What’s new? Well, some of the same in the banking sector this year. On May 1st, 2023 the First Republic Bank was seized by regulators and parts sold to JPMorgan Chase, marking the third major bank failure in recent months, and the second-biggest bank failure in the history of the United States. And this at the back of the collapse of Credit Suisse, Silicon Valley and Signature banks only recently.

Are we living in a new version of 2008? This is now the question on the minds of many investors.

The collapse of First Republic has sent shockwaves throughout the financial world, raising concerns about the stability of the banking system in the US. But what were the reasons behind the bank’s downfall? What is the economic impact? How will the clients be affected? We will try to factor in the role of regulators and highlight any warning signs that were ignored before the collapse.

What Led To The Collapse Of First Republic?

The collapse of First Republic Bank was fueled in part by panic among depositors due to the bank’s financial instability. According to its earnings report, the bank had lost $100 billion in deposits in the first quarter of 2023. This was primarily due to the fact that 68% of First Republic’s deposits were uninsured, meaning they were above the FDIC-insured limit of $250,000.

Moreover, the bank has long faced criticisms for its high-risk lending practices, especially in the real estate sector. First Republic was known for offering loans to wealthy clients with little collateral, a strategy that worked for several years but eventually led to the bank’s collapse. The mass withdrawal of deposits by panicked customers caused the bank’s liquidity to dry up, leading regulators to seize control of the bank and sell off parts of it to banking giant JPMorgan Chase.

Economic Impact And Consequences

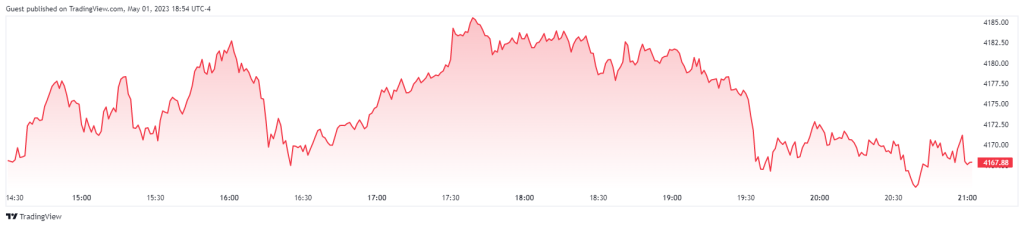

The collapse of First Republic Bank has triggered fears of a broader financial crisis and could lead to a wave of bank failures. This has already caused a decline in the stock market, which saw a drop of over 5% on the day of the bank’s collapse. The economic impact of the bank’s collapse could be felt for years to come, with the ripple effects hurting businesses and individuals who relied on the bank’s services.

The consequences for the bank’s clients have been severe as well. Many have lost their deposits above the FDIC-insured limit, leaving them with significant financial losses. The bank’s collapse has raised fresh concerns about the safety of bank deposits, leading to increased anxiety among customers and a potential run on other banks if the situation does not stabilize soon.

Regulatory Oversight And Warning Signs

The collapse of First Republic Bank has also highlighted the shortcomings of regulatory oversight in the US. The bank’s lending practices were known to be high-risk, but regulators failed to take action in time to prevent its collapse. In addition, the FDIC-insured limit of $250,000 was not enough to protect many of First Republic’s depositors, leaving them vulnerable to significant losses.

On top of all of that, the acquisition of deposits by JPMorgan breaks the rule of one bank controlling more than 10% of all US deposits.

Preventing Similar Collapses In The Future

To prevent similar collapses in the future, regulators need to take a more proactive approach to identifying and addressing high-risk lending practices. They should also consider raising the FDIC-insured limit to protect more depositors in case of a bank failure. Banks, on the other hand, should be required to maintain higher reserves to ensure their stability in times of financial stress.

In conclusion, the collapse of First Republic Bank has raised serious concerns about the stability of the banking system in the US. It will be interesting to see how this news affects the prices of cryptocurrency that seem to have been connected to previous collapses this year. Popcorn anyone?

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class

- March 7, 2025SatoshiCraig Wright Banned from UK Courts with Civil Restraint Order