A quiet revolution has been started that is reshaping the way financial markets operate. This revolution isn’t happening in the traditional equities market but rather in the realm of digital assets, most notably, Bitcoin. A visual comparison of active trading hours reveals a striking disparity between the traditional equities stock market and Bitcoin, highlighting the transformative impact of 24/7 trading in the digital age.

The Legacy of Limited Trading Hours: Equities Stock Market

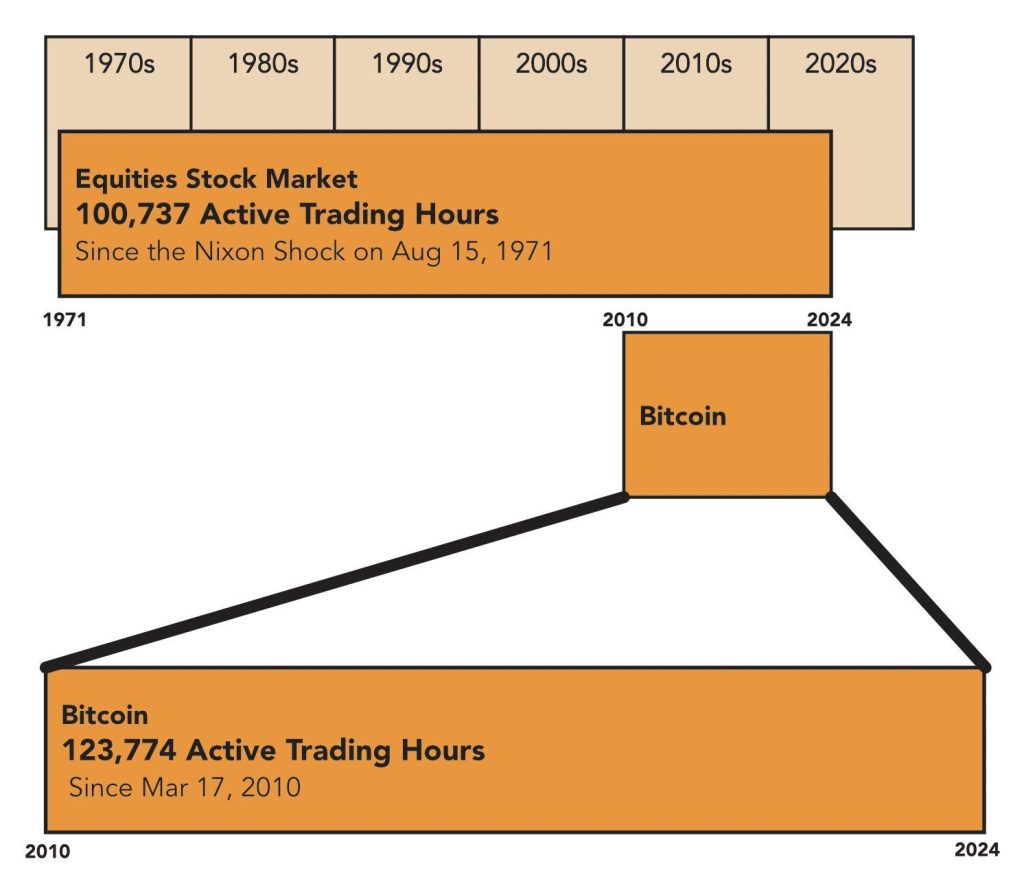

Since the Nixon Shock on August 15, 1971, which ended the Bretton Woods system and led to the fiat currency era, traditional equity markets have been bound by the confines of fixed trading hours. Over the past five decades, the equities stock market has accumulated a total of 100,737 active trading hours. These hours reflect the structured trading schedules that are typical of traditional stock exchanges, such as the New York Stock Exchange (NYSE) and Nasdaq, which operate Monday through Friday, from 9:30 AM to 4:00 PM Eastern Time.

This limited trading window has historically shaped investor behavior and market dynamics. Market participants must navigate the constraints of time zones, holidays, and weekends, leading to periods of inactivity that can create pent-up demand or exacerbate market reactions when trading resumes. Furthermore, this structure has led to the rise of after-hours and pre-market trading, albeit with reduced liquidity and increased volatility compared to regular trading sessions.

