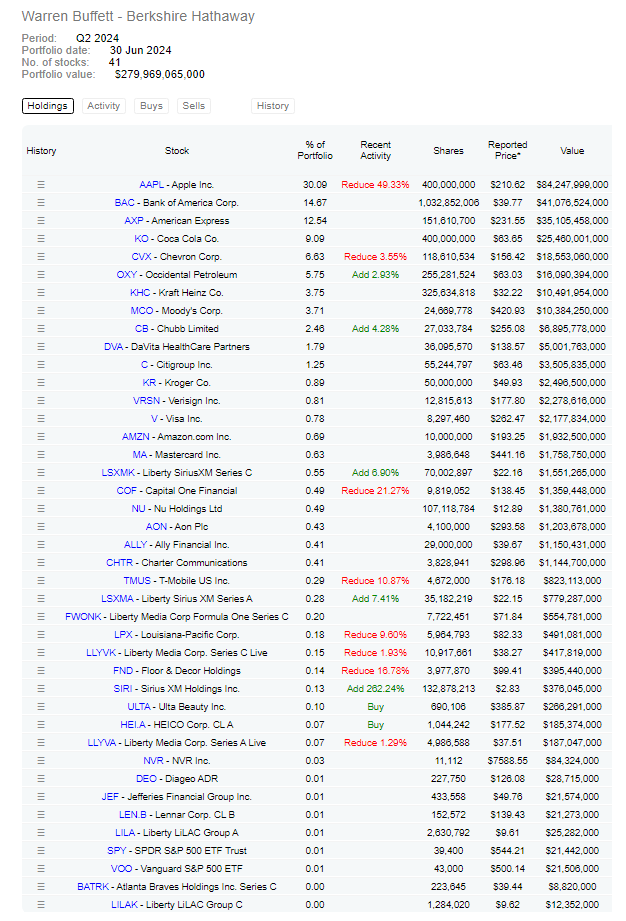

Warren Buffett, the well known investor and CEO of Berkshire Hathaway, has once again made notable adjustments to his vast investment portfolio in Q2 2024. Known for his value investing philosophy and long-term approach, Buffett’s moves are closely watched by investors around the globe. His recent activity includes a mix of reductions in some of his top holdings and selective increases in others, reflecting his strategic thinking in an uncertain market environment. The key changes in Berkshire Hathaway’s portfolio total nearly $280 billion across 47 stocks.

Key Reductions: Shifting Away from Major Tech and Financial Holdings

One of the most significant adjustments in Buffett’s portfolio is the reduction of his stake in Apple Inc. (AAPL), Berkshire Hathaway’s largest holding, which accounts for 30% of the portfolio. Buffett sold 4.5% of his Apple shares, totaling approximately 20 million shares, valued at over $16.4 billion. Despite this reduction, Apple remains his largest single investment, underscoring his confidence in the tech giant’s long-term prospects even as he trims exposure amid market volatility.

Buffett also reduced his position in Bank of America Corp. (BAC), his second-largest holding, by 3%. This move is notable given his historical preference for stable financial stocks. Bank of America still represents 14.6% of Berkshire’s portfolio, valued at approximately $41 billion. Additionally, Berkshire Hathaway cut its stake in Chevron Corp. (CVX) by 3.6%, reducing its exposure to the energy sector amid fluctuating oil prices and market conditions.

Other notable reductions include a 21.7% decrease in Capital One Financial Corp. (COF) and a 10.3% reduction in Liberty Media Corp. Series C. These adjustments suggest a strategic reallocation of capital, possibly to mitigate risk or reposition for anticipated changes in the economic landscape.

Selective Additions: Building Up Healthcare and Consumer Stocks

On the buy side, Buffett made several strategic additions, particularly in the healthcare sector. Berkshire increased its stake in DaVita HealthCare Partners (DVA) by 4.4%, reflecting Buffett’s ongoing interest in the healthcare space, which he sees as having strong long-term growth potential. The company now holds over 4.6 million shares valued at $505 million.

Buffett also added to his positions in Occidental Petroleum (OXY), with a 3.9% increase, and Mastercard Inc. (MA), which saw an 8.6% boost. These moves indicate a targeted approach, increasing exposure to sectors where he sees future value while maintaining a balanced diversification strategy.

Berkshire made a notable new purchase with a position in Liberty Media Corp. Series A Live Nation Entertainment (LYV), reflecting Buffett’s occasional interest in entertainment and consumer discretionary sectors. This addition, though smaller in scale, showcases his strategy of exploring niche opportunities that align with broader consumer trends.

Community Reaction

The community reactions to Warren Buffett’s latest portfolio adjustments at Berkshire Hathaway reveal a mix of surprise, humor, and critical analysis, highlighting the continued fascination with the legendary investor’s every move. One common theme among the comments is the scrutiny of Buffett’s decision to reduce his stake in popular tech stocks like Apple and financials such as Bank of America.

Users are quick to point out the absence of investments in trendy sectors, with one commenter humorously noting, “No Nvidia, No Tesla, No BTC… Man’s really hardcore,” emphasizing Buffett’s steadfast adherence to his value investing principles, even as other high-profile investors chase after the latest tech giants or cryptocurrencies.

Others took a lighter approach, poking fun at Buffett’s increased position in Sirius XM, with a user joking, “Dude’s buying SIRI like he just started listening to Howard Stern,” referencing the popular radio personality known for his Sirius XM show. The community’s comments reflect a blend of admiration for Buffett’s consistency and a recognition of his unique investment style that often bucks the latest market trends.

There’s also a sense of respect for Buffett’s long-term vision, with followers appreciating the effort to keep up with his strategic changes, despite the complexity and size of Berkshire Hathaway’s portfolio. Overall, these reactions underscore the cultural impact of Buffett’s decisions, which continue to generate lively discussion and engagement across social media platforms.

Continued Confidence in Core Holdings

Despite the adjustments, Buffett’s core holdings remain largely intact, demonstrating his continued confidence in his primary investment philosophies. Coca-Cola (KO), another of Buffett’s longtime favorites, remained unchanged, reflecting his steadfast belief in the enduring value of established consumer brands. American Express (AXP) and Kraft Heinz Co. (KHC) also saw no changes, underscoring Buffett’s preference for stable, cash-generating businesses with strong brand recognition.

Overall, Berkshire Hathaway’s latest portfolio adjustments reflect Buffett’s nuanced approach to navigating current market dynamics, characterized by strategic reductions in tech and financials while bolstering positions in healthcare and select consumer stocks. His moves suggest a cautious yet opportunistic stance, balancing the need to manage risks with the pursuit of long-term value creation.

Author Profile

- I have been writing articles about finance, the stock market and wealth management since 2008. I have worked as an analyst, fund manager and as a junior trader in 7 different institutions.

Latest entries

- June 4, 2025NewsWireHow Webmasters Are Paying the Price for the AI Boom

- April 24, 2025NewsWireCapital One-Discover Merger Reshaping the Credit Card Industry

- April 15, 2025NewsWireMichael Saylor’s Strategy New $286 Million Bitcoin Purchase

- February 14, 2025NewsWireBreaking Down the U.S. Budget