During a discussion with Troy Cross, Matthew Pines brought attention to the substantial holdings of Bitcoin by the U.S. government, which is approximately equivalent to those of significant entities such as MicroStrategy (MSTR) and Grayscale Bitcoin Trust (GBTC). This disclosure has ignited discussions and speculations on potential market impacts and the political implications of such holdings.

The discussion, was further fueled by responses from philosopher and environmentalist Troy Cross, center on the U.S. government possessing enough Bitcoin to account for over a year of mining output at post-halving issuance rates. Cross highlights a scenario that raises concerns about market manipulation, where a hypothetical sell-off by the Biden Administration at peak prices could significantly disrupt the market, especially ahead of an election, leading to a major political uproar and possibly instilling doubt about the stability and viability of Bitcoin as a digital asset.

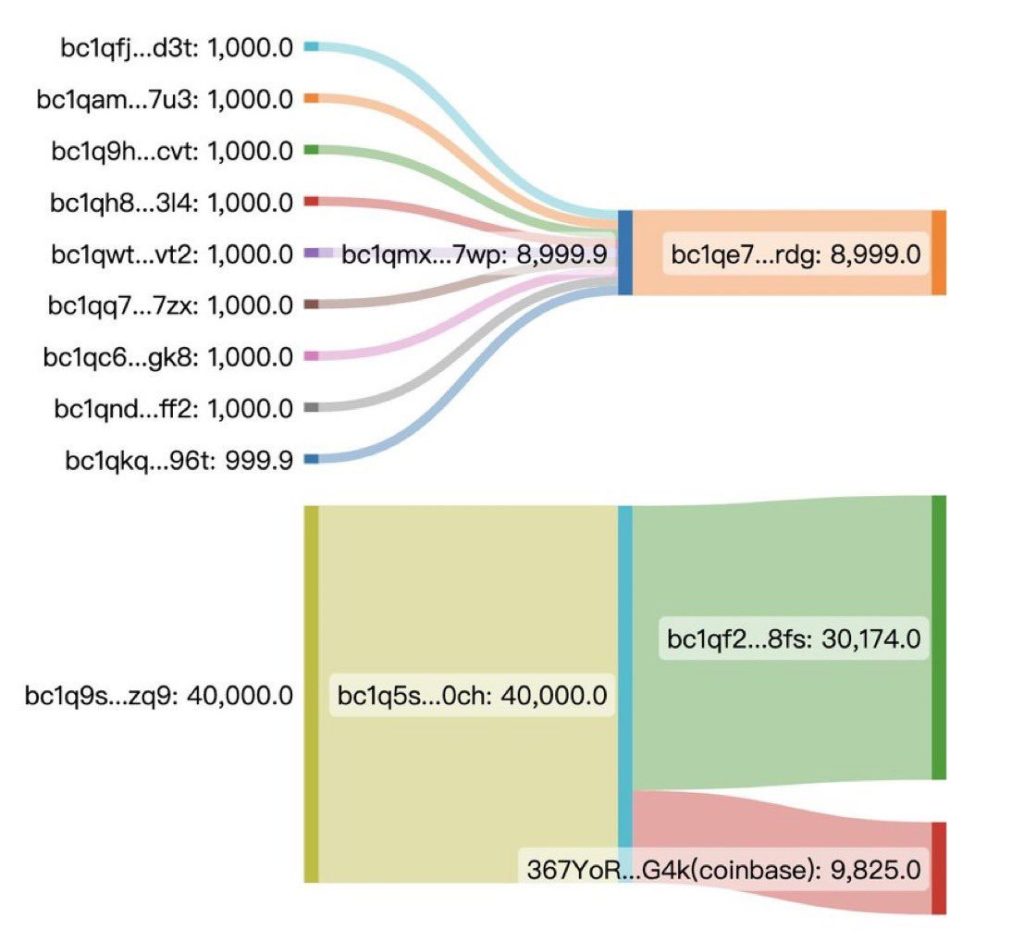

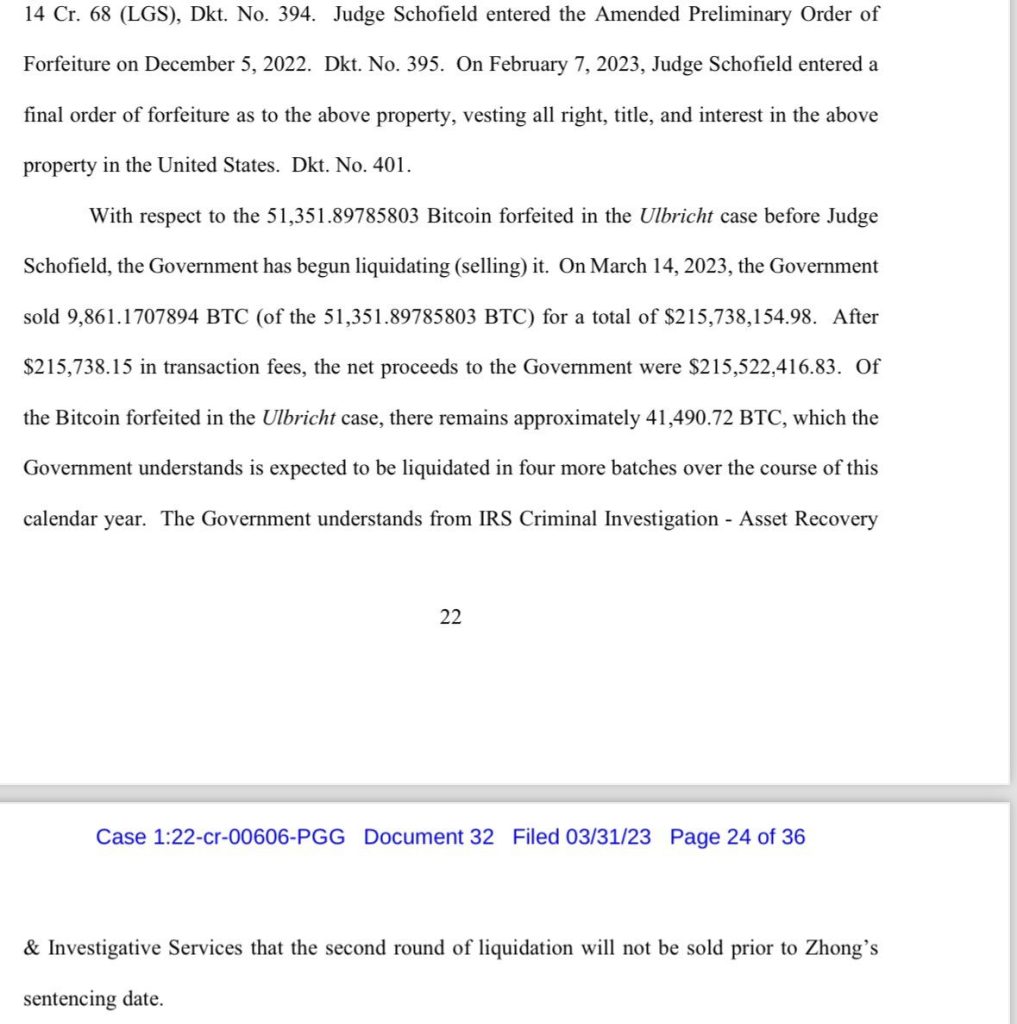

The strategic handling of this situation by the U.S. government, such as the division of sales into tranches and partnering with Coinbase for OTC sales, suggests a careful approach to minimize market impact and optimize value without triggering drastic price slippages. However, the mere existence of such a large controlled reserve has led some to question the overall market dynamics, including the significance of the Bitcoin halving, which has traditionally been viewed as a major event marking Bitcoin’s growth and scarcity-driven value appreciation.

As Cross eloquently puts it, the halving remains a ceremonial milestone in Bitcoin’s evolution, despite not having a strong influence on his short-term price expectations. The situation presents a complex tableau, where the decentralized ethos of Bitcoin is juxtaposed with the potential for centralized, large-scale market movements. It’s a narrative thread in the broader tapestry of Bitcoin’s integration into the fabric of global finance, underscoring the importance of understanding the multifaceted influences on the cryptocurrency market.

Community Reaction

