The Bitcoin halving is a pivotal event in the cryptocurrency world that significantly affects Bitcoin’s supply and, potentially, its price. As the countdown to the next Bitcoin halving ticks closer, the crypto community is abuzz with speculation and analysis. This halving, expected around April 19, 2024, at block 840,000, will reduce the block reward given to Bitcoin miners, thereby decreasing the rate at which new Bitcoins are created and added to circulation.

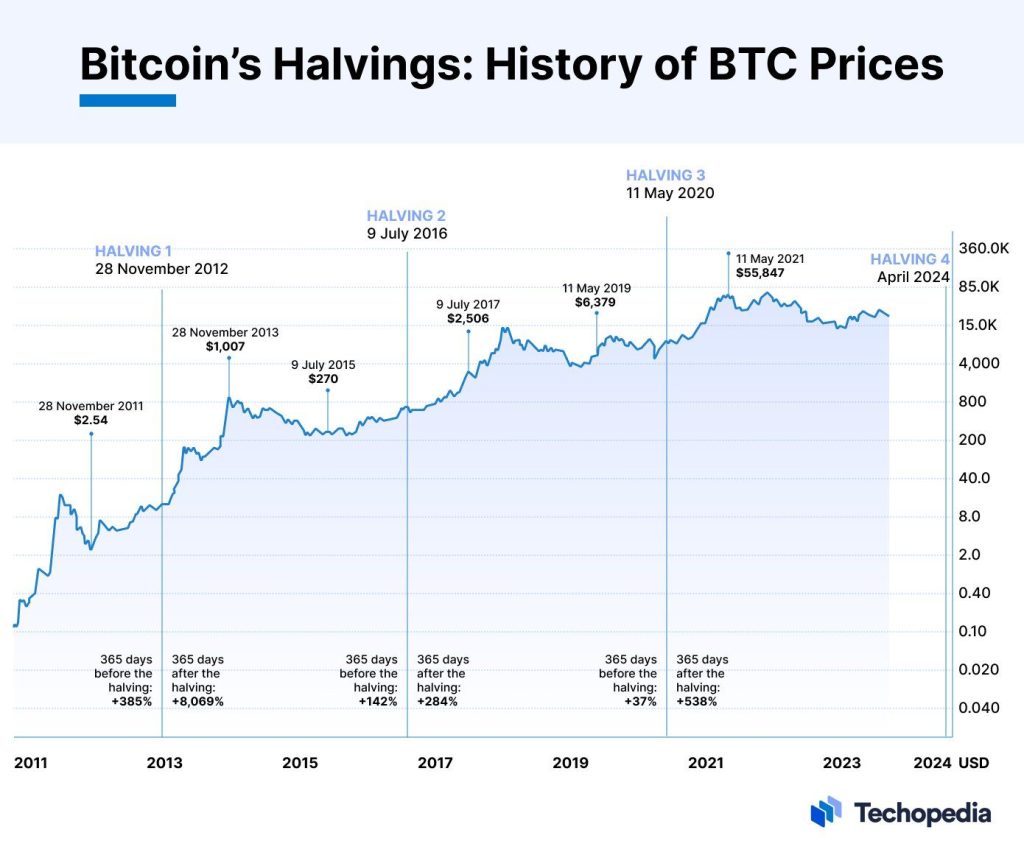

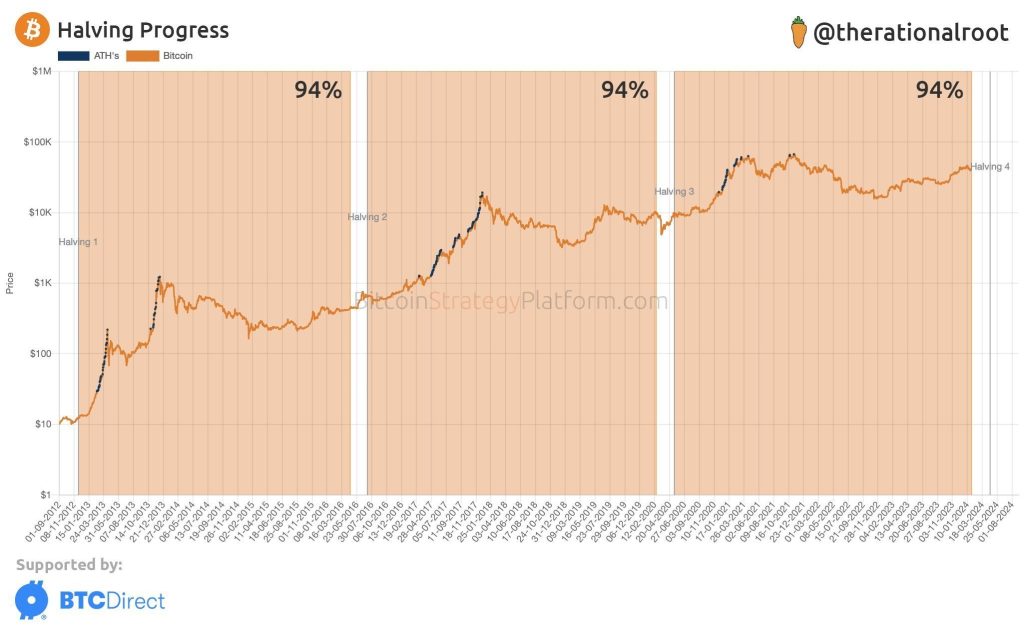

Historically, the halving has been associated with bullish trends in Bitcoin’s price. This pattern was observed in the year following past halvings, with substantial increases in Bitcoin’s price, although with diminishing percentage returns each time due to the growing market capitalization and size of the asset.

History of BTC Prices in Relation to Halving

Experts have varying opinions on the impact of the upcoming halving. Some predict a surge in Bitcoin’s price due to the reduced supply and increased scarcity. There’s a consensus that the halving will continue to be a positive event for Bitcoin’s price, but the extent of its impact could be less than in previous occurrences due to the maturation of the market and other factors, such as the influence of institutional investors and the evolving role of transaction fees for miners.

Furthermore, the halving could have ripple effects on other cryptocurrencies, including Ethereum, which may see increased attention and investment due to Bitcoin’s reduced new supply and the ongoing developments in Ethereum’s ecosystem, such as the transition to Eth2.0, DeFi, and NFTs.

As for Bitcoin miners, the halving poses a challenge as it will effectively cut their revenue from block rewards in half, potentially pushing out less competitive miners and consolidating rewards among larger players. This could lead to greater industry consolidation and a focus on operational efficiency.

With regards to the entire crypto market capitalization, the halving event is expected to bring a lot of attention to the space, which could result in a significant increase in market valuation, further entrenching cryptocurrencies as a mainstay in the financial landscape.

It’s important to note that while the halving typically generates excitement and optimism, it’s also crucial for investors to approach it with a balanced perspective, considering both the historical patterns and the unique circumstances of the current market. As always, due diligence and a long-term investment strategy should be paramount in the decision-making process of any investor.

