In the pantheon of recent financial controversies, there is one more. One entity looms larger and darker than the infamous Sam Bankman-Fried’s FTX saga: Digital Currency Group (DCG) and its CEO, Barry Silbert. The story of DCG’s alleged fraud involves a twisted tale of trust, deception, and the collapse of what was once a revered institution in the cryptocurrency space.

The Origins of a Financial Goliath

It all began in 2013 when Barry Silbert founded Grayscale, which offered the first fund, GBTC, that allowed equity investors to purchase Bitcoin via brokerage accounts. For years, Grayscale was the only gateway for stock market capital to access Bitcoin, creating an inflated market value above the fund’s Net Asset Value (NAV) due to its structure as a trust without an ETF-like redemption mechanism. Investors were willing to pay this premium for Bitcoin exposure, a decision that, in hindsight, sowed the seeds for future turmoil.

The Premium Arbitrage Play

GBTC’s premium to NAV enabled a lucrative arbitrage strategy. Investors could short Bitcoins while giving an equivalent amount to Grayscale, then, after six months, cover the short by selling the GBTC shares that traded at a premium. The persistent GBTC premium opened the floodgates to a high-stakes arbitrage strategy. The ensuing months would see the GBTC shares, now inflated in value, cover the initial short position, yielding substantial profits. This mechanism wasn’t just lucrative; it was perceived as practically risk-free. This “farming of the premium” seemed riskless, until it wasn’t anymore.

The House of Cards

The plot thickened with the entry of Three Arrows Capital (3AC) and BlockFi, both now bankrupt, who exploited this arbitrage to great effect, leveraging borrowed Bitcoin to amplify returns. And where did this borrowed Bitcoin come from? The fuel for their financial fire was provided by Genesis, a prime brokerage and crown jewel of DCG’s empire supplied Bitcoin to various players, including 3AC. Genesis collected Bitcoin from large-scale holders, offering them returns on their deposits, and in turn, lent out these assets at higher rates, profiting from the spread.

1/ There was a much more important fraud than SBF's embezzlement that took place in 2022. It was a fraud (allegedly) perpetrated by one of the oldest companies in the space, @DCGco and its CEO, @BarrySilbert.

— Vijay Boyapati 🦢 (@real_vijay) November 6, 2023

Time for a thread 👇

The Conflict of Interest

The incentive structure within DCG’s network was problematic. Genesis’ loans promoted the GBTC arbitrage trade, benefiting Grayscale by locking in more Bitcoin, and ensuring a steady revenue stream of management fees for DCG. The conflict of interest was glaring, further highlighted by Grayscale CEO Michael Sonnenshein’s signature on a loan Genesis made to 3AC. Claims of arm’s length operations between DCG’s family of companies appeared increasingly dubious.

The Fall

As new Bitcoin investment avenues emerged, GBTC’s premium plummeted, turning into a discount and killing the arbitrage opportunity. 3AC, heavily reliant on this trade, spiraled into high-risk maneuvers, ultimately leading to its downfall following the TerraUSD and LUNA collapse. The dominoes began to fall: Genesis, exposed to massive uncollateralized loans to 3AC, found itself with a $1.2 billion hole in its balance sheet.

The Cover-Up

In crypto, the line between solvency and insolvency can be as volatile as the currencies themselves. This line was precariously treaded by Genesis and its parent company, Digital Currency Group (DCG), under the leadership of Michael Moro and Barry Silbert.

