The European Central Bank’s (ECB) Financial Stability Review (FSR) for May 2024 provides a comprehensive analysis of the current state of financial stability within the euro area. This report, a critical tool for policymakers, financial industry professionals, and the public, aims to promote awareness and understanding of systemic risks. The following review critically assesses the key themes, findings, and implications presented in the report.

“Improvement” in Financial Stability Conditions

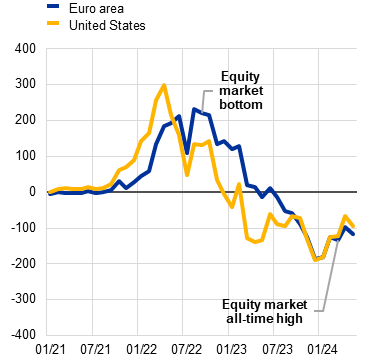

The report begins on a positive note, highlighting alleged improvements in financial stability conditions since the last edition. The near-term risk of a deep recession and rising unemployment, which were significant concerns six months ago, have diminished according to this. Disinflation has also proceeded in parallel, contributing to a more stable economic environment apparently. However, the report points out that geopolitical tensions remain a significant source of risk for both euro area and global financial stability. The high level of policy uncertainty, particularly in a year with many major elections, exacerbates these risks.

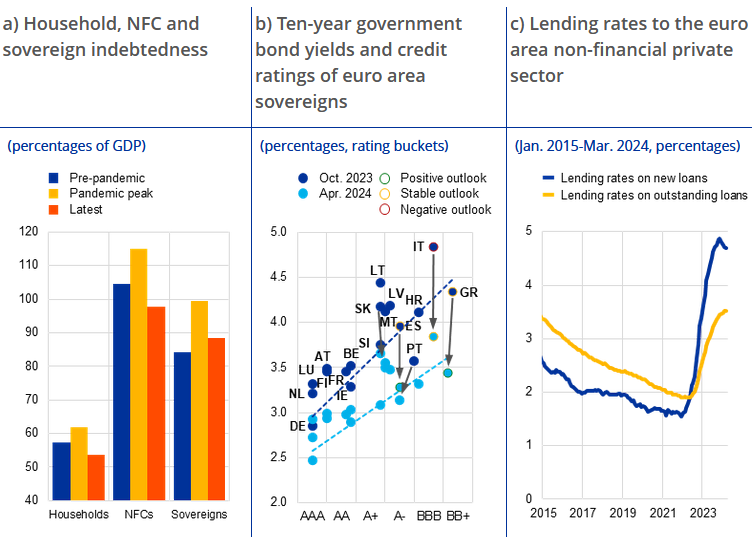

The improvement in financial stability is largely attributed to resilient household and corporate balance sheets and robust euro area banks, which have withstood recent shocks well. However, the report cautions against complacency, noting that pockets of vulnerability persist. This cautious optimism is well-founded, as financial stability heavily depends on the capacity to absorb shocks, which can vary significantly across different sectors and regions.

Macro-Financial Environment

One of the core sections of the report, the macro-financial and credit environment, provides a detailed analysis of the macroeconomic context. The ECB notes that while the risks of a deep recession have decreased, geopolitical risks are on the rise. The report emphasizes that lax fiscal policies could reinforce public debt sustainability concerns. This is particularly pertinent given the varying debt service capacities among euro area firms, especially those in the real estate sector, which show greater vulnerability to rising interest rates.

The discussion on property markets is particularly insightful. The report highlights a correction underway in property markets, notably in the commercial segment. This correction is essential for addressing the imbalances that have built up over recent years, but it also presents risks to financial stability, particularly if it leads to significant declines in asset quality for banks.

