It’s not all Micky Mouse business. The Walt Disney Company, a household name synonymous with entertainment, has grown far beyond its humble beginnings as an animation studio in the 1920s. The infographic provided is a striking visual representation of Disney’s vast portfolio, showcasing the media titan’s extensive reach into virtually every corner of the entertainment industry.

At the core of Disney’s success is its acquisition strategy, which has systematically brought a diverse array of media and entertainment companies under its wing. Each acquisition has been a strategic move to broaden Disney’s market dominance and diversify its content and distribution platforms.

Marvel Entertainment’s Multiverse within Disney

Disney’s acquisition of Marvel Entertainment has proven to be a strategic masterstroke, propelling the company to the forefront of the superhero genre. Through Marvel Studios, Disney has delivered an unprecedented string of box office successes with its Marvel Cinematic Universe (MCU), which intricately weaves together a tapestry of characters and storylines.

This winning formula has generated a robust revenue stream from film ticket sales, merchandising, theme park attractions, and streaming content. The synergy of Marvel’s IP within Disney’s extensive media network exemplifies a symbiotic fusion that not only captivates global audiences but also drives Disney’s growth across multiple platforms, solidifying its position as an entertainment behemoth.

The 21st Century Fox Integration

The acquisition of 21st Century Fox by Disney in 2019 was indeed one of the most monumental consolidations in the realm of media and entertainment. This $71 billion merger not only diversified and expanded Disney’s already formidable repository of content but also significantly enhanced its international reach. The deal brought a treasure trove of classic movies and television shows, including iconic franchises like “X-Men,” “The Simpsons,” and “Avatar,” into Disney’s portfolio.

Furthermore, it granted Disney a controlling interest in Hulu and a significant stake in Roku, bolstering its streaming capabilities to compete in the rapidly expanding digital market. This strategic move positioned Disney as a global powerhouse with an unrivalled content library, vital for the success of its direct-to-consumer streaming services, such as Disney+. The merger not only symbolized a shift in the media landscape but also indicated Disney’s ambition to leverage scale and diversity of content to meet evolving consumer demands in the age of digital streaming.

The Prowess of ESPN and ABC

Disney’s media empire extends its influence through ESPN and ABC, two cornerstones in the realms of sports and news broadcasting. ESPN is a juggernaut in sports media, with its extensive coverage of live events, sports news, and original programming. This presence affords Disney a competitive edge, particularly as live sports continue to draw viewers willing to pay for real-time action, a trend relatively unaffected by the shift towards on-demand content consumption.

ABC broadens Disney’s reach into news, serving as a vital conduit for journalism, political discourse, and entertainment programming. Together, these networks reinforce Disney’s capacity to reach diverse audiences, ensuring its content remains integral to viewers across various demographics and interests.

Streaming Wars and Direct-to-Consumer Services

A significant part of Disney’s current strategy, is its direct-to-consumer segment, with services like Hulu and Disney+. These platforms represent Disney’s aggressive pivot to streaming, seeking to capture the cord-cutting audience and compete with other streaming giants. The success of Disney+ has been meteoric, and it’s a testament to Disney’s ability to leverage its vast content libraries and new, original productions.

Theme Parks and Experiences

Disney’s Parks, Experiences, and Consumer Products division acts as a cornerstone of the company’s brand, turning fantastical narratives into real-world experiences. The global array of Disneylands, theme parks, resorts, and cruise lines immerses visitors in the storied enchantment of Disney, extending the connection beyond the screen.

This division not only serves as a significant revenue generator through ticket sales, hospitality, and merchandise but also fortifies brand devotion by creating lasting memories. The success of these ventures is a testament to Disney’s ability to craft experiences that resonate universally, encapsulating the essence of its storytelling prowess in physical spaces around the world.

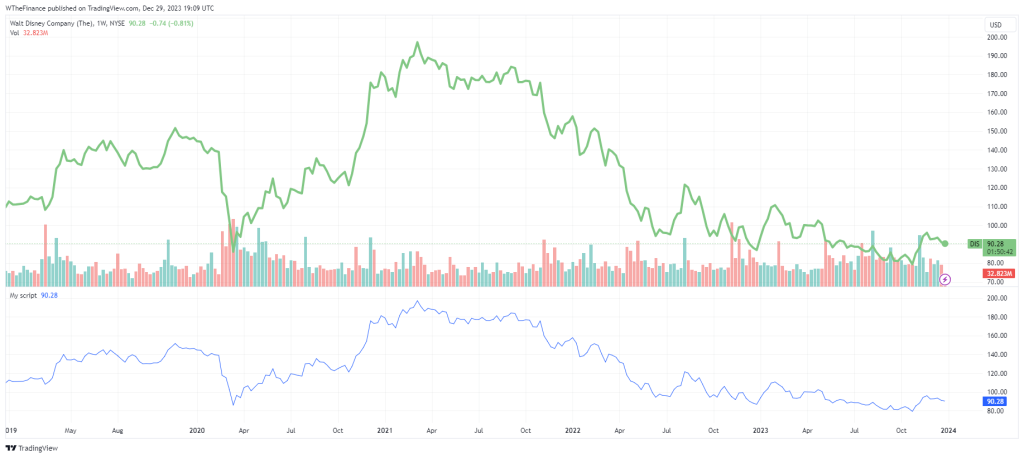

DIS NYSE 5-Year Chart

Ventures & Investments

Steamboat Ventures, named after one of Walt Disney’s earliest animations, “Steamboat Willie,” is the venture capital arm deeply embedded within the Disney ecosystem. It serves as a strategic beacon for the media giant, providing both financial backing and industry expertise to nascent media and technology ventures. This forward-looking approach allows Disney to tap into a wellspring of innovation, essential for maintaining its market leadership in an industry characterized by swift technological shifts.

By investing in startups that align with its business interests, Disney not only fosters external innovation but also gleans valuable insights that can fuel its own product and service development, keeping the company at the vanguard of the entertainment and technology interface.

This is a map of the empire that is The Walt Disney Company, highlighting how its acquisitions and strategic business units work in synergy to maintain its status as an entertainment behemoth. It’s clear that Disney’s strategy is not just about dominating the present, it’s about trying to shape the future of entertainment globally. Is this a futile attempt or will the company be able to dominate entertainment?

That remains to be seen.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class

- March 7, 2025SatoshiCraig Wright Banned from UK Courts with Civil Restraint Order