As of the latest data, Bitcoin continues to dominate the cryptocurrency market with a staggering market capitalization of $535.217 billion USD. This considerable valuation is bolstered by a robust 24-hour trading volume of approximately $9.973 billion USD, indicating substantial investor interest and liquidity.

When it comes to supply metrics, Bitcoin’s circulating supply stands at around 19.51 million coins, drawing ever closer to its programmed maximum supply cap of 21 million. These statistics not only underscore Bitcoin’s prominence as a digital asset but also serve as a testament to its widespread adoption and enduring appeal among both retail and institutional investors despite several negative developments.

In the ever-volatile landscape of cryptocurrency, black swan events, those unpredictable, high-impact occurrences, often loom like spectres of doom. These events can irrevocably shift market dynamics and cause widespread financial turmoil. Not to mention huge losses amongst retail investors.

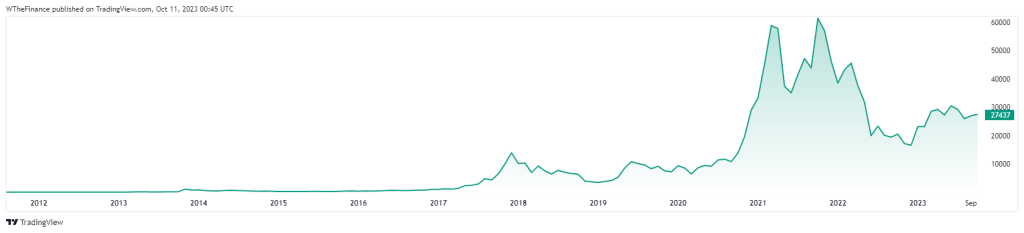

However, the digital gold that is Bitcoin has showcased a resilience that defies market logic, even in the face of seemingly insurmountable odds. Let’s examine a series of catastrophic events that, against all expectations, failed to push Bitcoin down to the $12,000 mark.

BTC All-Time Price Chart

Terra Luna Failure

The failure of Terra Luna, a blockchain protocol known for its stablecoin ecosystem, represented a severe setback not just for the protocol but also for the broader cryptocurrency and DeFi markets. Terra had championed the concept of algorithmically pegged stablecoins, presenting itself as an alternative to traditional financial systems. Its sudden downfall shook investor confidence and had an almost immediate impact on liquidity pools, borrowing-lending protocols, and yield farming platforms that were intrinsically linked to Terra’s stablecoins.

Interestingly, despite these disastrous events, Bitcoin managed to maintain a relatively stable price point, not descending to the apocalyptic lows that many had predicted. This curious stability amidst turmoil begs further investigation into the resilience and interconnectedness of crypto assets, even as the Terra Luna failure itself serves as a cautionary tale highlighting the volatility and inherent risks associated with decentralized financial platforms.

Three Arrows Capital Liquidation

The liquidation of Three Arrows Capital, a prominent investment fund heavily involved in cryptocurrencies and digital assets, had a ripple effect across the financial landscape. Known for their aggressive trading strategies and sizable positions in various cryptocurrencies, the firm’s sudden liquidation served as a bellwether for the vulnerabilities lurking within the digital asset ecosystem. When the firm liquidated its positions, the sell-off triggered a cascade of automated liquidations and margin calls across various exchanges and DeFi platforms, exacerbating market volatility.

Astonishingly, Bitcoin‘s value did not plummet to the extreme lows of $12,000 as many analysts had anticipated, which invites speculations about the asset’s resilience in the face of such black swan events. The Three Arrows Capital incident serves as a potent reminder of the domino effect that one significant entity can have on the broader market, underscoring the need for risk mitigation strategies in the volatile realm of digital assets.

Celsius & Blockfi Collapse

The simultaneous collapse of Celsius and Blockfi, two prominent platforms in the realm of cryptocurrency lending and borrowing, had seismic implications for the digital asset markets. These platforms pioneered the concept of earning interest on cryptocurrency holdings, thereby providing liquidity to the broader financial ecosystem. Their downfall not only left thousands of investors in a state of financial limbo but also shook the foundations of trust that underpin these innovative financial services.

