The recent rally in NVIDIA’s stock has shifted from “incredibly impressive” to somewhat alarming, raising concerns that go beyond AI safety. Nic Carter, a well-known investor and cryptocurrency expert, recently shared his perspective on this phenomenon, shedding light on the broader implications of AI’s rapid advancements and its impact on various sectors.

Early Involvement in AI

Carter’s early investment in CoreWeave, a startup that has seen remarkable growth, provided him with unique insights into emerging AI use cases. In 2019, CoreWeave’s servers were overwhelmed by AI Dungeon, a text-based fantasy game built on GPT-2. This early experience with an advanced language model was eye-opening, illustrating the transformative potential of AI technology. Many others experienced a similar revelation with the release of ChatGPT.

In 2020, Carter came across Gwern Branwen’s scaling hypothesis, which argued that increasing data and computational power could potentially lead to artificial general intelligence (AGI). This theory reinforced Carter’s belief in the boundless potential of AI. By 2022, the release of Stable Diffusion, an advanced image generation model, further solidified his conviction that AI was evolving into a truly multimodal technology.

Shifting Investment Strategy

Despite his early exposure to AI through CoreWeave, Carter realized he was underexposed to the sector. Determined to change this, he made significant investments in AI-focused ventures. In 2023, he invested in Mythos Ventures, a venture capital firm specializing in AI applications, and wrote his largest angel check to Friend.com, an AI wearable startup founded by Avi Schiffmann.

Carter’s heavy investment in AI was driven by several key beliefs:

- Empowerment of Capital:

- AI would dramatically empower capital relative to labor. By automating tasks that previously required human effort, companies could maintain productivity with fewer employees. This shift is already evident in Carter’s practice, where AI tools have made programming and data analysis exponentially more efficient. This trend, Carter believes, will continue to accelerate, disrupting professional services and shifting the balance of power towards shareholders and firms.

- Investment Opportunity:

- Investors who overlook AI risk missing out on the biggest theme of the decade. Early-stage investors stand to benefit significantly as AI reduces the number of staff needed to run startups. The rise of solopreneurs, individuals who can build and operate businesses independently using AI, exemplifies this trend. Carter has therefore leaned heavily into AI venture capital funds, AI angel deals, and hybrid AI-crypto investments.

- End of the Post-Truth Era:

- AI’s ability to generate arbitrary content means that unsigned content will no longer be considered reliable. Future reliability will depend on content being signed, attested to, and timestamped, likely on a blockchain. This shift will fundamentally alter how information is assessed, driving investments in startups that focus on digital attestation and AI wearables for creating verifiable digital records.

- Economic Impact:

- AI could help the U.S. navigate its demographic challenges and debt overhang by adding 2-4 points to GDP growth over a decade. Carter believes that the U.S. will benefit from the AI boom, much like it did from technological advancements post-World War II. The epicenter of AI development being in the U.S. bolsters his optimism about the country’s fiscal prospects.

The Bottlenecks and the NVIDIA Rally

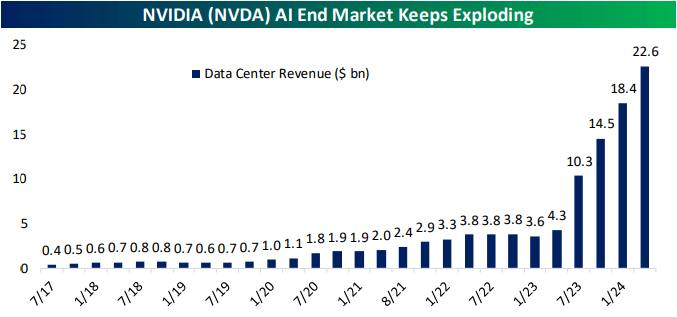

The AI boom has reached a scale where new bottlenecks are emerging. Between 2021 and 2023, the primary constraint was the availability of hardware, specifically NVIDIA’s A100 and H100 chips. Today, the bottleneck has shifted to the availability of Tier 4 data centers, which require advanced networking, higher power density, and more cooling.

Mark Zuckerberg recently highlighted on a podcast that the new constraint on AI compute growth is power. The level of investment in AI infrastructure by major tech companies like Amazon, Alphabet, Meta, and Microsoft is staggering, with $200 billion allocated this year alone.