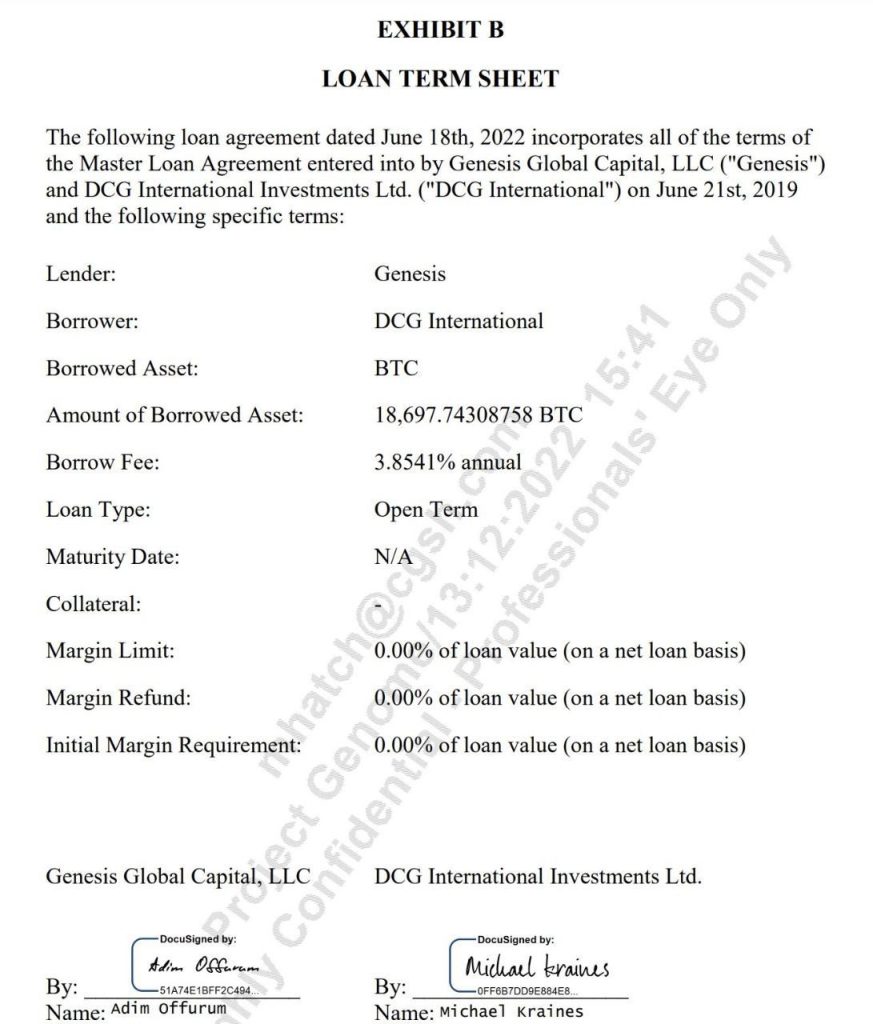

As the financial stability of Genesis teetered on the brink following the collapse of Three Arrows Capital (3AC), a crisis strategy was devised not to stabilize the actual finances but to give the illusion of stability. Rather than openly declaring bankruptcy, as would have been the expected course of action given the dire circumstances, Moro and Silbert chose a different path. They opted to issue a promissory note, a financial instrument promising to pay a specified sum to the bearer at a specified date or on demand.

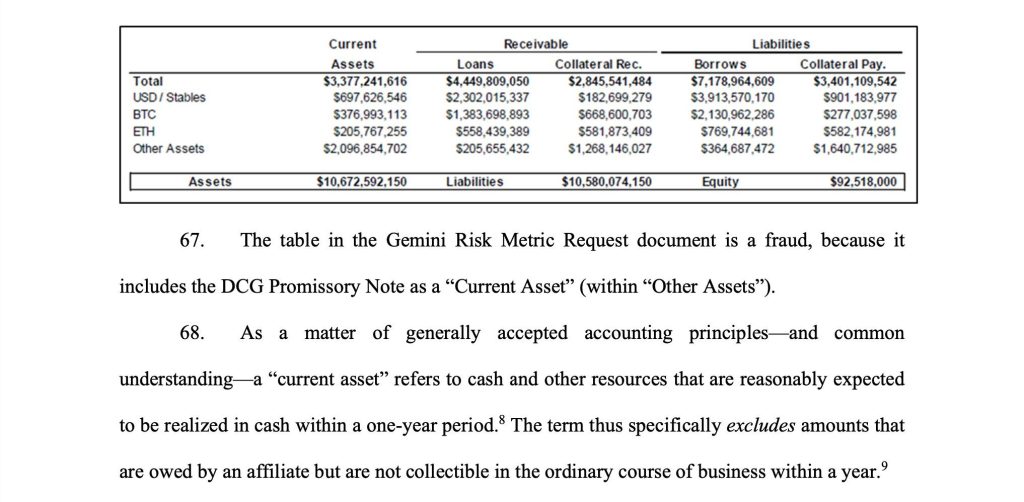

The use of this promissory note was a desperate attempt to fill the gaping $1.2 billion deficit left by the unpaid loans from 3AC. On the surface, this move could be seen as an innovative solution to a complex problem, but the underlying reality was far more troubling. The promissory note, instead of representing an injection of tangible assets or capital, was essentially a placeholder, a promise to pay in the future, underpinning a facade of liquidity that simply did not exist.

