In an audacious move that mirrors the high volatility and high reward potential of the cryptocurrency market itself, Sunny Po shares a four-month update on their experiment: maxing out eight credit cards to purchase Bitcoin. This unconventional investment strategy is not for the faint-hearted and reflects a deep conviction in the future of digital currency.

Daring Debt for Digital Gold

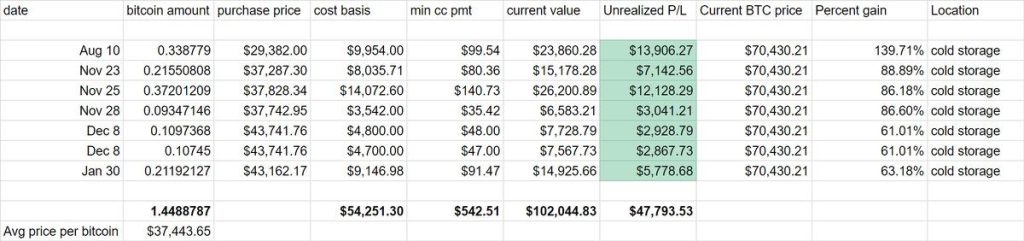

Sunny Po’s venture into leveraging credit for cryptocurrency began with a considerable accumulation of debt, amounting to $54,251, the price paid for 1.4488 Bitcoin at an average cost of $37,443 per coin. Remarkably, this bold strategy seems to have paid off, at least on paper. With the current value of Bitcoin rising, Sunny Po reports an unrealized profit of $47,793, marking an increase of 10.93% since the last update.

The Strategy and Its Risks

This gamble hinges on two factors: the performance of Bitcoin and the intricacies of credit card interest rates. Sunny Po has strategically maneuvered the debt to benefit from 0% APR, which is set to last until May 2025. The plan is to continue rolling over the debt into new credit cards offering 0% APR on balance transfers for 18 to 21 months, effectively kicking the can down the road to late 2026 or early 2027.

A Calculated Risk with an Exit Plan

The spreadsheet snapshot accompanying Sunny Po’s update provides a transparent view of the investment’s performance over time, including each purchase date, the amount of Bitcoin bought, and the corresponding gains. It’s a calculated risk, betting that the potential returns from Bitcoin will outpace any debt incurred from credit card use.

Sunny Po’s endgame is not accumulating dollar profits but accruing wealth in Bitcoin. Contrary to the conventional exit strategy of cashing out for fiat currency at market highs, Sunny Po’s goal is to maximize Bitcoin holdings for the long term.

Sunny Po’s strategy illustrates a nuanced understanding of Bitcoin’s volatility and the financial systems that can be leveraged to one’s advantage. It’s a calculated risk, acknowledging that while the dollar debt diminishes with regular payments, Bitcoin’s value has the potential to soar, thus requiring the sale of less cryptocurrency to become debt-free.

The Big Question: Is It Worth It?

While this method defies traditional investment wisdom, it underscores the innovative and sometimes radical strategies emerging in the era of digital assets. It poses the question: can unconventional paths to investment, coupled with a comprehensive understanding of financial tools and market trends, lead to substantial payoffs?

Sunny Po’s approach is predicated on an unwavering belief in Bitcoin’s long-term value over the fiat system. This conviction is so strong that the exit plan does not involve converting Bitcoin into millions of dollars but retaining as much of the cryptocurrency as possible. By utilizing a series of balance transfers within a familial network, Sunny Po plans to defer the debt indefinitely.

This long game involves a meticulous watch over Bitcoin’s market value, waiting for the moment when a small fraction of the holdings can be liquidated to settle the entire dollar debt. For instance, if Bitcoin reaches the $300,000 mark, only a minor portion, like 0.16 BTC, would be needed to pay off the debt, allowing the retention of the majority, in this case, 1.28 BTC.

Word of Caution to the Community

Sunny Po’s open invitation for inquiries reflects confidence in this method, yet it also carries a responsibility to underscore the gamble involved. For every success story, there may be untold accounts of significant losses when the market does not perform as anticipated or if the balance transfer strategy encounters unforeseen hurdles.

Looking Ahead

As Sunny Po continues to track and share this journey, the crypto community watches with bated breath. This approach encapsulates the high-risk, high-reward ethos that has come to define cryptocurrency investing. Whether Sunny Po’s strategy will serve as a cautionary tale or an inspiring case study of success remains to be seen as we approach the 2025 rollover date.

The idea is not just to profit but to shift the wealth paradigm from traditional currency to Bitcoin. It’s an innovative strategy that reflects a broader trend among cryptocurrency enthusiasts who see Bitcoin not as a speculative asset, but as a cornerstone of a new financial system.

A Note to Aspiring Investors

For those intrigued by Sunny Po’s daring, it’s crucial to remember that such financial maneuvers require an intimate understanding of both cryptocurrency markets and credit systems. This strategy is not recommended for everyone and should be approached with diligence, a strong nerve, and a clear strategy for managing potential downsides.

Sunny Po’s plan is as much an ideological stance as it is a financial strategy. It is a commitment to the principle of cryptocurrency as the future of money, betting on Bitcoin’s continued ascendancy and the gradual decline of traditional fiat currency’s purchasing power.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class

- March 7, 2025SatoshiCraig Wright Banned from UK Courts with Civil Restraint Order