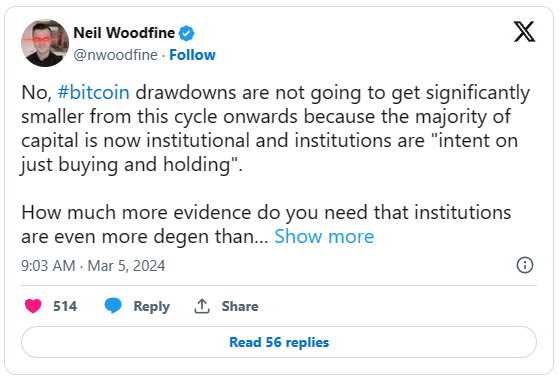

In the ever-evolving narrative of Bitcoin, a new chapter seemed to be written with the entry of institutional investors into the cryptocurrency market. The consensus among many observers was that this shift marked a new era of maturity and stability for Bitcoin, suggesting that the wild price swings of the past would be tempered by the steady hands of institutional finance. However, Neil Woodfine’s critical perspective challenges this optimistic view, offering a sobering analysis of the potential impacts of institutional involvement on Bitcoin’s volatility.

The Myth of Institutional Stability

The core of Woodfine’s argument rests on dismantling the assumption that institutional investors are primarily interested in holding Bitcoin for the long term, thereby providing a stabilizing effect on its price. Drawing parallels with traditional financial markets, Woodfine points out that institutions are known for their opportunistic trading strategies, seeking quick profits rather than demonstrating unwavering commitment to an asset. This behavior, he argues, is likely to extend to their Bitcoin investments, contradicting the expectation that institutional capital would act as a bulwark against significant price drawdowns.

The Lack of Conviction Among Institutions

A critical element of Woodfine’s commentary is the assertion that institutional investors lack a deep conviction in the fundamental value of Bitcoin. Unlike the early adopters and retail investors who were drawn to Bitcoin’s revolutionary potential, institutions are portrayed as opportunistic participants with no intrinsic belief in what Bitcoin represents or aims to achieve. This skepticism is not just a matter of differing investment philosophies; it has tangible implications for Bitcoin’s market dynamics. Institutions, Woodfine argues, are not the ‘holders of last resort’—a role played by those with unwavering belief in Bitcoin through market highs and lows.

Herd Behavior and Market Volatility

Another concern raised by Woodfine is the susceptibility of institutional investors to herd behavior, which could exacerbate market volatility rather than mitigate it. In times of uncertainty or negative news, the tendency of institutions to act in concert—either in buying frenzies or sell-offs—could lead to exaggerated market movements. This phenomenon is not unique to Bitcoin but is a well-documented aspect of traditional financial markets that could carry over into the cryptocurrency space.

External Events and Institutional Panic

Woodfine also highlights the potential for significant market events to test the resolve of institutional Bitcoin holders. Regulatory changes, environmental concerns, operational issues within the cryptocurrency ecosystem, or even geopolitical developments could all serve as triggers for institutional investors to reevaluate their Bitcoin holdings. The critical point here is not necessarily the likelihood of these events occurring but the reaction they might provoke among institutional players. Woodfine suggests that in the face of such challenges, the lack of deep conviction in Bitcoin among institutional investors could lead to panic selling, further fueling market volatility.

The False Promise of a Stabilized Market

The attraction of imagining a Bitcoin market characterized by stability and gradual appreciation is understandable, especially among those who have weathered its dramatic price fluctuations. However, Woodfine’s analysis warns against this overly simplistic view. The introduction of institutional investors into the Bitcoin market does not inherently change the fundamental dynamics that drive volatility. If anything, their involvement could introduce new variables that contribute to price instability.

The Road Ahead

Despite the cautionary tone of Woodfine’s commentary, it is not a blanket dismissal of institutional involvement in the Bitcoin market. Instead, it serves as a reminder of the complexity of market dynamics and the need for a nuanced understanding of the factors that influence Bitcoin’s price. The belief in Bitcoin’s long-term potential remains a critical foundation for sustained investment, one that transcends the opportunistic strategies of institutional players.

The narrative that institutional investment will lead to a more stable Bitcoin market is challenged by the realities of financial behavior and market psychology. Woodfine’s commentary sheds light on the potential for increased volatility driven by institutional actions, underscoring the importance of conviction and long-term belief in the face of market uncertainties. As Bitcoin continues to navigate its path towards broader acceptance and integration into the global financial system, the role of institutional investors will undoubtedly be significant, but perhaps not in the ways many have anticipated.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class

- March 7, 2025SatoshiCraig Wright Banned from UK Courts with Civil Restraint Order