The cryptocurrency landscape is electric, charged with a sense of anticipation. The buzz centers around Bitcoin, the original and most established digital currency, which stands on the brink of what many believe could be its most dramatic surge in value yet. The cause of this fervent optimism? A technical phenomenon within Bitcoin’s trading charts, the crossing of the weekly Moving Averages 100 (MA100) and 200 (MA200). This event, occurring for the first time in the currency’s storied history, has been interpreted by many investors and analysts as a potent harbinger of a monumental bull run, potentially eclipsing all that have come before it.

The significance of the MA100 and MA200 crossing cannot be overstated. In the realm of cryptocurrency trading, moving averages are used to smooth out price data over a specific period, providing a clearer picture of the overall trend. The MA100 reflects the average closing prices of the last 100 weeks, while the MA200 stretches this analysis over the last 200 weeks. When the shorter-term MA100 crosses above the longer-term MA200, it’s often seen as a bullish signal, indicating that the market’s momentum is shifting upwards. This event, known colloquially as a “golden cross,” is viewed by many traders as a confirmation of a long-term bullish trend.

Adding to the excitement is Bitcoin’s recent performance, which has seen it reach a new all-time high (ATH) before its upcoming 2024 halving event. The halving, a scheduled occurrence every four years where the reward for mining new blocks is halved, effectively reducing the rate at which new bitcoins are generated, has historically been a catalyst for significant price movements. The fact that Bitcoin has already achieved an ATH before such an event is unprecedented and suggests that the underlying demand and optimism surrounding Bitcoin are stronger than ever.

This combination of technical and fundamental factors has created a perfect storm of bullish sentiment. The crossing of the MA100 and MA200 indicators is not just a technical milestone; it’s a signal that the long-term outlook for Bitcoin is overwhelmingly positive. Coupled with the pre-halving ATH, it underscores the growing mainstream acceptance of Bitcoin as not just a speculative asset but a viable and valuable digital currency with the potential to revolutionize the financial landscape.

Investors, both seasoned and new to the crypto space, are watching closely, knowing that the market is notoriously volatile but also aware of the substantial gains that could be realized in a bull market. The potential for Bitcoin’s value to soar beyond current levels in the wake of these developments is enticing, driving both excitement and speculative investment.

However, it’s not just the possibility of financial gain that has the crypto world abuzz. The implications of a major Bitcoin bull run extend far beyond the charts. A significant increase in Bitcoin’s value and visibility could accelerate its adoption as a means of payment and a store of value, further embedding it in the fabric of global finance. It could also act as a catalyst for broader acceptance of cryptocurrency and blockchain technology, paving the way for innovation and transformation across various sectors.

The Scarcity of Bitcoin and Its Implications

Rajat Soni’s insights into the future of Bitcoin offer a fascinating glimpse into the transformative potential of cryptocurrency. By emphasizing the inherent scarcity of Bitcoin, capped by design at 21 million coins, Soni projects an economic landscape radically altered by the digital currency’s limited supply. This scarcity, a fundamental characteristic not shared by traditional fiat currencies, which can be printed in unlimited quantities by governments, serves as the bedrock for Soni’s predictions. As the availability of new Bitcoins dwindles, due in part to the halving events that cut the mining reward in half roughly every four years, the value of each coin is poised to rise significantly in response to sustained or increased demand.

In Soni’s envisioned future, the appreciation of Bitcoin’s value transforms it from a mere digital asset into a key that unlocks extraordinary purchasing power. The concept of buying houses, cars, and other significant assets for mere fractions of a Bitcoin is not just a testament to the cryptocurrency’s potential for value increase but also highlights a shift in how wealth and assets could be perceived and transacted in the future. This scenario suggests a world where the conventional metrics of value and the economy at large are recalibrated in Bitcoin’s favor, leading to a new era of financial transactions. It implies a significant evolution in the market dynamics, where Bitcoin’s scarcity and growing acceptance propel it to become a universal medium of exchange, capable of commanding vast amounts of physical wealth. Such a shift would not only redefine investment strategies but could also reshape global economic structures, challenging traditional notions of money and property ownership.

