Bitcoin has once again captured the spotlight with a surge to repeated all-time highs, surpassing $72,000. This remarkable milestone is the culmination of several factors, both macroeconomic and regulatory, that have coalesced to propel Bitcoin to unprecedented heights. This article delves into the key drivers behind Bitcoin’s latest rally, the role of the first spot Bitcoin ETF approval by the SEC, and the optimistic outlook for Bitcoin’s future. But how

The Surge to New Heights

Bitcoin’s ascent to over $72,000 marks a significant milestone in the digital asset’s journey, reflecting a surge in investor confidence and adoption. According to mainstream reports, this rally is largely attributed to the Securities and Exchange Commission’s approval of the first spot Bitcoin ETF earlier this year, a development that has made Bitcoin more accessible to investors and has been a long-awaited step towards mainstream financial integration.

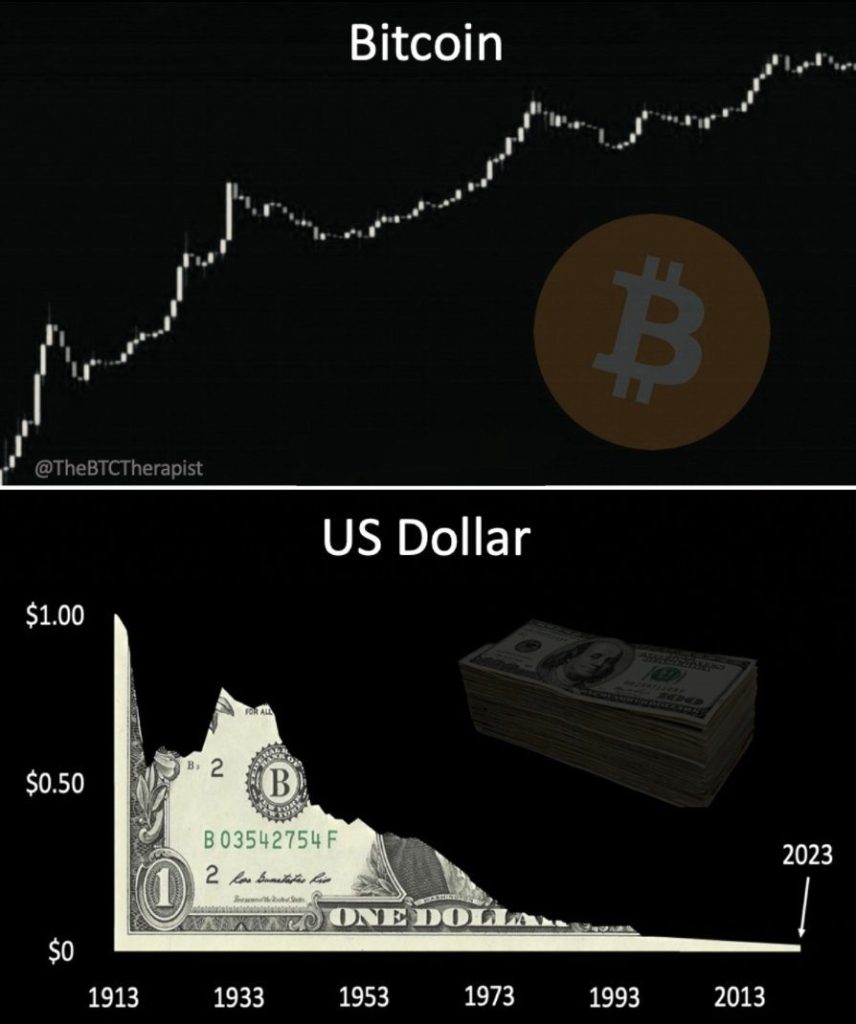

The impact of macroeconomic factors and banking uncertainties cannot be understated in Bitcoin’s recent performance. Amid global financial instability, Bitcoin and other cryptocurrencies have emerged as attractive investment alternatives. Roundups highlight Bitcoin’s resilience and appeal as a store of value, with a noteworthy increase of over 21% in March alone, outpacing traditional assets like the S&P 500 and Nasdaq.

The Catalysts Behind the Rally

Several catalysts have been instrumental in driving Bitcoin’s recent surge:

- Community Conviction: Whatever anyone says about Bitcoin, without the laser eye focus of the community, in the potential and value of the digital currency, none of this would be possible. Retail investors might be less equipped to raise the price in a single move, however their persistence seems to be the epitome of Bitcoin’s success.