Cryptocurrency heavyweight Adam Back has recently shed light on the intriguing phenomenon of price movements, suggesting a feedback loop that may be at play in the current market trends. Adam Back’s analysis points to the potential of a self-reinforcing cycle where increasing prices fuel media attention, which in turn sparks investor interest and leads to significant inflows of capital. This surge of investment can lead to further price increases, thereby creating a “positive feedback loop.”

His commentary follows a notable uptick in net inflows, with $542 million entering the market on a Friday, succeeding a substantial $405 million the previous Thursday. The timing of these inflows, occurring just hours before US ETF markets opened, signals a growing momentum that could have significant implications for the market.

Halving Bull Run?

Reflecting on the past to gauge the future, Back recalls October 1, 2021, when Bitcoin crossed the $47k mark, a prelude to its $69k all-time high (ATH) achieved within a 41-day sprint. With the Bitcoin halving, a scheduled event that reduces the reward for mining new blocks, thus constricting the supply of new coins, looming just 70 days away, Back ponders the possibility of not just another ATH but a leap towards the $100k mark before the halving occurs.

This speculation is rooted in historical performance, a method often employed by investors to forecast future price movements, albeit with the understanding that past performance is not always indicative of future results. Nevertheless, it provides a framework for investors to evaluate the potential trajectory of Bitcoin’s value in the run-up to significant events such as the halving.

Adam Back’s insights exemplify the intricate interplay between investor behavior and market outcomes in the cryptocurrency sphere. As the halving approaches, the market appears to be in the midst of a momentum-driven climb, a pattern that, if sustained, could lead to unprecedented highs and reinforce the transformative potential of digital currencies in the global financial landscape.

Author Profile

- Ex-community moderator of the Banano memecoin. I have since been involved with numerous cryptocurrencies, NFT projects and DeFi organizations. I write about crypto mainly.

Latest entries

- June 6, 2025NewsWireElon Musk to Decommission SpaceX Dragon after Trump Threat

- December 9, 2024Stock MarketMaster the Time Value of Money Financial Concept

- November 18, 2024Stock MarketFinancial Ratios Guide to Measuring Business Performance

- November 11, 2024NewsWireLabour’s UK Budget: A Fiscal Smirk of Contempt for Working People