- Discussion around Bitcoin ETFs is hotting up as a move is anticipated soon

- Bitwise undercuts fees to 0.24%

- SEC acknowledges the final S-1 filing amendments

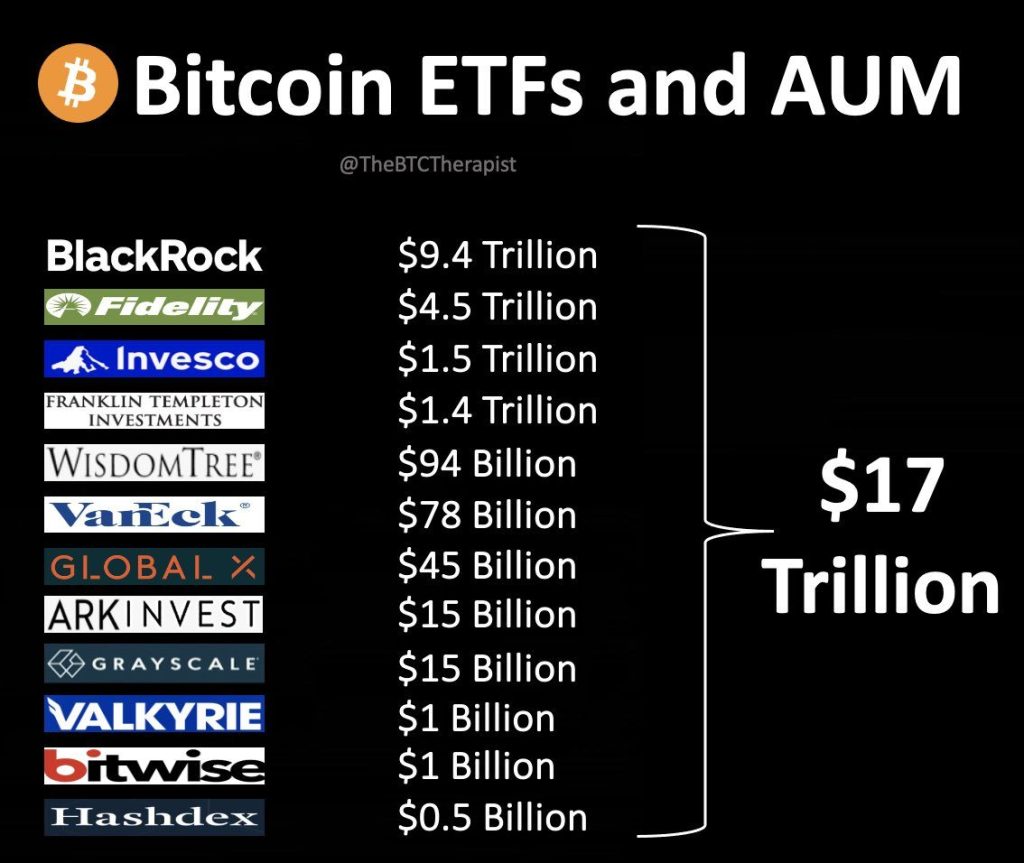

- ETFs are a $17 Trillion market

With the price of Bitcoin surpassing the $45,000 mark and reaching up to $47,000, the discussion around Bitcoin ETFs coming to market is not dying down. The anticipation is growing. Investors are now increasingly looking at Bitcoin-related Exchange Traded Funds (ETFs) as a way to gain exposure to the digital currency market without directly holding the assets.

The Exchange Traded Funds (ETFs) market, which is valued at an impressive $10 trillion, continues to expand. The long-awaited introduction of a Bitcoin spot ETF marks a significant milestone. This integration signals a major leap in bridging the gap between traditional finance and the burgeoning world of cryptocurrencies. For investors and crypto enthusiasts alike, this development represents not just an endorsement of Bitcoin’s growing mainstream acceptance but also an opportunity to partake in its potential in a more regulated and familiar framework. As we approach this new era, the message is clear: it’s time to buckle up for an exciting journey in the financial landscape.

A recent Bloomberg Intelligence report provides a detailed overview of the current Bitcoin ETF offerings, highlighting key factors such as fees, exchange listings, custodian information, and SEC filings.

Diverse Fee Structures in Bitcoin ETFs

The spectrum of management fees for Bitcoin-related funds reveals diverse strategies and operational models. Grayscale Bitcoin Trust’s negative fee of -2.00% is highly unconventional, diverging from the typical positive fee structure seen across the industry. This negative fee could be an innovative approach to attract investors by effectively offering a discount, or it might reflect a strategic move to manage fund expenses more efficiently.

