The latest developments in Bitcoin are as fascinating as always. It feels that things started really accelerating since the approval of Bitcoin ETFs. Here’s a comprehensive overview of the key points:

1. Bitcoin’s Price Movement

Bitcoin has shown signs of strain under heavy overhead resistance, with its price recently dropping to a one-week low. Despite attempts by bulls to hold the price above $52,000, the cryptocurrency faced a short-term trend change. After the approval of spot Bitcoin ETFs, the price of Bitcoin surged, reaching as high as $47,650, before experiencing a quick retraction. Since then, the price movement has been upwards, breaking the $50k barrier and now hovering around $52k.

2. Spot Bitcoin ETFs

The approval of spot Bitcoin ETFs has been a significant development. The Bitcoin Fear and Greed Index reached 76, indicating extreme greed following this event. However, the market response to this announcement was mixed, as the anticipated sell-off post-approval did not materialize, suggesting that the impact of the ETFs might have already been priced into the market.

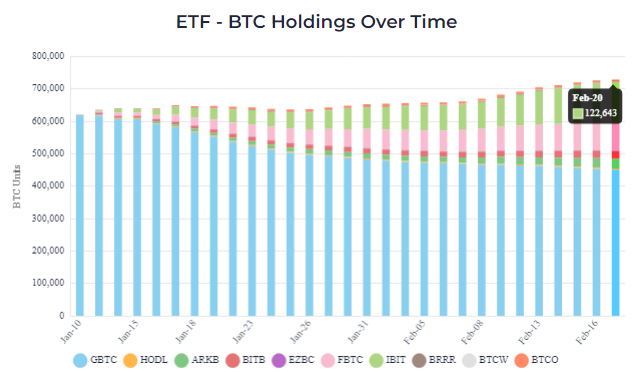

Since then, the landscape of Bitcoin ETFs has witnessed a notable influx, with recent data showcasing a net inflow of 2.6K Bitcoin. This surge has propelled the total Bitcoin holdings in ETFs to a new all-time high of 728.7K BTC. This upswing is partly due to the entry of new ETFs, which collectively have added an impressive 5.2K BTC to the ecosystem. Such movements indicate a growing confidence and interest in Bitcoin as an investable asset among institutional players.

Demand for spot Bitcoin ETFs is “8-10x” as much new supply is being created.

Michael Saylor

Among the highlights of this trend, Blackrock has augmented its Bitcoin position by 3K BTC, and Fidelity has increased its holdings by 1.4K BTC, showcasing their bullish stance on the digital asset. However, it’s not an industry-wide increase; the Grayscale Bitcoin Trust (GBTC) has seen a reduction of 2.6K BTC in its holdings. This contrasting dynamic points to a divergent approach to Bitcoin investment strategies among institutional entities and suggests a shift in investor preference within the diverse range of Bitcoin ETF offerings.

3. Market Analysis and Predictions

Bitcoin’s future open interest hit a two-year high, causing alarm among traders about the potential risks for bulls. Analysts are also focusing on the behavior of Bitcoin whales and the impact of Nvidia in this context.

