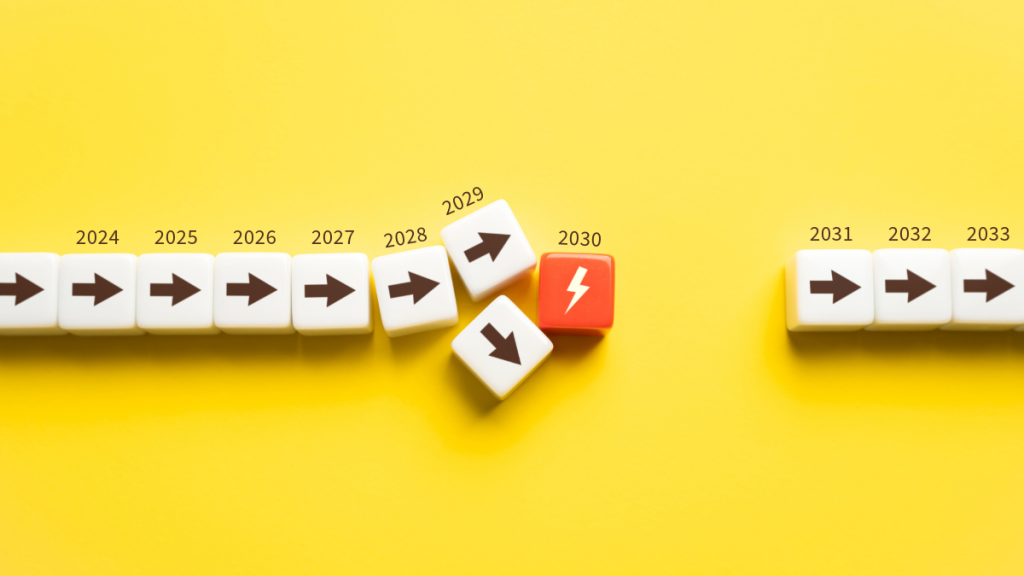

With a new decade on the horizon, it’s time to take a look at the economic challenges that investors will face in the coming years. From technological disruptions to climate change and population shifts, there are plenty of factors which could shape the way markets move and affect investor portfolios. Let’s take a look at some of the most formidable challenges investors will face over the next 10 years.

Technological Disruption

Technology is changing faster than ever before, and this is having an impact on economies around the world. As new technologies are developed and adopted by businesses, they can quickly disrupt existing economic models.

- Automation, AI, and Robotics: These technologies have revolutionized several industries. Manufacturing, for instance, has seen a significant transformation with the integration of robotics and automation, leading to reduced labor costs and increased efficiency. This shift not only alters the financial dynamics of companies in these sectors but also impacts labor markets. For instance, jobs that involve repetitive tasks are increasingly automated, leading to a shift in the nature of workforce demand.

- Impact on Different Sectors: The influence of these technologies isn’t limited to manufacturing. Sectors like finance, healthcare, and retail are also experiencing a digital transformation. In finance, AI-driven algorithms are used for everything from credit scoring to automated trading, changing how financial institutions operate. In healthcare, AI and robotics are playing roles in diagnostics and surgery, potentially revolutionizing patient care and reducing costs.

- Investment Implications: For investors, staying abreast of these technological advancements is crucial. Companies that are quick to adopt and integrate new technologies may offer significant growth potential. Conversely, companies that fail to adapt may lose their competitive edge, negatively impacting their market value.

- Emerging Technologies and Markets: Additionally, investors should look at emerging technologies like blockchain, which underpins cryptocurrencies and has potential applications in various industries including supply chain management and voting systems. These technologies could open new markets and investment opportunities.

- Ethical and Sustainable Investing: It’s also important to consider the ethical implications of investment in technology. For example, how does a company manage its digital footprint? Is it contributing positively to environmental sustainability? With a growing emphasis on ethical and socially responsible investing, these factors can influence investment decisions and company valuations.

- Market Volatility and Technology: Finally, the rapid pace of technological change can lead to market volatility. New innovations can quickly make existing technologies or business models obsolete. Investors need to be mindful of this and consider diversifying their portfolios to manage associated risks.

