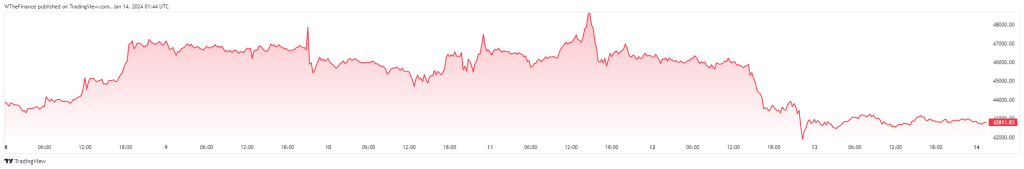

The cybersecurity breach of the U.S. Securities and Exchange Commission’s (SEC) Twitter account took the cryptocurrency world by storm, demonstrating an intriguing and counterintuitive reaction from Bitcoin traders. An analysis of the TradingView candlestick chart tells a tale that defies conventional market expectations: Bitcoin’s price experienced a drop upon the announcement of Bitcoin ETF approval — a move that typically would predict a bullish response.

The sequence of events unfolds as follows: A tweet from the SEC’s hacked account claiming the approval of Bitcoin ETFs coincided with an unexpected dip in Bitcoin prices. This initial response goes against the grain of common market behavior where approval of ETFs would generally be viewed as a positive regulatory step, encouraging investor confidence and potentially driving prices up. Instead, the market dipped, suggesting a sell-off occurred.

Here are some potential reasons for the unusual market behavior:

Market Sophistication

The unexpected downturn in Bitcoin’s price following the SEC’s hacked tweet could reflect the high degree of sophistication within the cryptocurrency investment community. Seasoned investors, with their finger on the pulse of regulatory trends and market news, may have instinctively questioned the authenticity of such a pivotal announcement being made via Twitter. Their experience would suggest a more formal channel for official communications. These savvy investors may have read between the lines, deciding to liquidate positions before a potential correction in price once the truth emerged. This collective skepticism, and the resulting sell-off, could have contributed significantly to the initial price drop, demonstrating that in markets sensitive to information, the first mover advantage can sometimes be to disbelieve and act swiftly on those doubts.

Automated Trading

In modern financial markets, a significant volume of trades is executed by algorithms. These automated systems scan news feeds and social media for keywords and sentiment, triggering trades within milliseconds of potential market-moving events. In the case of the SEC tweet, trading algorithms may have been programmed to interpret ‘approval’ of a Bitcoin ETF as a potential signal to sell, based on historical data where initial spikes in price due to positive news are often followed by a downturn as the market corrects from an overbought condition. The initial sell-off could be a function of these algorithms executing a counterintuitive strategy to capitalize on the anticipated reactionary volatility, rather than the news itself.

Risk Aversion

The crypto markets are notably sensitive to regulatory actions, and the sudden announcement of Bitcoin ETF approval, especially in a regulatory environment that has been cautious about such moves, might have been seen as a red flag to risk-averse investors. The markets are always wary of regulatory surprises, and an announcement of this magnitude, if perceived to be premature or potentially erroneous, could have triggered a flight to safety. Investors may have chosen to sell off their holdings to protect against the potential for a regulatory crackdown or a retraction of the announcement, which could cause a more significant drop in price.

Profit-Taking

Cryptocurrency markets are characterized by their volatility and the speed with which they can gain and lose value. For traders who had been holding Bitcoin in anticipation of a bullish event like the approval of an ETF, the tweet could have been seen as an opportune moment to cash in on their investments. These traders, particularly those who trade on shorter time horizons, often set target prices at which they plan to exit their positions. The spike in price, even if based on false information, might have reached these targets, prompting an immediate sell-off. This profit-taking could have contributed to the initial dip as a significant number of traders might have simultaneously decided to realize their gains, adding to the downward pressure on Bitcoin prices.

Following the initial dip, the SEC’s announcement of the hack and the clarification that no ETFs had been approved further influenced the market, leading to additional volatility. The SEC’s subsequent tweets, acknowledging the account compromise and denying the ETF approval, helped to stabilize the situation, although by that time, the misinformation had already left its mark on the market.

This episode serves as a poignant reminder of the complexities of market dynamics, particularly within the realm of cryptocurrencies. It underscores the necessity for robust cybersecurity measures, the influence of automated trading systems, and the sophisticated nature of market participants who may respond to news in unexpected ways. As the dust settles, the hacking incident acts as a cautionary tale, emphasizing the critical need for verified and reliable information in an age where digital assets can swing on a single tweet.

Author Profile

- Ex-community moderator of the Banano memecoin. I have since been involved with numerous cryptocurrencies, NFT projects and DeFi organizations. I write about crypto mainly.

Latest entries

- June 6, 2025NewsWireElon Musk to Decommission SpaceX Dragon after Trump Threat

- December 9, 2024Stock MarketMaster the Time Value of Money Financial Concept

- November 18, 2024Stock MarketFinancial Ratios Guide to Measuring Business Performance

- November 11, 2024NewsWireLabour’s UK Budget: A Fiscal Smirk of Contempt for Working People