In a significant move toward transparency, the Luna Foundation Guard (LFG) has released a comprehensive technical audit report conducted by the renowned third-party auditing firm JS Held. The release of this document sheds light on the measures taken by LFG and Terraform Labs (TFL) to maintain the stability of TerraUSD ($UST) during the tumultuous period of May 8th to May 12th, 2022.

The decision to engage JS Held for the audit was driven by a commitment to transparency, particularly in light of several serious allegations that had surfaced on social media. Stakeholders and observers had raised concerns about the potential misappropriation, embezzlement, or theft of LFG funds, as well as the possibility of funds being used to benefit insiders or the existence of undisclosed LFG funds.

To address these allegations head-on, JS Held was granted unfettered access to on-chain wallets and trading accounts associated with the peg defense operations. In a diligent approach to accuracy, the audit was based on primary raw data, rather than solely on the representations provided by TFL, ensuring an unbiased review of the facts. Notably, the auditors’ compensation was not contingent on the outcome of their findings, further emphasizing the objectivity of the audit.

The findings of the report are clear and conclusive: all LFG funds were utilized in defense of the $UST peg to the dollar. The report confirms that the remaining balances in LFG’s accounts are consistent with their public declarations, effectively quashing any rumors of embezzlement or misappropriation of funds. According to the audit, all actions taken were in the interest of maintaining $UST’s peg parity, and no funds were diverted for any other purpose.

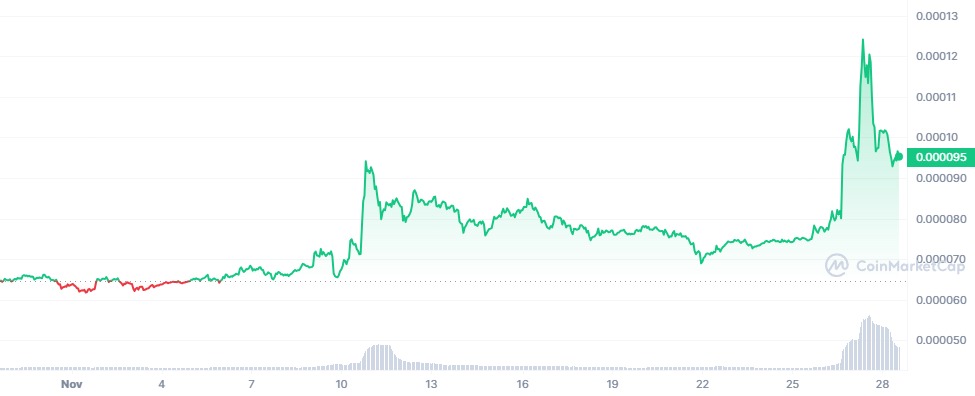

LUNC USDT Price Chart

This audit not only addresses the immediate concerns raised but also casts light on past events that have impacted the stability of $UST. It is now publicly acknowledged that in February 2021, a significant currency contraction for UST was triggered by Alameda Research. The firm sold $500 million worth of UST within minutes, which led to the depletion of its curve pools amid the Magic Internet Money (MIM) crisis.

Court Rejects Detentions

In a related development, a court in Seoul has rejected the prosecution’s request to detain executives of Terraform Labs. This decision marks a pivotal moment for the company, as it continues to navigate the legal and regulatory challenges following the $UST crisis.

The JS Held audit report stands as a pivotal document in the ongoing narrative of LFG and TFL’s efforts to maintain the TerraUSD peg. It serves as a testament to the organization’s dedication to transparency and due diligence. For the broader cryptocurrency community, the report not only provides closure to several burning questions but also underscores the importance of accountability and transparency in the decentralized finance space.

However, US courts have not held the same beliefs about Do Kwon and his conduct.

Do Kwon

Do Kwon is a South Korean entrepreneur and software engineer, best known for co-founding Terraform Labs, the company behind the blockchain platform Terra. His name became synonymous with the innovative yet controversial stablecoin TerraUSD (UST) and its sister token, Luna, which garnered widespread attention for their algorithmic approach to maintaining a stable value. Kwon’s vision for Terra was to combine the price stability and wide adoption of fiat currencies with the censorship-resistance of Bitcoin to create a new digital currency that could be used for everyday transactions.

His leadership and ambition led Terra to significant early success; however, this was followed by intense scrutiny following the dramatic de-pegging event of UST in May 2022, which led to a massive market crash affecting the entire crypto ecosystem. Kwon’s approach and decisions remain a topic of debate within the cryptocurrency community, as he faces both staunch critics and steadfast supporters.

It seemed though that after everything he has been through the tide was starting to run for both him and Terra Luna.

Arrest & Approved Extradition

The court’s decision in Montenegro to extradite Kwon to either the US or South Korea for fraud charges is a critical juncture in addressing the legal and regulatory fallout of the $40 billion implosion of TerraUSD and its sister token, Luna. This development not only underscores the heightened regulatory scrutiny facing the crypto industry but also signals a potential shift in investor confidence and market stability for Terra.

The charges against Kwon, including securities, commodities, and wire fraud, highlight the complexities and risks inherent in the cryptocurrency market. The decision of the Montenegrin justice minister on the extradition will be a pivotal moment for Terra, as it could influence both the legal precedent for crypto-related cases and the future direction of Terra’s recovery and regulatory compliance efforts.

Author Profile

- Ex-community moderator of the Banano memecoin. I have since been involved with numerous cryptocurrencies, NFT projects and DeFi organizations. I write about crypto mainly.

Latest entries

- June 6, 2025NewsWireElon Musk to Decommission SpaceX Dragon after Trump Threat

- December 9, 2024Stock MarketMaster the Time Value of Money Financial Concept

- November 18, 2024Stock MarketFinancial Ratios Guide to Measuring Business Performance

- November 11, 2024NewsWireLabour’s UK Budget: A Fiscal Smirk of Contempt for Working People