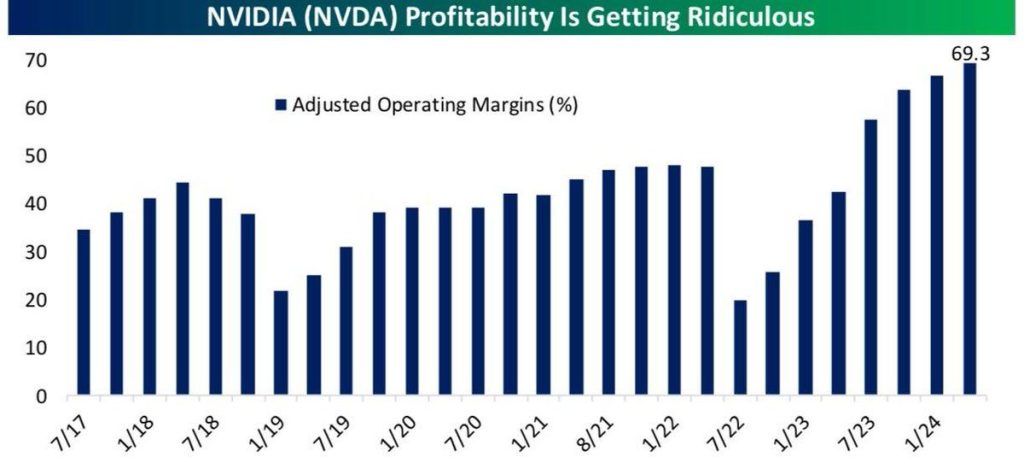

Carter finds the NVIDIA rally concerning, not because of AI safety, but due to its economic implications. NVIDIA’s market cap has surged to $2.8 trillion, driven by the belief that the company holds a monopoly-like position in AI hardware. This rally appears to be diverting capital from other sectors, reflecting investor sentiment that NVIDIA is currently the most important company in the world.

The Uneven Impact of AI on Society

AI’s impact on the workforce is profound, with the potential to render many jobs obsolete. Fields like translation, transcription, and even white-collar professions are seeing significant disruptions. As AI tools improve, the need for human labor in these areas diminishes, raising concerns about the future of work and societal stability.

The social contract in developed countries stipulates that displaced workers be taken care of, but the rapid pace of AI advancements could strain this arrangement. Carter predicts a worsening division between capital and labor, with AI driving productivity growth but also leading to massive furloughing of workers. This could result in reprisals against capital, including increased regulation, higher taxes, and greater government spending on social welfare.

Allegations Against NVIDIA

NVIDIA has recently come under intense scrutiny for allegedly engaging in deceptive practices that have artificially inflated its financial performance and market value. According to a detailed investigation by JustDario, the company is implicated in a broader fraudulent scheme that involves manipulating sales and financial commitments to present an overly optimistic financial outlook.

- Artificial Inflation of Purchase Commitments:

- NVIDIA’s 10-Q filings reveal a significant increase in “non-inventory purchase obligations” for cloud services, which soared by 251% to $8.8 billion in one quarter. This dramatic rise raises suspicions that NVIDIA is inflating these figures to boost perceived demand for its GPUs. The pattern of increased commitments without a corresponding increase in actual sales further supports these concerns.

- Channel Stuffing and Gray Market Sales:

- The filings also suggest that NVIDIA is involved in channel stuffing, where products are sold to intermediaries rather than end-users. This creates a misleading picture of demand. Moreover, there are indications that many of these products end up in unauthorized “gray markets,” particularly in regions like Taiwan and Singapore. This practice not only skews sales data but also poses significant regulatory and reputational risks.

- Questionable Financial Relationships:

- NVIDIA’s dealings with certain customers and partners, such as CoreWeave and Microsoft Azure, have come under scrutiny. It appears that NVIDIA may be involved in reciprocal agreements where it invests in these companies, which in turn purchase NVIDIA’s products. Such arrangements can artificially inflate sales figures and misrepresent the company’s true market demand and financial health.

- Opaque Sales Terms and Revenue Recognition:

- The company has been criticized for its loose sales terms, where most transactions are made on a purchase order basis that can be canceled without penalty. This flexibility in sales commitments complicates revenue forecasting and might be used to manipulate financial results to meet market expectations. The significant reliance on a few major clients also suggests a fragile revenue base that could be easily disrupted.

Implications

The alleged practices, if proven true, point to a systematic effort by NVIDIA to inflate its financial performance and market position artificially. These actions not only mislead investors but also create systemic risks for the financial markets, given NVIDIA’s significant market capitalization and influence.

Furthermore, the reliance on reciprocal financial arrangements with companies like CoreWeave and Microsoft Azure highlights potential conflicts of interest and ethical concerns. Such practices could undermine trust in NVIDIA and the broader tech industry, leading to increased regulatory scrutiny and potential legal repercussions.

About NVIDIA

NVIDIA Corporation, a leader in the technology industry, is renowned for its advancements in graphics processing units (GPUs) and AI computing. Founded in 1993 by Jensen Huang, Chris Malachowsky, and Curtis Priem, the company revolutionized the gaming and professional visualization markets with its groundbreaking GPU technology. In recent years, NVIDIA has expanded its reach into the fields of artificial intelligence and deep learning, powering innovations in autonomous vehicles, data centers, and supercomputing.

The company’s GPUs are pivotal in AI research and development, providing the necessary computational power for training and deploying machine learning models. This expansion has contributed to its significant financial growth, with a market cap that recently soared to $2.8 trillion, reflecting its critical role in the tech industry’s future. NVIDIA’s commitment to innovation continues to drive its success, positioning it as a cornerstone of modern computing and AI advancements.

NVDA Stock Price

While the AI boom presents colossal investment opportunities, it also poses significant societal challenges. As Carter suggests, the success of AI may be “too successful,” leading to disruptions that necessitate a careful and informed approach. Investors must balance aggressive allocation to AI with an awareness of the potential for economic and social upheaval.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- June 30, 2025NewsWireBank Savings at Risk: The Dark Side of EU’s Savings Standard

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class