The recent collapse of Silicon Valley Bank (SVB) has brought to light some troubling truths about the private sector financial world, revealing how investors and regulators were blindsided by risks that should have been more apparent. Two significant issues have been identified in relation to the role of government agencies and the use of collateral in the financial system.

One of these lesser-known entities is the Federal Home Loan Bank (FHLB) system, a state-backed collection of wholesale cooperative banks that provide ultra-cheap debt to extend loans. The FHLB’s lending saw a dramatic surge long before the problems at SVB came to light, and data shows that the three banks that collapsed in March 2023, including SVB, were heavy borrowers from FHLB. The secretive nature of FHLB support potentially conceals stress in banks and undercuts market discipline.

Furthermore, the use of collateral in the financial system has exploded, both in capital markets and banking. While collateralization is intended to make finance safer, it can also reduce incentives to screen and monitor borrowers, leading to increased aggregate leverage.

Collateral composed of securities, like treasuries, heightens liquidity risk and could trigger destabilizing dynamics if the value of the collateral is adversely affected. The emphasis on over-collateralized policies by institutions like FHLB and regulatory encouragement for banks to hold treasuries have added to the complexities of the financial system.

List of Banks That Collapsed in 2023

- Silicon Valley Bank (SVB)

- Signature Bank

- First Republic Bank

- Credit Suisse

- Silvergate Bank

The urgent need for a discussion arises as current trends in FHLB advances to other banks could potentially create similar distortions, and the implications of these issues continue to unfold. In light of these revelations, it is imperative for regulators and market participants to address and reform both the FHLB system and the use of collateral to promote greater market discipline and mitigate systemic risks in the long term.

How Did the Collapse Affect Cryptocurrencies?

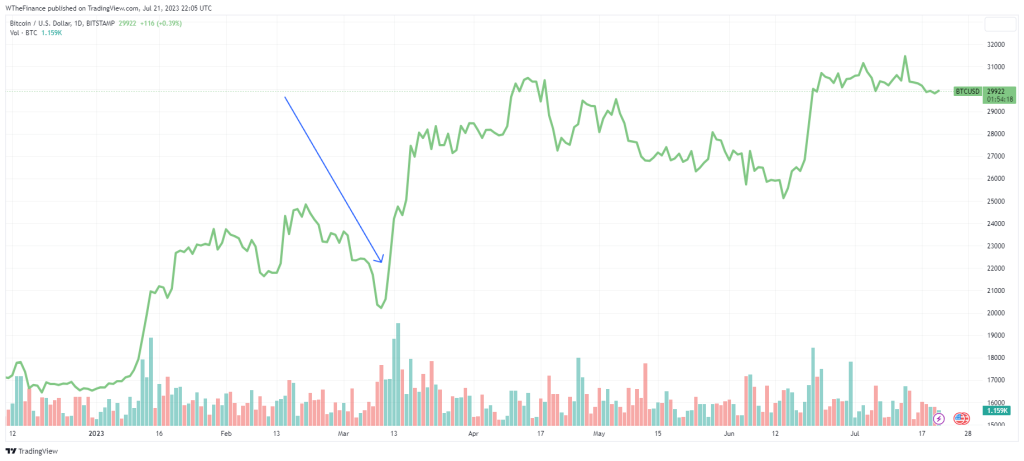

Famously the collapse of the banks catapulted the price of Bitcoin from a yearly low of $16,000 to $30,000 in a short period of time. This prompted Cathie Wood from ARK Invest to label this event as a game changer in how people see Bitcoin, namely as a safe store of value and revised her bullish projection to $1.5 Million.

Cathie Wood says, "Bull case for bitcoin is $1,500,000 per coin and our confidence has actually increased"

— Documenting ₿itcoin 📄 (@DocumentingBTC) July 18, 2023

"Bitcoin is an insurance policy. We won't have another '08-'09 crisis with bitcoin. It's decentralized and transparent"

pic.twitter.com/evjDFMaHUL

Analysts predict that future banking crises could lead many investors to trust in digital assets, therefore significantly boosting the cryptocurrency economy. Whilst gold and other commodities also stand to gain from these situations, increasingly investors are turning to crypto.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- June 30, 2025NewsWireBank Savings at Risk: The Dark Side of EU’s Savings Standard

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class