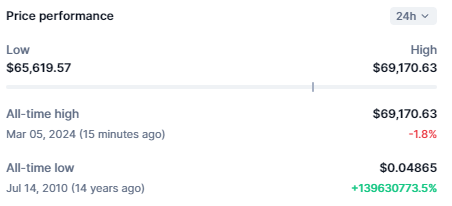

Bitcoin’s ascent to an all-time high (ATH) of around $69,000 in November 2021 underscored its burgeoning acceptance and investor confidence. This milestone was not just a testament to Bitcoin’s growing appeal but also highlighted the cryptocurrency market’s maturation.

Influential Factors Behind Bitcoin’s Valuation

Market Dynamics and the Role of Halving Events

Bitcoin’s price is influenced by various factors including regulatory changes, institutional adoption, and market sentiment. However, one of the most significant events affecting Bitcoin’s value is the halving. Occurring approximately every four years, the halving reduces the reward for mining new blocks by half, effectively lowering the rate at which new bitcoins are generated. This event has historically led to an increase in Bitcoin’s price due to the reduced supply and increased scarcity of the asset. The anticipation of these halving events, coupled with the network effects of increased adoption and technological advancements, plays a crucial role in Bitcoin’s price dynamics.

Technological Advancements and Network Effects

Advancements in Bitcoin’s underlying technology continue to enhance its efficiency, scalability, and security. Innovations such as the Lightning Network address scalability issues, enabling faster and more cost-effective transactions. These technological improvements not only bolster Bitcoin’s utility but also drive its adoption for daily transactions, contributing to its price appreciation.

Navigating the Future of Bitcoin and Cryptocurrency

The Maturation of the Cryptocurrency Market

The cryptocurrency market is witnessing a phase of maturation, characterized by the increasing participation of institutional investors, the development of cryptocurrency financial products, and the integration of cryptocurrencies into the financial system. This evolution promises more stability, lower volatility, and enhanced investor protection, positioning cryptocurrencies as a permanent fixture in the financial landscape.

Challenges and Opportunities Ahead

While the outlook for Bitcoin and cryptocurrencies is generally optimistic, challenges such as regulatory hurdles and technological limitations persist. Yet, these challenges also present opportunities for regulatory clarity, technological innovation, and market growth. The evolving regulatory landscape will likely bolster investor confidence, and ongoing technological advancements will address current limitations, unlocking new applications for Bitcoin and other cryptocurrencies.

Incorporating the impact of halving events into the analysis of Bitcoin’s price trajectory adds a critical dimension to understanding its market dynamics. These events, by reducing the new supply of Bitcoin, have historically preceded periods of significant price increase, highlighting the intricate balance between supply and demand in the cryptocurrency market.

Bitcoin’s journey to and beyond its previous ATH is a complex interplay of technological innovation, market dynamics, and periodic halving events. As the market continues to mature, Bitcoin’s role in the global financial ecosystem is likely to expand, heralding a new era of digital currency. The path forward may be fraught with challenges, but the potential for growth and innovation remains boundless, promising an exciting future for Bitcoin and the wider cryptocurrency space.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class

- March 7, 2025SatoshiCraig Wright Banned from UK Courts with Civil Restraint Order