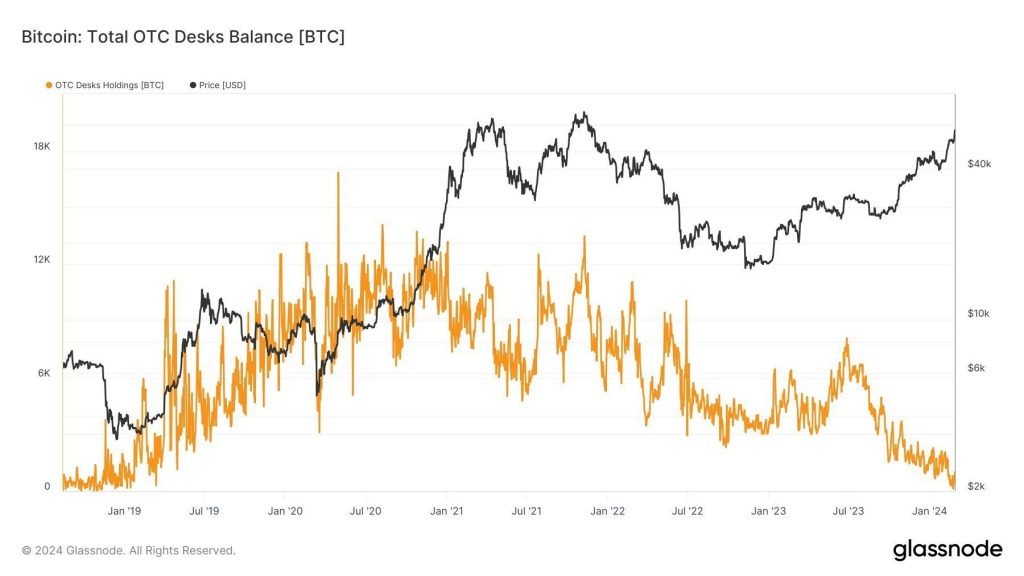

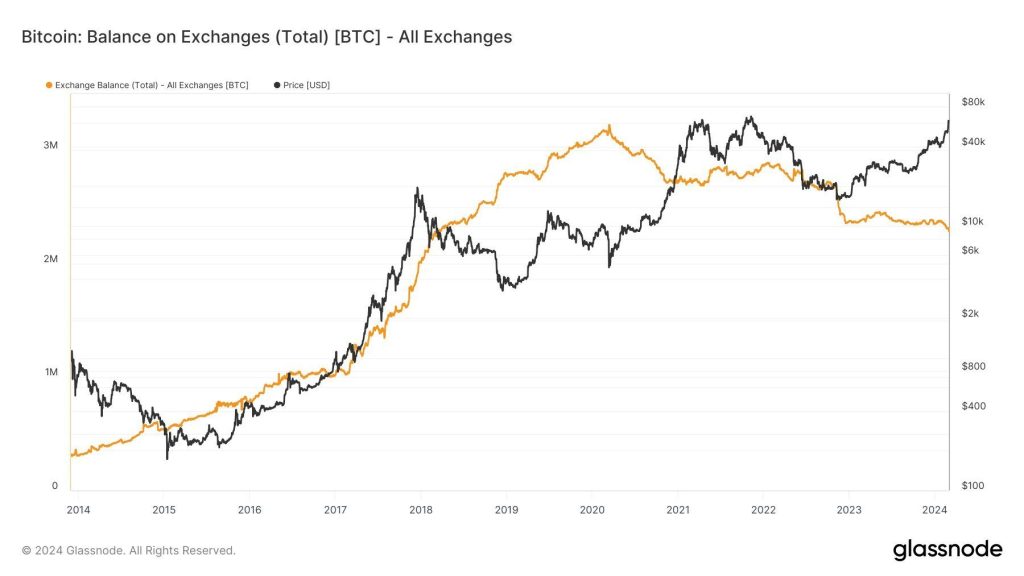

Mister Crypto, a keen observer of the digital currency landscape, has spotlighted a critical trend: the #Bitcoin Over-The-Counter (OTC) balance is edging dangerously close to zero, while the balance of Bitcoin on exchanges is experiencing a rapid decline. This phenomenon signals a potential supply shock, a situation that could have far-reaching implications for the market.

The essence of Mister Crypto’s observation lies in the dwindling availability of Bitcoin in places where it is usually bought and sold. OTC markets, which cater to large-volume trades outside of traditional exchanges, are seeing their Bitcoin reserves dry up. Concurrently, the balance of Bitcoin held on exchanges, which facilitates everyday trading for the average investor, is also diminishing at an alarming rate.

This significant decrease in available Bitcoin points towards an imminent supply shock. In economic terms, a supply shock occurs when there’s a sudden decrease in the supply of a commodity, in this case, Bitcoin, without a corresponding drop in demand. The immediate consequence of such a situation is often a sharp increase in prices, as buyers scramble to acquire the asset amid dwindling supplies.

Bitcoin’s Market Potential Before the 2024 Halving

Joe Burnett’s analysis offers a glimpse into the immediate future of Bitcoin, predicting a price of $70,000 before the 2024 halving. He emphasizes the sheer scale of fiat assets looking to allocate to Bitcoin, which currently has a market cap of only $1.3 trillion, with much of it not for sale. This disparity highlights the potential for exponential growth in Bitcoin’s value as more investors seek to include it in their portfolios.

The potential for Bitcoin to transform the financial landscape is immense. As it continues to gain acceptance and stability, it may well become the digital gold of the 21st century, offering a unique combination of security, scarcity, and potential for appreciation. With prominent voices in the cryptocurrency community echoing the sentiment that Bitcoin’s best days are still ahead, the journey of this digital titan is far from over.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- June 30, 2025NewsWireBank Savings at Risk: The Dark Side of EU’s Savings Standard

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class