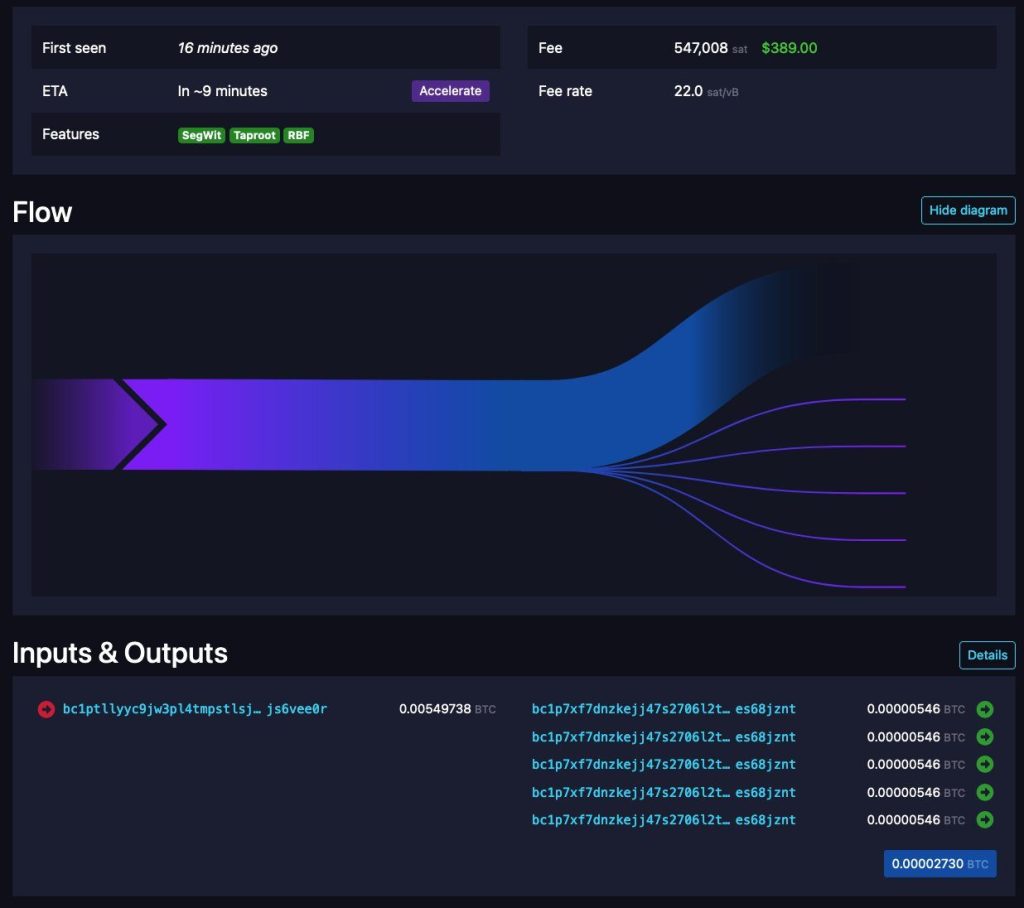

A recent Bitcoin transaction raised eyebrows: $389 paid to move a mere $1.94. At first glance, this seems to defy the very essence of Bitcoin’s economic rationality. However, such a transaction prompts a deeper discussion about the complex relationship between the Bitcoin network’s functionality and the economic incentives that drive miner behavior.

Rationality vs. Regulation: The Miner’s Conundrum

The incident serves as a stark reminder that actions within the Bitcoin network, often perceived as strictly economically driven, can be influenced by external factors such as regulatory compliance and legal considerations. Miners, the key players in transaction validation, face a nuanced decision-making process where profitability must be weighed against regulatory compliance. It’s a misconception to assume that miners will always act in the network’s best interest when their bottom line is at stake.

The principle of economic rationality fails to encapsulate the totality of miners’ incentives. Compliance with government regulations, such as avoiding transactions linked to blacklisted addresses, can lead miners to forgo transaction fees that seem lucrative at face value. This behavior was observed in the case of Wasabi Wallet, which brought to light the costly consequences of non-compliance.

The Consequences of Spam & Block Size Mismanagement

Further complicating matters is the issue of ‘spam’ transactions flooding the network, a scenario traditionally regarded as an attack. Yet, from a miner’s perspective, such spam can be construed as an opportunity to collect fees without considering the network’s health. Today’s reality contradicts the original intent for block sizes, with sizes reaching what was once deemed a theoretical maximum, intensifying concerns about centralization.

A Call for Community Action and Technological Shifts

The solution may lie in a community-driven response, recognizing these actions as attacks on the network’s integrity. Migration to node software that prioritizes user interests, like Bitcoin Knots, has gained momentum. Simultaneously, the push for miners to choose pools that offer options to sidestep harmful practices is growing, albeit from a small base.

The core ethos of Bitcoin as decentralized, user-empowering money must be protected. This has historically led to the sidelining of initiatives that deviate from this vision, such as bcash and segwit2x. The present scenario requires a similar, though not easy, approach to uphold the tenets of decentralization and accessibility for all users, regardless of technical expertise.

Resilience in the Face of Repetition

As Bitcoin continues to evolve, it finds itself revisiting old battles that center on the importance of running a node that is affordable and simple enough for anyone to use, thereby ensuring decentralization and resisting centralization forces. Despite the complexity brought on by a growing ecosystem and political maneuvers, the community’s resolve is being tested once more.

High transaction fees are not the panacea for these challenges. Instead, it’s about maintaining a principled understanding of what Bitcoin stands for. As history tends to repeat itself, the community’s collective memory and experience become invaluable in addressing these recurring trials. The steadfast ‘laser-eyed toxic maxis’ may yet again be the bulwark that preserves Bitcoin’s defining characteristics against the tide of challenges.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- June 30, 2025NewsWireBank Savings at Risk: The Dark Side of EU’s Savings Standard

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class