The recent UK budget has been, to put it mildly, a small disaster. Led by Chancellor Rachel Reeves, it has drawn fierce criticism across the nation. Everyone has been affected. Some more than others. The £40 billion tax increase, aimed at shoring up public finances and funding crucial services like the NHS, has left many Britons feeling frustrated, People feel short-changed and rightly so. As the dust settles, some are questioning whether Reeves’ policies are pushing Britain’s wealthiest residents (and their investments), out of the country.

A Tax Burden in Disguise?

Rachel Reeves presented the tax hike as a solution to what she calls “broken Britain“. However, many critics argue that it will have the opposite effect, especially as it includes sneaky measures like freezing tax bands while inflation rises. Freezing the bands effectively means that as salaries increase to keep up with inflation, more people will be pushed into higher tax brackets without actually earning more in real terms, a phenomenon known as “fiscal drag”. As Reeves pushes the tax burden up to 38.2% of GDP, the public is feeling the pressure.

One observer noted, “£40 billion has been sucked out of the real economy to service irresponsible debt, while creating even more debt”. This sentiment reflects the fear that the budget’s measures do little to foster genuine growth. Instead, it’s seen as squeezing more out of the population without addressing the root issues.

The “Death Tax” on Pensions

One of the most controversial elements of the budget is the inclusion of defined contribution pensions in inheritance tax (IHT) calculations starting from 2027. Currently, pensions are exempt from IHT, making them a safe harbor for people looking to pass down wealth. Financial advisors have long recommended a “pensions last” strategy, suggesting that retirees use other assets first to maximize tax efficiency. But now, those with significant pensions face the reality that their heirs could be hit with a hefty tax bill.

Richard Parkin, head of retirement at BNY Mellon, warns, “This will have a huge impact on retirement management”. The new rules could drive people to gift assets early, potentially endangering their own financial security in later years.

Another cause for concern is the sharp rise in the rate of Capital Gains Tax, which has increased by 20-80%. This is a discouraging signal for potential investors and small business owners. The UK, as an investment destination, just got a bigger bite from the taxman for those selling their assets or cashing out shares. Reeves has cast this as a move to make the tax system fairer. But it hardly sounds fair. It has engendered a sense of unease and fear amongst the business community. “It’s a good reason not to invest in the UK,” said one critic who highlighted the potential risk of an exodus of businesses.

The Institute for Fiscal Studies points out that CGT was previously paid by less than 1% of the population, mostly the wealthy. This means that while the tax change will raise funds, it also disproportionately affects the very group that drives investment and economic growth.

Farmers Under Pressure

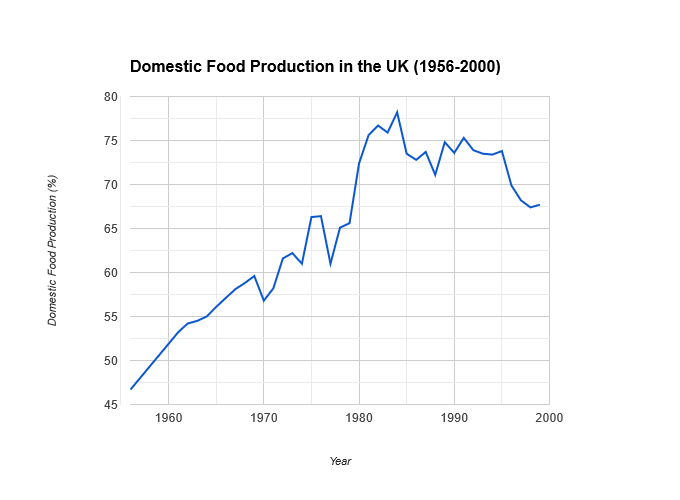

One lesser-known aspect of the budget is its effect on farmers, particularly in the context of passing farms to the next generation. By taxing farmers heavily upon inheritance, the budget has inadvertently put long-term food security at risk. Farming is a capital-intensive business with slim profit margins. Everyone knows that. Taxing inheritance in this sector could force some families to sell their land, decreasing domestic food production. A massive problem as domestic food production has continue to drop since the 1990’s. So are critics wrong when they argue that these tax policies ignore the essential role of farming in national stability?

The Chancellor’s decision to freeze tax bands and increase the cost of hiring workers has also come under fire. By making it more expensive to hire, the budget indirectly places the burden on “working people,” the very demographic Reeves claims to support. Employers facing higher National Insurance contributions may hold back on hiring, ultimately harming job prospects and wage growth. The situation is particularly disheartening given Reeves’ past statement that she didn’t plan to be a “big tax-raising chancellor”. Instead, her budget has become one of the most significant tax hikes since the 1990s.

Even seemingly minor gestures, like the 1p cut on pints of beer, have been met with ridicule. “It’s the kind of thing they’d do if they believed we are all broke morons who shuffle down the pub for our petty source of joy,” commented someone.

In the wake of these sweeping tax changes, some wealthier Britons are eyeing the exit. With digital nomad visas available in over 50 countries, there’s a growing opportunity for professionals to work remotely from tax-friendlier places. As one tax expert put it, “If you can easily leave the UK, you now cost 15% less to an employer if you’re a remote or overseas contractor”.

The UK’s high tax burden and complex tax landscape are driving some of its wealthiest residents to consider relocation. Given the impact of tax hikes on investors, business owners and high-net-worth individuals, the exodus could result in a loss of talent and investment that further stymies economic growth. “They’ve made the UK a less attractive, less enjoyable, less secure, less affluent place,” one business analyst remarked, summing up the frustration felt by many.

Not Again

The UK’s latest budget has sparked a firestorm of criticism. While Rachel Reeves insists these tax hikes are necessary to fix Britain’s finances, many argue they will do more harm than good. They are only good for driving away investment, discouraging entrepreneurship and making life harder for everyday Britons.

On top of these tax hikes, increases in university fees from next year, mark another false promise by the Labour government. As part of its election manifesto Starmer and Labour were promising free education for all.

For those with the means to leave, the message is clear: there’s a big, wide world out there and many places don’t treat their people with such disdain. For those that have to stay. Get ready for a miserable next 4 years. And maybe even more. God forbid.

Author Profile

- Ex-community moderator of the Banano memecoin. I have since been involved with numerous cryptocurrencies, NFT projects and DeFi organizations. I write about crypto mainly.

Latest entries

- June 6, 2025NewsWireElon Musk to Decommission SpaceX Dragon after Trump Threat

- December 9, 2024Stock MarketMaster the Time Value of Money Financial Concept

- November 18, 2024Stock MarketFinancial Ratios Guide to Measuring Business Performance

- November 11, 2024NewsWireLabour’s UK Budget: A Fiscal Smirk of Contempt for Working People