In an era where geopolitical tensions are escalating, particularly in the Middle East and Eastern Europe, the defense sector is drawing considerable attention from investors. One company that stands out in this regard is Lockheed Martin ($LMT). With conflicts in Israel and Ukraine, Lockheed Martin presents a potentially compelling investment case, backed by various factors like its product portfolio, historical performance, and industry standing.

Financial Viability

When considering an investment in the aerospace and defense sector, Lockheed Martin ($LMT) presents itself as an eminently appealing option, backed by robust financial indicators and a resilient business model. One of the most compelling figures is the Return on Invested Capital (ROIC) of 29%, signaling that the company is effectively utilizing its capital to generate profits. In an industry as capital-intensive as aerospace and defense, an elevated ROIC indicates operational efficiency and financial stewardship, qualities that are of immense value to investors.

Additionally, the forward Price to Earnings (Fwd PE) ratio of 15x suggests that the stock is not overly valued, especially when compared to industry peers and considering its growth prospects. This multiple indicates that investors can acquire future earnings at a relatively reasonable price, thereby fortifying the investment rationale.

The market capitalization of 100.916 billion USD places Lockheed Martin among the giants in its sector, thereby providing the stability that often comes with size and scope. Moreover, a dividend yield of 2.99% for the fiscal year signifies a rewarding income stream for investors, particularly those seeking a blend of growth and income in their portfolios. When it comes to the Price to Earnings Ratio (TTM) of 14.53 and Basic Earnings Per Share (EPS) of 27.45 USD, these figures further solidify the company’s profitability and its ability to provide shareholder value.

The P/E ratio demonstrates that the market has fair expectations regarding Lockheed Martin’s earnings potential, while the EPS confirms that these expectations are not unfounded but are grounded in solid financial performance. As geopolitical conflicts brew and defense budgets swell, Lockheed Martin, with its diversified portfolio of military products, stands well-positioned to capitalize on these trends, thereby making it a desirable stock at this juncture.

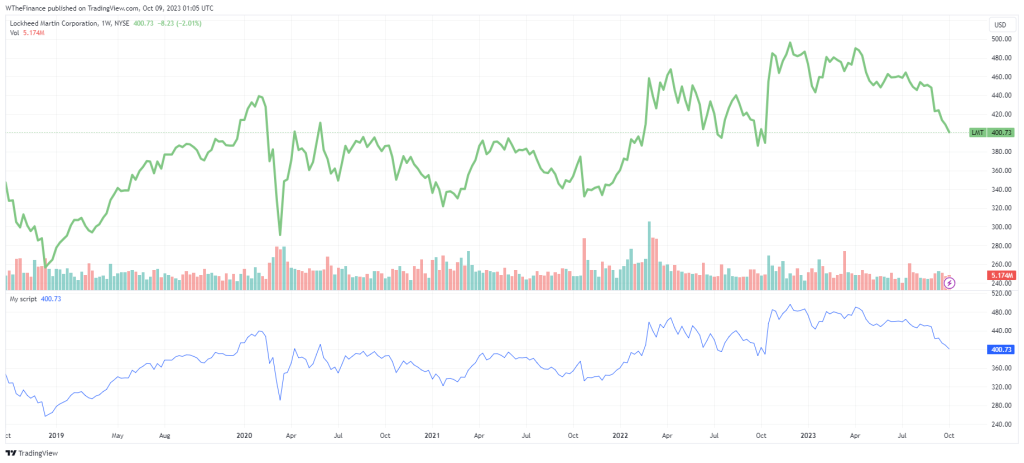

LMT 5 Year Price Chart

Product Portfolio

Lockheed Martin’s diverse range of military products—F-35 Lightning II fighter jets, C-130J Super Hercules transport aircraft, CH-53K King Stallion heavy-lift helicopters, TH-73A Red Hawk trainer jets, and HIMARS—places the company as a major supplier not only to the U.S. military but also to global forces. Their products are employed in a myriad of military operations from air strikes and ground combat to missile defense. As noted by Twitter user Curic, Lockheed is a “pure defense play,” unlike some competitors that have significant commercial airline exposure, which can be vulnerable in a declining economy.

Industry Outlook

Commentator Malcolm FleX said, “The only winners in the Middle East will be Raytheon, Lockheed Martin, Northrop Grumman, and General Dynamics.” The recent flare-ups in geopolitical hotspots have amplified the demand for defense equipment tailored for combat in specific terrains. In such volatile times, Lockheed Martin’s products gain an edge, both in terms of operational excellence and market value.

Ethical Controversy

While the ethical dimension of defense contracting often comes under scrutiny, Lockheed Martin has taken preemptive steps to address these concerns. A statement by Richard W. Painter, who formerly served as the chief White House ethics lawyer, raises several significant ethical and legal questions regarding Lockheed Martin’s business dealings. Specifically, the claim that Jared Kushner intervened to secure a better price for Saudi Arabia on a $110 billion arms deal with Lockheed Martin, followed by a subsequent $2 billion investment from the Saudis into Kushner’s business, raises concerns about potential conflicts of interest, kickbacks, or even bribery.

This is particularly poignant because Lockheed Martin has been publicly promoting an “ethics” program in defense contracting for a decade. If Painter’s assertions warrant a full investigation and are found to be true, this could significantly tarnish Lockheed Martin’s reputation and question the credibility of its much-vaunted ethics program, thereby leading to legal scrutiny and potential financial penalties.

From an investor perspective, any form of investigation or subsequent legal action could have far-reaching implications on Lockheed Martin’s stock. In the short term, public sentiment could turn negative, leading to stock price volatility. Furthermore, any proven ethical or legal misconduct could result in substantial financial penalties and could jeopardize existing or future contracts, not only with the Saudi government but also with other nations that may reconsider their business relationships with the company.

In an industry where reputation and trustworthiness are paramount, the ripple effects of such a scenario could be significant and long-lasting. Therefore, while Lockheed Martin may present a robust investment case based on financial metrics and product portfolio, the shadow of ethical and legal considerations could pose a considerable risk.

Economic Impact

Dr. Paul DeSantis brings another angle into this discussion by stating that the “billions” given to Ukraine are not in cash but in contracts to major defense contractors like Lockheed Martin. He argues that this has a “very positive effect on the US economy” as it helps to expand the American industrial base. Lockheed Martin, along with other key players, has also been actively hiring to meet the demands of these contracts, further stimulating the job market.

US Army Support

The recent official statement from Lockheed Martin highlights the company’s instrumental role in fortifying the defense capabilities of the United States military. Last week, Lockheed Martin assisted the U.S. Navy in successfully executing its 191st test launch of an unarmed Trident II D5 Fleet Ballistic Missile, a system that was both built and upgraded by Lockheed Martin.

This test serves as a critical benchmark, not merely showcasing the technical efficacy of the missile system, but also demonstrating the operational readiness of both the system and the crew aboard the USS Louisiana, an OHIO-class submarine. In a broader context, this statement emphasizes Lockheed Martin’s continued commitment to excellence in defense technology, reinforcing its position as a crucial contributor to national and international security.

Short or Long Term Gains?

Lockheed Martin is well-positioned to benefit from the rising demand for military equipment amid ongoing conflicts in Israel and Ukraine. Financially robust, with a diverse product portfolio, and demonstrating operational excellence, $LMT offers a solid investment opportunity. As conflicts around the world show little sign of abating, Lockheed Martin’s strategic importance is set to rise, thereby making it a highly desirable stock at this juncture.

This is not financial advice. Always consult with a qualified professional before investing.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class

- March 7, 2025SatoshiCraig Wright Banned from UK Courts with Civil Restraint Order