- Spot Bitcoin ETF Approval: The SEC’s green light for the first spot Bitcoin ETF has been a game-changer, facilitating greater accessibility and institutional adoption of Bitcoin as a legitimate investment vehicle.

- Macroeconomic Turbulence: The backdrop of banking uncertainties and inflationary pressures has prompted investors to turn to Bitcoin as a hedge against traditional financial system vulnerabilities.

An Optimistic Outlook for Bitcoin

Looking ahead, the trajectory for Bitcoin is laden with optimism. Several factors contribute to a positive outlook:

- Demand and Supply Dynamics: The anticipation of additional spot Bitcoin ETFs and the upcoming fourth halving event in April 2024 suggest a favorable supply-demand balance that could further propel Bitcoin’s price.

- Regulatory Developments: Positive regulatory changes and the adoption of fair-value accounting for Bitcoin by the FASB signify growing institutional and corporate acceptance.

- Increasing Adoption and Technological Advancements: The rise in the number of Bitcoin addresses and the advancement in Layer-2 solutions like the Lightning Network emphasize Bitcoin’s maturing ecosystem and its potential as a medium of exchange.

- Environmental, Social, and Governance (ESG) Recognition: Bitcoin is increasingly being recognized for its potential contributions to ESG objectives, adding another layer of attractiveness for investors.

Community Reaction

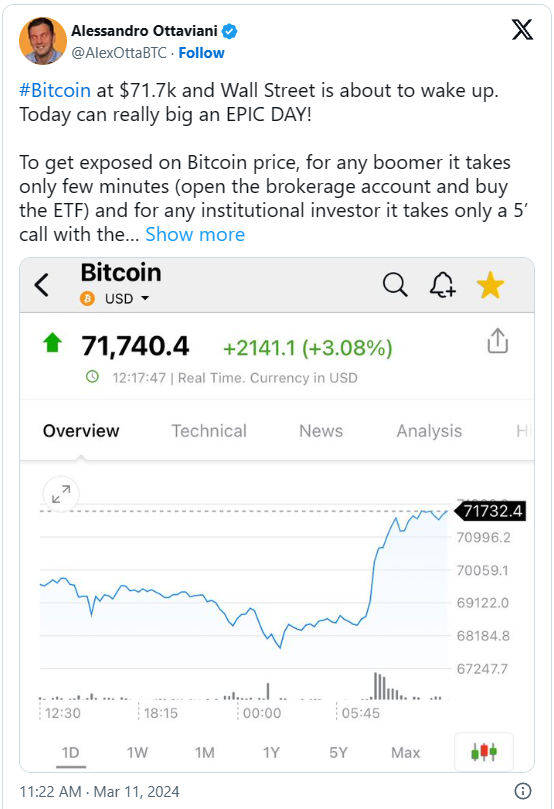

As the US financial capital gears up for the day, expectations are sky-high for what could be an “EPIC DAY,” according to Alessandro Ottaviani, a German Bitcoin YouTuber and commentator on the matter.

Ottaviani highlights the unprecedented ease with which investors can now gain exposure to Bitcoin’s price movements. For the new retail investors, often humorously referred to as “boomers,” accessing Bitcoin investments is as simple as opening a brokerage account and purchasing an ETF. This ease of access extends to institutional investors as well, who need only a brief conversation with their financial advisors to include Bitcoin ETFs in their asset offerings.

This democratization of investment into Bitcoin signals a significant shift in how digital currencies are perceived and utilized in the broader financial landscape. The recent approval of spot Bitcoin ETFs has paved the way for this change, making Bitcoin an investable asset for institutions through traditional financial products.

The surge in Bitcoin’s price and its enhanced accessibility through ETFs is not just a boon for investors but also a bellwether for the cryptocurrency market’s maturation. Wall Street’s response to this shift could set the tone for global markets, potentially ushering in a new era of digital currency integration into mainstream finance.

Bitcoin’s recent surge to over $72,000 is more than just a numerical milestone; it’s a testament to the digital asset’s growing integration into the mainstream financial system and its resilience as a store of value amidst global economic uncertainties. With the approval of the first spot Bitcoin ETF by the SEC and the anticipation of further regulatory and technological advancements, Bitcoin’s future looks promising. As investors and observers alike watch this space, the evolution of Bitcoin continues to unfold, signaling a robust and optimistic outlook for 2024 and beyond.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class

- March 7, 2025SatoshiCraig Wright Banned from UK Courts with Civil Restraint Order