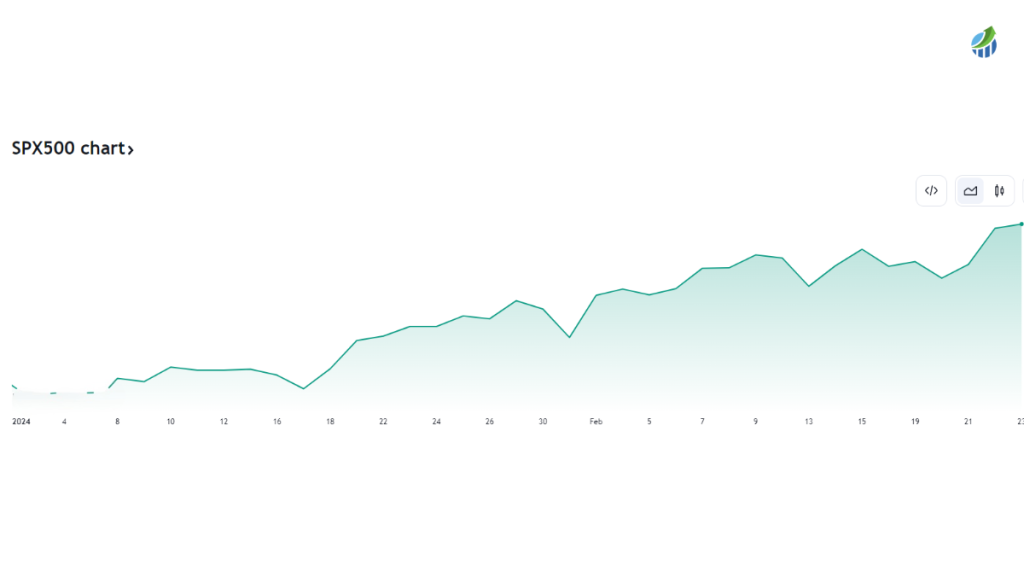

The conclusion of 2023 saw a robust rally in the U.S. equity market, a surge that has culminated in a prevailing sentiment of overvaluation across the stock spectrum as we step into 2024. This overvaluation signifies a tightrope of sorts for the market: there’s little leeway for missteps, and investor expectations are soaring. Such a climate fosters a delicate balance where the slightest of corporate or economic perturbations could have amplified effects. This is particularly pertinent in light of observations from analysts at Morgan Stanley, who suggest that the corporate earnings forecasts for the year might be tinged with an excess of optimism.

Their cautionary stance is rooted in the anticipation of a deceleration in U.S. economic growth, a factor that could significantly dampen the hitherto bullish earnings outlook and, by extension, impact investor sentiment and market behavior. As of February 2024, the stock market is presenting a landscape shaped by various factors and trends:

- Market Valuations and Earnings Outlook: In response to this intricate financial milieu, there emerges a clarion call for a recalibration of investment strategies. Traditional high-growth stocks, while attractive in a bull market, may not be the most prudent choice in an environment brimming with heightened valuations and optimistic earnings projections teetering on the edge of feasibility. Instead, there’s a growing advocacy for pivoting towards value-style stocks, particularly in sectors that historically exhibit resilience or are undervalued. Sectors such as financials, industrials, utilities, consumer staples, and healthcare are gaining prominence in this context. These sectors, often characterized by stable earnings and strong fundamentals, could offer a safer harbor in a sea of overvaluation and uncertain economic forecasts. This strategic shift not only aims to mitigate risk but also to capitalize on potential undervalued opportunities that may yield sustainable returns in a market landscape that is navigating through a phase of recalibration and realignment.

- Monetary Policy and Inflation: In 2024, the financial market’s pulse is strongly tied to the maneuvers of the Federal Reserve, particularly in terms of interest rate decisions. Investors and analysts alike are keenly observing these moves, with many harboring expectations of rate cuts, a scenario that could substantially sway market dynamics. However, this anticipation is tempered by insights from J.P. Morgan Research, which points towards the persistence of inflation and a complex macroeconomic environment. Such factors are likely to necessitate a more sustained period of elevated rates, diverging from the market’s hopes for relief. This scenario poses significant implications for equity performance, potentially leading to a more cautious and calculated approach by investors as they navigate the intertwining paths of monetary policy and market responses amidst ongoing inflationary pressures.

- Sector Focus: Several sectors are showing potential for growth in 2024. Basic materials companies, which include producers of chemicals, tin, and timber, are emerging from a period of de-stocking and might present valuable opportunities. In the healthcare sector, companies providing equipment and capacity-building services are well-positioned. The semiconductor sector is also noteworthy, with companies like Texas Instruments drawing attention due to their potential for strong demand post de-stocking.

- Options Trading as a Strategy: In the ever-shifting landscape of the 2024 financial market, characterized by pronounced volatility and uncertainty, a notable strategy gaining traction among investors is the selling of put options. This approach serves a dual purpose: it allows investors to generate income and offers an avenue to acquire stocks at prices below their current market value. Particularly in times of heightened market volatility, this strategy can prove to be especially advantageous. The reason lies in volatility itself, which tends to inflate the premiums that put sellers can command from buyers, thereby potentially increasing the profitability of this tactic. However, it’s crucial to underscore that options trading is not a one-size-fits-all solution. It comes with its distinct set of risks and complexities, making it an approach that might not be suitable for every investor. For those considering put selling, it demands a thorough understanding of the options market and a well-calibrated risk tolerance, ensuring that investors are fully equipped to navigate the intricacies and potential pitfalls of this investment strategy.

While the stock market in 2024 presents opportunities, it’s also characterized by high valuations, cautious earnings expectations, and a complex interplay of macroeconomic factors. Investors might benefit from a balanced approach, paying close attention to sector-specific trends and being mindful of the broader economic and monetary policy context.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class

- March 7, 2025SatoshiCraig Wright Banned from UK Courts with Civil Restraint Order