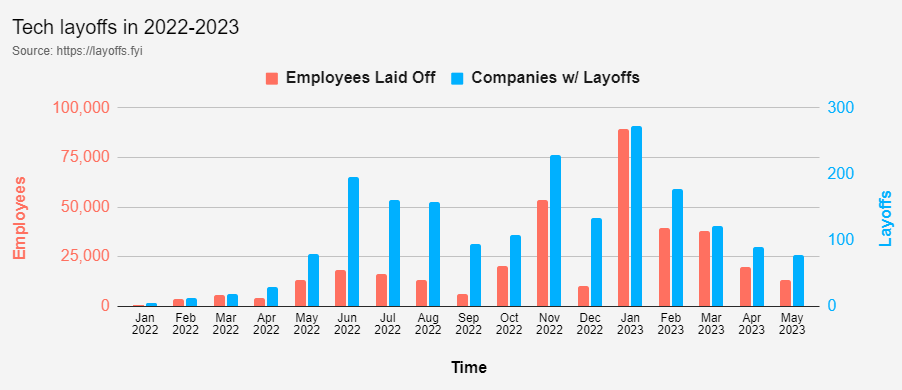

- The entire technology market sector experienced major losses since November 2021. The drop in the sector reached as low as -41% in October 2022. This change led to major reductions in staffing across the big tech companies with multiple rounds of of lay-offs for thousands of employees that started in 2021 and continued throughout 2023.

- Since the low point in October 2022, the big tech index has been rising steadily. It has regained 45% of its value since and it keeps rising with NVIDIA (NVDA) recently adding 172% on its share price in 2023 alone. The NVDA stock rose so much that it pushed the total value of the company almost to the exclusive $1 Trillion dollars, a number exclusively held by the top tech companies such as AAPL, MSFT, GOOGL and AMZN.

- Analysts expect the sector to make further gains with AI in a specific area of interest. AI drove the rise of NVDA and is also behind a tech race between Google, Microsoft (OpenAI) and many others trying to catch up. Any meaningful implementation of AI to improve processes in these big tech giants is likely to be followed by significant races in the trade price of the stocks involved. It is also possible however that any of the companies involved fail to make progress with AI in good time, their prices will suffer.

- As much as always speculation is rife and the state of the technology market constantly evolving. Please always make your own research before deciding to invest in any stocks or other assets. 2023 is evolving to be a very interesting year for investors.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class

- March 7, 2025SatoshiCraig Wright Banned from UK Courts with Civil Restraint Order