A user suggested that the U.S. Government, acknowledging Bitcoin’s value, might refrain from dumping their holdings, making it a pivotal asset to hold. Troy Cross, a prominent voice in the space, chimed in with a nuanced take, indicating that while the government’s recognition of Bitcoin’s power is significant, their decisions might be swayed by upcoming elections. This strategic political play could lead to market volatility if the administration decides to liquidate a portion of their Bitcoin assets as a calculated move.

Adding to the mix, another user, baba yaga, dismissed the whirlwind of conjectures, advocating for a simple strategy amidst the uncertainty: keep accumulating Bitcoin.

Rich aka Riches asserts that the supply quantity of Bitcoin is a known variable, implying that government actions may have limited impact. However, Troy Cross counters, questioning the common belief in the halving events’ significance if government holdings are deemed irrelevant.

Colin Cooke, a Chartered Financial Analyst, suggests that the U.S. is unlikely to offload its Bitcoin holdings hastily, arguing that decision-makers may not grasp the full importance of the digital asset. Troy Cross offers a contrasting perspective, highlighting Senator Elizabeth Warren’s involvement in cryptocurrency regulation as an indication of informed figures in governance, despite potential personal tech challenges.

Onefatex contributes to the conversation, nodding to the thoughts of Bitcoin advocates like Michael Saylor and Andreas Antonopoulos, who hint at security and a long-term strategy as being vital to understanding the current situation. The user also dismisses the notion of a politically motivated Bitcoin dump as illogical.

A tweet from ogFaraday puts a spotlight on what is perceived as a massive opportunity cost: the U.S. government has, according to the tweet, potentially missed out on over $13 billion by selling seized Bitcoin rather than holding onto it. This observation comes courtesy of a sales tracker reportedly maintained by well-known Bitcoin advocate, Jameson Lopp.

The tracker details a stark difference between the total USD gained from past sales of Bitcoin by the government, which stands at $366,493,104, and the current USD value of all sold Bitcoin, which is over $13 billion. This implies that, had the U.S. government opted to ‘hodl’ rather than liquidate, the potential gains could have been exponentially higher, particularly in light of Bitcoin’s price surges over the years.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- June 30, 2025NewsWireBank Savings at Risk: The Dark Side of EU’s Savings Standard

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class