Astonishingly, despite the catastrophic nature of these events, Bitcoin displayed remarkable resilience, refusing to plummet to the doom-and-gloom predictions of analysts. The failures of Celsius and Blockfi raised urgent questions about regulatory oversight and risk management within the cryptocurrency sector, but the market’s robustness in the face of such adversity suggests a certain degree of maturation and could potentially serve as a harbinger for a more stable future for digital assets.

Voyager Collapse

The collapse of Voyager, a widely used cryptocurrency brokerage platform, sent tremors through the financial markets, particularly within the realm of digital assets. The platform had served as a gateway for a multitude of retail and institutional investors to access an array of cryptocurrencies, and its downfall raised serious questions about the stability and security of similar platforms. Yet, what captured the attention of market observers was Bitcoin’s ability to hold its ground despite this significant rupture in the crypto ecosystem.

The Voyager debacle served as a litmus test for Bitcoin’s resilience, revealing that the cryptocurrency could maintain its value and investor confidence even when faced with a high-impact, negative event. This steadfastness suggests a maturation of the Bitcoin market, positioning it as a durable financial asset rather than a volatile, speculative venture.

FTX Crypto Exchange Collapse & Genesis Bankruptcy

The abrupt collapse of FTX, a once-high-flying cryptocurrency exchange lauded for its innovative financial products and rapid market expansion, sent shockwaves across the financial ecosystem. With its pioneering role in creating tokenized derivatives and futures, FTX had become a linchpin in the crypto trading community, boasting a high volume of daily transactions. The dissolution of the platform thus had an immediate domino effect, affecting liquidity and market confidence on a global scale.

Remarkably, Bitcoin and other major cryptocurrencies displayed a tenacious resistance to plummeting to extremely low values, a testament to the asset class’s growing resilience. The FTX debacle underscores the critical need for stringent risk management protocols and raises fresh concerns about the regulatory environment surrounding digital asset exchanges. Nonetheless, the market’s relative stability in the wake of the FTX collapse may indicate a new phase of maturity and robustness for the broader cryptocurrency ecosystem.

The SEC’s Battle with Cryptocurrency

The U.S. Securities and Exchange Commission‘s (SEC) ongoing skirmish with the cryptocurrency industry marks a critical juncture in the evolution of digital assets and financial regulation. The SEC has positioned itself as a regulatory vanguard, scrutinizing Initial Coin Offerings (ICOs), DeFi platforms, and various crypto-native companies for compliance with existing securities laws. These efforts have culminated in high-profile legal battles, most notably with Ripple Labs over its native token, XRP. The regulatory agency’s stance has prompted vigorous debate about whether cryptocurrencies should be classified as securities, commodities, or an entirely new asset class.

The uncertainty introduced by these legal confrontations has stoked volatility in crypto markets and has had a chilling effect on innovation within the U.S., as startups opt to launch in more crypto-friendly jurisdictions. The SEC’s aggressive approach towards regulation is seen by some as necessary for consumer protection and market integrity, but others argue it stifles the very innovation that could propel the financial system into a new era. This ongoing battle will undeniably set critical precedents, shaping the future of digital assets and their role in the global financial ecosystem.

New Found Resilience

The resilience of Bitcoin amidst these cataclysmic events is a testament to its robustness as a financial asset and its ever-increasing integration into mainstream finance. While these black swan events did shake the markets and induce varying degrees of short-term volatility, they failed to usher in the sort of apocalyptic downturn for Bitcoin that many had forecasted. Therefore, one may argue that Bitcoin has transitioned from being a fragile, speculative asset to a more robust and resilient financial instrument, one that is capable of weathering even the most severe of financial storms.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- June 30, 2025NewsWireBank Savings at Risk: The Dark Side of EU’s Savings Standard

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class