Bitcoin: A Paradigm Shift with 24/7 Trading

Enter Bitcoin, a digital asset that has flipped the script on market accessibility and trading hours. Since its inception on March 17, 2010, Bitcoin has operated continuously without pause, amassing an astounding 123,774 active trading hours by 2024. That is outstripping the traditional equities market in less than 15 years. This 24/7 trading model is not just a technical detail; it represents a fundamental shift in how markets function, offering constant liquidity, price discovery, and global accessibility.

Bitcoin’s around-the-clock trading is facilitated by a decentralized network that operates independently of traditional financial institutions and market hours. This means that anyone, anywhere in the world, can trade Bitcoin at any time. For investors, this provides unprecedented flexibility and the ability to respond instantly to market-moving news, geopolitical events, or economic data releases, regardless of when they occur.

The Implications of 24/7 Trading

The impact of Bitcoin’s 24/7 trading on the financial landscape cannot be overstated. It introduces several key advantages and challenges:

- Continuous Liquidity and Price Discovery: The absence of trading halts allows for a more continuous and dynamic price discovery process. Prices adjust in real-time to new information, reducing the potential for gaps or sudden price jumps that are common in traditional markets when they open after a closure.

- Increased Accessibility and Global Reach: Unlike traditional markets that are bound by specific time zones, Bitcoin’s market is truly global. This democratizes trading, enabling participation from individuals in any country without the need to adhere to specific trading hours.

- Enhanced Volatility Management: While 24/7 trading provides constant market access, it also introduces heightened volatility, particularly during periods of lower trading volume, such as weekends or late-night hours in major markets. This can lead to significant price swings that may not occur in traditional, time-restricted markets.

- Investor Behavior and Market Dynamics: The 24/7 model challenges traditional notions of market timing and strategic trading. Investors accustomed to set schedules and regular market opens must adapt to a new reality where news-driven moves can occur at any moment, requiring constant vigilance or the use of automated trading tools.

Could Equities Follow Suit?

The stark contrast between Bitcoin’s trading hours and those of the traditional equities market raises an intriguing question: Could traditional stock exchanges eventually adopt a 24/7 trading model? While the technology exists to support such a shift, there are significant hurdles, including regulatory challenges, the need for new market infrastructure, and the potential impact on market participants accustomed to the current system.

However, the success of digital assets like Bitcoin demonstrates the demand for continuous market access and may eventually pressure traditional exchanges to explore extended or around-the-clock trading options. Already, innovations like after-hours trading and international market cross-listings hint at the potential for a more flexible approach in the future.

Embracing the New Trading Frontier

The comparison of active trading hours between Bitcoin and the traditional equities market encapsulates a broader trend: the move towards a more open, accessible, and constantly available financial ecosystem. Bitcoin’s success in establishing a 24/7 market model not only challenges the status quo but also paves the way for a reimagined future of trading. As digital assets continue to gain prominence, the rest of the financial world may need to adapt, embracing the lessons of Bitcoin’s relentless market pace to better serve a global, digitally-connected investor base.

As we stand at the crossroads of traditional finance and digital innovation, the question is not whether markets will evolve, but how quickly and to what extent they will embrace the new possibilities offered by the digital revolution. For now, Bitcoin leads the way, setting a new standard for market accessibility and redefining what it means to trade in the modern era.

Author Profile

- Ex-community moderator of the Banano memecoin. I have since been involved with numerous cryptocurrencies, NFT projects and DeFi organizations. I write about crypto mainly.

Latest entries

- June 6, 2025NewsWireElon Musk to Decommission SpaceX Dragon after Trump Threat

- December 9, 2024Stock MarketMaster the Time Value of Money Financial Concept

- November 18, 2024Stock MarketFinancial Ratios Guide to Measuring Business Performance

- November 11, 2024NewsWireLabour’s UK Budget: A Fiscal Smirk of Contempt for Working People