We know ETF investors care deeply about fees

Matt Hougan (Bitwise CIO)

In contrast, fees around the 0.80% mark, such as those for the ARK 21Shares Bitcoin ETF and Valkyrie Bitcoin ETF, align with industry norms for ETFs, balancing operational costs with investor accessibility. On the other hand, the WisdomTree Bitcoin ETF’s lower fee of 0.39% positions it as a cost-effective option, potentially drawing cost-conscious investors looking for value in a competitive market. These fee structures not only influence investor choice but also reflect the evolving dynamics of the cryptocurrency investment product landscape.

Filing and Regulatory Compliance

The world of cryptocurrency-based investment products, like Bitcoin ETFs, is characterized by a rapidly evolving regulatory landscape. This environment necessitates continuous updates to filings and sometimes re-filings of initial proposals by issuers. Such actions demonstrate the issuers’ proactive approach in navigating the complex compliance requirements set forth by regulatory bodies.

Re-filings may reflect modifications in strategy, structure, or governance in response to feedback from regulators or changes in the market. This adaptive process is essential for issuers to remain compliant and for the products to align with current regulations, ensuring that they can operate within the legal framework while seeking to provide investors with new opportunities in the digital asset space.

Custodial Trust: A Cornerstone for Security

Security is paramount in the realm of digital assets. The role of the custodian is crucial as it safeguards the assets underpinning the ETFs. Coinbase, a leading cryptocurrency exchange, is the custodian for several funds, including GBTC and the Bitwise Bitcoin ETP Trust. This suggests a strong trust in Coinbase’s security and institutional services within the industry.

5 things I’m watching this week re: spot bitcoin ETFs…

— Chain Bucks Official (@MalikSaqibH) January 8, 2024

1) Remaining fee disclosures, esp from BlackRock & Grayscale. Can’t overstate importance of fees in this competition.

Fidelity current leader at 0.39%. Invesco at 0.59% (tho waiving fee for first 6mos)..#BTCETF #btc pic.twitter.com/MidZSuqhBK

The Significance of the ’19b-4 Amend?’ Column

The ’19b-4 Amend?’ mention refers to a specific regulatory procedure in the U.S. where exchanges must file a Form 19b-4 with the Securities and Exchange Commission (SEC) to propose a rule change. This is commonly used when an exchange seeks to list a new product, such as an ETF. An amendment to this form, indicated by a ‘Yes’ in the column, means the proposing entity has revised their initial filing.

These amendments often result from ongoing dialogue with the SEC, incorporating their feedback, or may be due to shifts in market dynamics or internal strategy changes. The amendment process is crucial for ensuring that the proposed ETF aligns with current regulatory standards and market practices, ultimately affecting the timing and structure of the ETF’s potential launch.

A Vast Market

The scale of Assets Under Management (AUM) by firms offering Bitcoin ETFs is staggering, with the cumulative total reaching an astounding $17 trillion. BlackRock leads the charge with $9.4 trillion in AUM, followed by Fidelity with $4.5 trillion, demonstrating the substantial financial weight behind these Bitcoin investment vehicles.

The illustration below underscores the significant confidence that major institutional investors are placing in Bitcoin, as they expand their portfolios into digital assets, hinting at the growing mainstream acceptance of cryptocurrencies within the traditional financial sector.

Implications for Investors

The Securities and Exchange Commission (SEC) has taken a crucial step forward in the cryptocurrency landscape by acknowledging the final S-1 filing amendments from issuers of potential spot Bitcoin ETFs. This progress signifies a move closer to integrating Bitcoin more deeply into the mainstream financial market.

The next pivotal phase involves the SEC’s approval of the S-1 and 19b-4 filings for each issuer, a decision eagerly anticipated by the financial and crypto communities. This development is a significant indicator of the evolving regulatory environment for cryptocurrencies and could herald a new era for Bitcoin’s role in institutional investment portfolios.

For investors, the management fees, custodial details, and regulatory compliance of each ETF are crucial factors to consider. Lower fees can improve returns, but the choice of custodian also impacts the security of their investment. Moreover, the constant amendments and re-filings reflect the issuers’ responsiveness to the SEC’s regulatory framework, signaling an evolving and maturing market.

As Bitcoin-related ETFs continue to gain traction, the landscape becomes more competitive and complex. Investors must stay informed and consider these multifaceted aspects when making investment decisions in the burgeoning field of cryptocurrency ETFs.

Author Profile

- Ex-community moderator of the Banano memecoin. I have since been involved with numerous cryptocurrencies, NFT projects and DeFi organizations. I write about crypto mainly.

Latest entries

- June 6, 2025NewsWireElon Musk to Decommission SpaceX Dragon after Trump Threat

- December 9, 2024Stock MarketMaster the Time Value of Money Financial Concept

- November 18, 2024Stock MarketFinancial Ratios Guide to Measuring Business Performance

- November 11, 2024NewsWireLabour’s UK Budget: A Fiscal Smirk of Contempt for Working People