because one thing, Calvin is greedy.

Christen Ager-Hanssen: He is greedy. He is greedy and he’s generous when it suits him. When it suits him. Because he doesn’t mind sharing on his condition. Deciding.

Stefan Matthews: I’m going to tell you a story about Nico. Three months ago, two and a half months ago, when I was in the family office, in my little room, and Nico was there. Closes the door, he says to me, Stefan, I have a question for you, if you don’t mind. By all means. What do I have to do to get a percentage of Calvin’s mining business?

What? I want a percentage of Calvin’s mining business. I said, why? Because that’s how I operate. I always work best when I got skin in the game.

And if I can get a percentage of his mining business, I’ll be totally committed. I said, first of all, you’ve been here five minutes. Second of all, asking is the wrong thing to do. And thirdly, if Calvin wants you to have a percentage of his mining business or a stake in it, which I don’t think he will ever do because you’ve got no connection to his mining business at all, he will give it to you. But he’s not going to give it to you now.

Stefan Matthews: You have to earn it. You have to earn it. And one thing I will tell you is if you ask for it, Calvin will cut off. Secondly, if you wait, you’ll find that he’s an extraordinarily generous person.

Christen Ager-Hanssen: Are delivering something about it. Yeah.

Stefan Matthews: That’s what we’re dealing with here. A greedy motherf***r who thinks he’s sitting on a pot of gold because he’s got how he got into this. He was friends with Valeria and Valeria got him in to do some job with something, some restructuring when they split the family office in half. He project managed that and then she promoted him to me and became your assistant. But he’s no good person.

Stefan Matthews: There’s something wrong with him. I pick flaws. I don’t know what it is, but there’s something not going to work out with him.

Christen Ager-Hanssen: No, he will not last.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- June 30, 2025NewsWireBank Savings at Risk: The Dark Side of EU’s Savings Standard

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class