The promissory note was a masterstroke of financial engineering, giving the appearance that Genesis had thoughtfully mitigated its losses and maintained a robust balance sheet. However, the note’s value was only as solid as the trust in the company’s future ability to honor it—a trust that was, by many measures, already faltering. The terms of this note, offering a below-market interest rate and a redemption period extending over a decade, were clear indicators that this was not an immediate solution but a deferral of the inevitable reckoning.

Creditors and investors, who were led to believe in the solvency of Genesis, were essentially misled. The supposed asset, positioned as equivalent to liquid cash on Genesis’ balance sheet, was nothing more than a sleight of hand in a grander illusion of financial stability.

Unraveling the Web

This facade was sustained with great effort until the shockwaves from FTX’s implosion rippled through the cryptocurrency market, triggering a critical mass of withdrawal requests that Genesis could not fulfil. The inability to meet these requests laid bare the insolvency that the promissory note had been designed to conceal. The withdrawal freeze that ensued was a clear admission of the reality that the company’s financial health had been compromised far earlier than admitted.

The ethical implications of such a strategy are profound. In the complex and largely unregulated world of cryptocurrency finance, the actions taken by Genesis and DCG have raised serious questions about corporate governance and the responsibility financial institutions have to their clients. This strategy of obfuscation, rather than transparency, has not only affected DCG’s credibility but has also cast a shadow over the broader crypto financial sector.

Legal Reckoning

The New York Attorney General filed a civil complaint against Gemini Trust Company, LLC, Genesis Global Capital, LLC, and Digital Currency Group, Inc. Among the individuals named are Soichiro “Michael” Moro and Barry E. Silbert, indicating the severity and high-profile nature of this legal action that is alleging a conspiracy to defraud investors. While civil, the substantial and detailed accusations bear the hallmarks of potential criminal fraud.

The complaint is a critical moment, reflecting the state’s commitment to holding industry players accountable for their actions and ensuring the integrity of the financial market within its jurisdiction. The filing of this complaint by the Attorney General demonstrates the ongoing efforts by regulatory authorities to bring transparency and justice to an industry that has been marred by allegations of misconduct and fraudulent activities. Sometimes exaggerated by nevertheless true.

The details of the complaint will likely shed light on the intricacies of the operations within these entities and could have significant implications for the future regulation and governance of cryptocurrency businesses. As this case progresses, it will be closely watched by investors, legal experts, and regulators alike, as it may set a precedent for how such cases are handled and the potential ramifications for the broader crypto market.

A Reflection on the Financial Media

This story, as significant as the FTX scandal, has largely escaped the scrutiny it warrants. The financial media’s failure to probe the superficial veneers presented by companies like FTX and DCG has been a disservice to the investing public, who have suffered immense losses. Do they deserve our trust in the future? Perhaps not.

The Final Act?

As the legal drama unfolds, the market watches with a wary eye, and the likelihood of criminal proceedings looms. With the potential for insider witnesses and the weight of the New York Attorney General’s Office, the final chapter for Barry Silbert and his empire may be far from written. The true cost of this facade, both financially and in terms of investor trust, is yet to be fully realized.

Author Profile

- Ex-community moderator of the Banano memecoin. I have since been involved with numerous cryptocurrencies, NFT projects and DeFi organizations. I write about crypto mainly.

Latest entries

- June 6, 2025NewsWireElon Musk to Decommission SpaceX Dragon after Trump Threat

- December 9, 2024Stock MarketMaster the Time Value of Money Financial Concept

- November 18, 2024Stock MarketFinancial Ratios Guide to Measuring Business Performance

- November 11, 2024NewsWireLabour’s UK Budget: A Fiscal Smirk of Contempt for Working People