The party cannot go on forever and what goes up must come down eventually. Analysts at major hedge funds are warning that the United States’ battle with inflation is far from over and that speculating on a rapid series of interest rate cuts from the Federal Reserve is premature.

While futures markets currently indicate expectations of one additional 0.25 percentage point rate increase by the autumn, followed by six interest rate cuts over the next 12 months, analysts believe that inflation is still too high and is likely to level out without significant changes.

They dismissed the idea of the Fed implementing the rate cuts that are currently priced into the market. A member of the Fed’s rate-setting committee emphasized the need for sustained declines in inflation before considering further rate hikes.

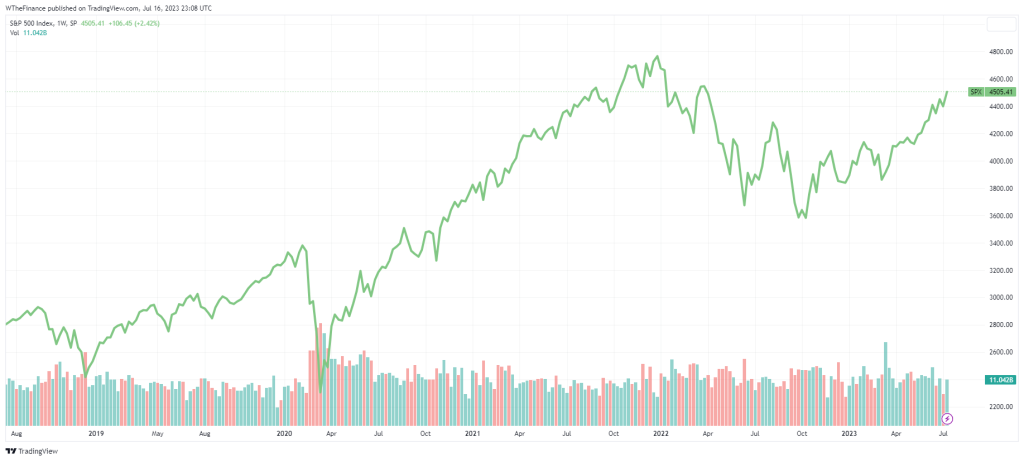

The global stock market, which has experienced a nearly $10 trillion rally this year, is now approaching a crucial juncture as numerous companies prepare to report their earnings in the coming weeks. According to data compiled by Bloomberg Intelligence, S&P 500 firms are expected to see a 9% decline in profits for the second quarter, marking the weakest earnings season since 2020.

SPX 5-Year Chart

In Europe, the projected slump is even more severe at 12%. However, with expectations already set low and some indicators pointing to a potential earnings recovery in the following year, market strategists hold divided opinions on how the market will respond to these results.

Investors displaying caution are increasingly acquiring derivatives to safeguard their portfolios in the event that the European stock market’s ongoing rally falters. This growing trend reflects mounting concerns among investors that slowing economic growth could impact markets, which are currently hovering near record highs.

Traders have been purchasing more put options, which act as insurance against price declines, compared to call options, which yield profits in the event of market rises. Bank of America analysts suggest that this shift indicates an “underlying nervousness” surrounding European stocks, despite their recent gains.

The ratio of puts to calls linked to the Euro Stoxx 50 index, which includes prominent companies such as LVMH, ASML, and Siemens, has reached its highest level in a decade according to BofA data. Although the index has risen by 14% since January to its highest level since 2007, the eurozone economy entered a mild technical recession in June after experiencing two consecutive quarters of contraction.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- June 30, 2025NewsWireBank Savings at Risk: The Dark Side of EU’s Savings Standard

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class