4. Institutional Trust and Regulation

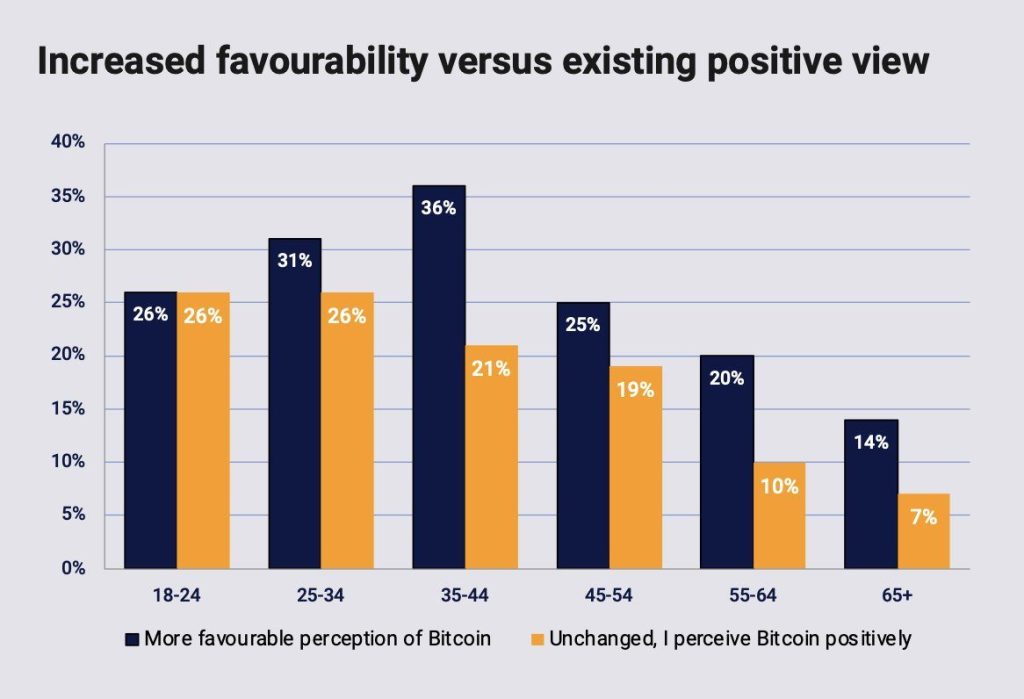

The adoption of Bitcoin ETFs could bring more institutional trust and potentially crypto-friendly regulation, as suggested by the CEO of Crystal Intelligence. The rise in positive sentiment towards Bitcoin, especially among older demographics, has also been noted following the U.S. spot Bitcoin ETF approvals.

In an unequivocal nod to the burgeoning significance of digital assets, BlackRock, the world’s largest asset manager, is set to convene an “Institutional Digital Assets Summit.” The event, scheduled for tomorrow, has stirred the financial community, with many interpreting it as a bullish signal for Bitcoin. This summit represents a pivotal moment as institutional interest in cryptocurrencies continues to swell, potentially setting the stage for wider acceptance and integration of Bitcoin into traditional investment portfolios.

On a similar note of optimism, billionaire hedge fund CEO Dan Morehead has shone a spotlight on the intersection of Bitcoin and Decentralized Finance (DeFi), describing it as a “$500 billion opportunity.” Morehead’s statement underscores the massive potential for growth and innovation as traditional financial mechanisms blend with the decentralized frameworks offered by blockchain technology. As DeFi protocols begin to incorporate Bitcoin, they open the door to a vast array of financial services previously untapped by the legacy cryptocurrency.

Adding to the wave of bullish sentiments, Fundstrat’s Tom Lee has expressed a bold outlook on Bitcoin’s future, positing that its price could soar as high as $500,000 in the coming years. Lee’s prediction is anchored in Bitcoin’s proven track record as a store of value and a risk asset, coupled with its unparalleled security features. If Bitcoin continues to follow its historical trajectory, fulfilling its dual role as both a digital gold and a driver of financial innovation, such price levels could indeed be within the realm of possibility, drawing a new era for Bitcoin and the cryptocurrency space at large.

5. MicroStrategy’s Bitcoin Strategy

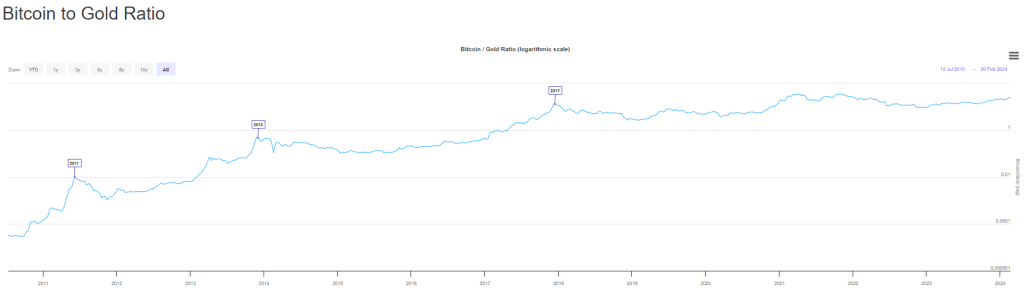

MicroStrategy executive chair Michael Saylor has expressed a strong belief in Bitcoin, claiming it to be superior to gold and real estate and anticipating that capital from these assets would eventually flow into cryptocurrency.

He must know something as MicroStrategy is now one of the world’s largest institutional holders.

