In the dynamic realm of cryptocurrency holdings, various entities have taken significant positions in Bitcoin, reflecting both institutional and governmental adoption of digital assets.

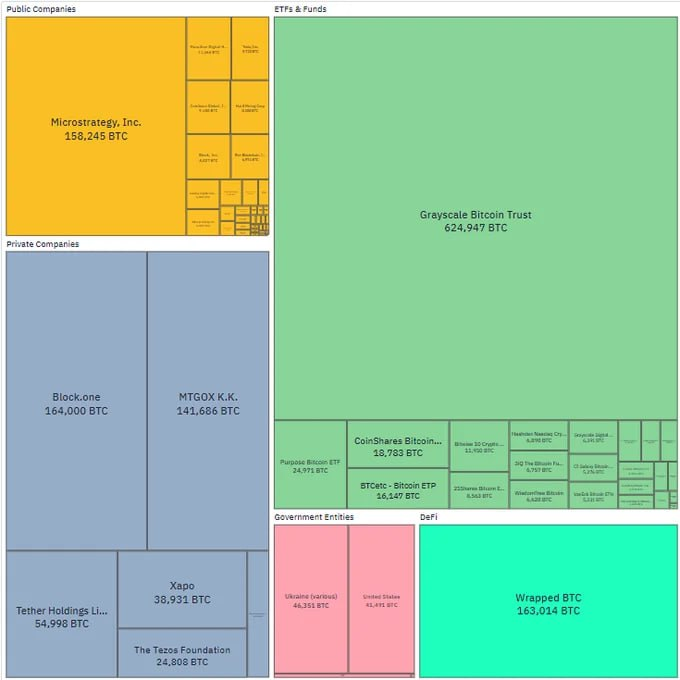

Notably, Grayscale Bitcoin Trust emerges as a substantial holder with an impressive stash of 624,947 BTC. This positions Grayscale as a dominant force in the Bitcoin investment landscape, especially within the ETFs and Funds category. Their holding underscores the growing trend of traditional investment vehicles incorporating cryptocurrency.

Public companies are also marking their territory in the Bitcoin ecosystem, with MicroStrategy, Inc. leading the pack. Their strategic accumulation of 158,245 BTC signals strong confidence in Bitcoin as a corporate asset and reflects a broader shift in asset allocation strategies in the corporate world.

Private companies are not far behind, with Block.one and MTGOX K.K. holding 164,000 BTC and 141,686 BTC, respectively. These holdings demonstrate the significant bet these private entities are placing on Bitcoin’s long-term value proposition.

In the exchange-traded products (ETP) space, entities like CoinShares Bitcoin ETP hold a notable amount of 18,783 BTC, contributing to the liquidity and accessibility of Bitcoin through regulated financial markets.

Not to be overlooked, decentralized finance (DeFi) platforms have carved out their niche, with Wrapped BTC (WBTC) representing a substantial 163,014 BTC. This indicates that Bitcoin’s utility is being extended into the DeFi ecosystem, allowing for its integration into various decentralized applications and smart contracts.

Even government entities have entered the Bitcoin arena, with Ukraine holding 46,351 BTC. This not only showcases Bitcoin’s appeal as a digital reserve but also highlights how nations are beginning to recognize the potential of cryptocurrencies.

Private holders such as Tether Holdings Limited and The Tezos Foundation, with 54,998 BTC and 24,808 BTC respectively, illustrate the diversification of cryptocurrency holdings beyond operational entities into foundational and operational reserves.

The Bitcoin holdings across these diverse sectors signal a robust and maturing market where cryptocurrencies are not just speculative assets but are increasingly seen as legitimate stores of value and investment vehicles. This trend is likely to continue as the adoption of blockchain technology and cryptocurrencies gain further momentum globally.

Author Profile

- Ex-community moderator of the Banano memecoin. I have since been involved with numerous cryptocurrencies, NFT projects and DeFi organizations. I write about crypto mainly.

Latest entries

- June 6, 2025NewsWireElon Musk to Decommission SpaceX Dragon after Trump Threat

- December 9, 2024Stock MarketMaster the Time Value of Money Financial Concept

- November 18, 2024Stock MarketFinancial Ratios Guide to Measuring Business Performance

- November 11, 2024NewsWireLabour’s UK Budget: A Fiscal Smirk of Contempt for Working People