Climate Change

Climate change poses a unique challenge for investors because it can have both positive and negative impacts on different sectors of an economy. While some industries may benefit from policies designed to combat climate change (such as renewable energy), other sectors may suffer due to increased regulations or higher energy costs. Investors need to assess how their investments may be affected by climate change, both directly and indirectly.

Population Shifts

As global populations burgeon, a domino effect on the demand for goods and services is inevitable. This demographic evolution is not just about the swelling numbers but also about the migration patterns, aging populations, urbanization rates, and changes in the workforce. Each of these dynamics plays a crucial role in shaping economic landscapes and, consequently, investment opportunities. Let’s peel back the layers to understand how these shifts present both challenges and opportunities for the savvy investor.

Urbanization & Infrastructure Development

The global drift towards urbanization has been relentless, with more individuals moving to cities in search of better opportunities. This migration often leads to a surge in demand for housing, public transportation, and utilities. For investors, this trend underscores potential growth in real estate investment trusts (REITs), construction companies, and infrastructure funds. Investments in smart city technologies and green infrastructure could also be primed for growth as urban centers expand.

Aging Populations & Healthcare

In many developed countries, populations are aging due to lower birth rates and higher life expectancy. This demographic shift can have a profound impact on healthcare services, insurance, pharmaceuticals, and retirement planning industries. Investors may find value in companies specializing in healthcare products, senior living facilities, and biotech firms focused on age-related diseases. Additionally, financial services tailored to retirement planning could see increased demand.

Population growth can lead to changes in consumer behavior patterns. As younger demographics with high digital literacy come of age, they are likely to continue fueling the growth of e-commerce and digital services. Investing in online retailers, digital payment systems, and companies that provide logistical support for e-commerce could capitalize on this shift.

Education & Technology

The surging global population and rapid technological advancements are reshaping the educational landscape, emphasizing the necessity for innovative educational services. The proliferation of online and technology-driven educational platforms is a direct response to the increased demand for accessible and flexible learning options. EdTech companies are at the forefront of this shift, offering an array of solutions ranging from virtual classrooms and learning management systems to AI-driven personalized learning experiences.

As the job market becomes increasingly competitive and the shelf life of skills shortens, there is a growing imperative for continuous upskilling and reskilling. This need transcends traditional academic boundaries, extending into professional training and lifelong learning programs. Businesses, educators, and governments are recognizing the value in investing in EdTech ventures that can deliver such training efficiently and at scale.

These companies are not only enhancing the delivery of content but also revolutionizing the way we measure learning outcomes and skills proficiency. The integration of technologies such as machine learning, big data, and predictive analytics into education allows for more effective curriculum development and career forecasting, thus better aligning educational programs with market needs.

For investors, the EdTech sector represents a burgeoning market with substantial growth potential. Investing in companies that are successfully bridging the gap between education and employment, thereby empowering a new generation of learners, could yield significant returns. The focus on lifelong learning also opens up a broader consumer base, from K-12 students to working professionals and beyond, ensuring a continuous and evolving market for innovative educational solutions.

Resource Management & Sustainability

An expanding population also implies increased pressure on natural resources. This creates investment opportunities in the sustainability sector, including renewable energy, water purification, and waste management companies. As resource scarcity becomes a pressing issue, technologies that enable more efficient use of resources could become particularly valuable.

Population shifts from rural to urban areas, or from one country to another, can result in certain regions developing into thriving markets. Emerging economies with young, growing populations may present opportunities for investors in various sectors, from consumer goods to fintech. Investors should monitor these trends closely and consider the geopolitical and economic stability of these regions when investing.

Understanding these demographic shifts is critical for investors aiming to stay ahead of the curve. Keeping a finger on the pulse of population trends can inform a dynamic investment strategy that anticipates future demand. This may involve a mix of equities, bonds, real estate, and alternative investments across different sectors and geographical locations.

There Is Always Opportunity For Gain

Despite the challenges, the next decade is shaping up to be an exciting one for investors. From technological disruption to climate change and population shifts, these are all issues that must be taken into consideration when making investment decisions going forward.

By staying informed about these trends and adjusting their strategies accordingly, savvy investors can ensure that their portfolios remain profitable despite these challenges!

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- June 30, 2025NewsWireBank Savings at Risk: The Dark Side of EU’s Savings Standard

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class