6. Global Influence and Integration

The political landscape in South Korea is taking a significant turn regarding cryptocurrency investments. The opposition party has pledged to allow domestic investors to purchase Bitcoin ETFs, aligning with the ruling party’s supportive stance on lifting the existing ban. This bipartisan support marks a potential paradigm shift, signaling a move toward greater financial liberalization and embracing the rise of digital assets within the nation’s investment options. Should this pledge materialize into policy, South Korean investors could soon have the opportunity to engage more directly with Bitcoin as part of their investment portfolios, reflecting the growing global recognition of cryptocurrencies as legitimate financial instruments.

Other important developments such as the integration of SegWit addresses for Bitcoin transactions by Revolut and the addition of Bitcoin to the curriculum in El Salvador schools by 2024 indicate a growing global influence and integration of Bitcoin.

The approval of Bitcoin ETFs has also significantly swayed public opinion in Australia (see chart below), with a notable 25% of Australians now viewing Bitcoin more favorably. This shift is signaling a broader acceptance and potential increased participation from Australian investors in the Bitcoin market.

7. Bitcoin’s Comparison with Gold

The ongoing debate about whether investors are favoring Bitcoin over gold in response to rising inflation fears highlights a pivotal shift in investment strategies and perceptions of asset value. Some analysts argue that Bitcoin, often referred to as ‘digital gold’, offers advantages over traditional gold, primarily due to its digital nature, ease of transfer, and potential for higher returns. The perception of Bitcoin as a hedge against inflation, similar to gold, has gained traction, especially among younger, tech-savvy investors who are more inclined towards digital assets.

However, gold continues to hold its ground due to its historical stability and universal acceptance as a store of value. This discussion reflects a broader trend where traditional and digital assets are increasingly compared, with Bitcoin emerging as a significant player in the investment landscape, challenging the long-held supremacy of gold as the go-to hedge against inflation and economic uncertainty.

8. Bitcoin in Decentralized Finance (DeFi)

The integration of Bitcoin ETF price feeds by Pyth Network into Decentralized Finance (DeFi) is a notable development that represents a convergence of traditional finance and the burgeoning DeFi sector. This integration has several implications and benefits:

- Enhanced Market Data Accessibility: By providing Bitcoin ETF price feeds, Pyth Network is enabling DeFi developers to access real-time market data that was traditionally available only in conventional financial markets. This access to up-to-date pricing information is crucial for the development of more sophisticated and reliable DeFi applications, such as trading platforms, financial derivatives, and lending protocols.

- Increased Transparency and Efficiency: The availability of accurate and timely price data is essential for the proper functioning of financial markets. In the DeFi space, this transparency can lead to more efficient price discovery mechanisms and reduce the risks of market manipulation and arbitrage opportunities due to delayed or inaccurate pricing.

- A bridge between Traditional and Decentralized Finance: This development represents a significant step in bridging the gap between traditional financial markets and DeFi. By integrating elements of the traditional financial system, such as ETF price data, into DeFi platforms, there’s a potential for greater adoption of DeFi solutions by mainstream investors and institutions who may be more comfortable with traditional financial instruments.

- Potential for New Financial Products and Services: The integration of Bitcoin ETF price data into DeFi could pave the way for the creation of new financial products and services that blend characteristics of both traditional finance and DeFi. For instance, it could lead to the development of decentralized versions of traditional financial instruments, like ETF-based derivatives, or new lending and yield-generating products that use ETFs as underlying assets.

- Regulatory Implications: This development might also have regulatory implications. As DeFi begins to incorporate elements of traditional finance, it could attract more regulatory attention. This might lead to a more regulated and structured DeFi environment, which could be both a challenge and an opportunity for the sector.

- Increased Institutional Participation: The inclusion of traditional financial data like ETF prices in DeFi platforms could make these platforms more attractive to institutional investors. These investors often seek the kind of reliability and familiarity that traditional financial data provides, potentially leading to increased institutional participation in the DeFi space.

These developments collectively paint a picture of a maturing Bitcoin market that is increasingly intertwined with broader financial trends and regulatory frameworks. The cryptocurrency continues to attract attention from both individual and institutional investors, underscoring its growing importance in the global financial landscape.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class

- March 7, 2025SatoshiCraig Wright Banned from UK Courts with Civil Restraint Order