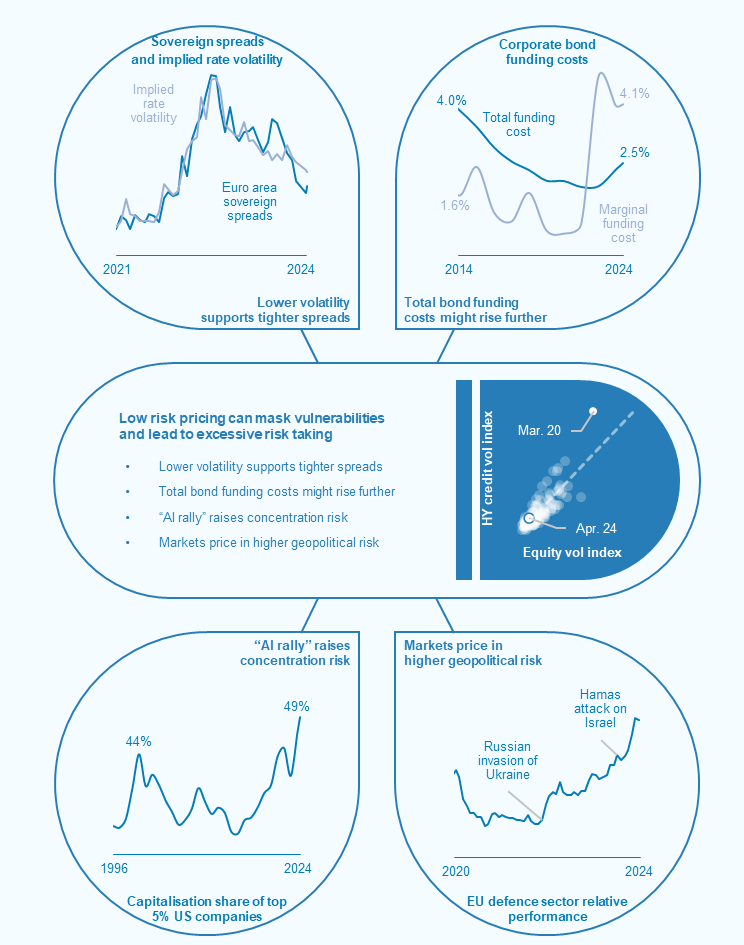

Financial Markets and Vulnerabilities

The section on financial markets addresses the adjustment to the expected shift in monetary policy. The report notes that benign pricing of risk has kept asset prices vulnerable to shocks. This is a crucial observation, as it underscores the potential for sudden market adjustments in response to adverse news. The discussion on exogenous risks adding to market volatility is particularly relevant in the current geopolitical climate. The report rightly identifies financial stability risks from basis trades in the US Treasury and euro area government bond markets, highlighting the interconnected nature of global financial markets.

The analysis of the euro area banking sector is thorough, detailing how profitability has peaked at multi-year highs but is now facing headwinds. The increase in bank funding costs and the slow deterioration in asset quality, particularly in commercial real estate, are significant concerns. The report’s emphasis on the resilience of banks, despite these challenges, is reassuring but also a call to action for ongoing vigilance.

Non-Bank Financial Sector

The FSR’s examination of the non-bank financial sector reveals its fragility amid a challenging macroeconomic outlook. The report identifies risks from concentrated portfolios, real estate, and low liquidity. The discussion on the liquidity preparedness of investment funds to meet margin calls in derivatives markets is particularly relevant.

The report suggests that while solvency is strong, the profitability outlook for insurers remains uncertain. This dual perspective of strength and vulnerability is critical for understanding the complex dynamics at play in the non-bank financial sector.

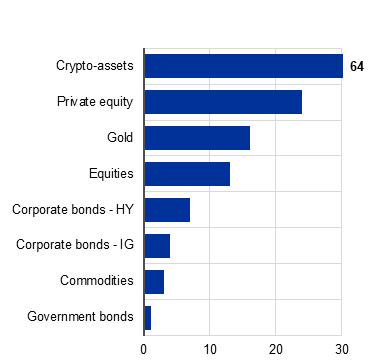

The Surge in Crypto-Assets

The review highlights a significant shift in monetary policy prospects that has bolstered investor confidence and increased risk appetite across various asset classes. Among these, crypto-assets have emerged as the top-performing asset class, showcasing a remarkable 64% increase in performance from November 22, 2023, to May 7, 2024.

The performance of crypto-assets is particularly noteworthy. This 64% surge surpasses the gains seen in other asset classes such as private equity, gold, and equities. Several factors contribute to this impressive performance, reflecting broader trends and sentiments within the financial markets:

- Increased Institutional Adoption: Over the past year, there has been a marked increase in institutional investment in crypto-assets. Major financial institutions have not only begun to integrate crypto-assets into their portfolios but have also launched various crypto-related financial products, such as exchange-traded funds (ETFs) and futures contracts. This institutional endorsement has provided a significant boost to market confidence and liquidity.

- Regulatory Developments: While regulatory landscapes for crypto-assets remain complex and varied across different regions, there have been positive developments aimed at fostering innovation while ensuring market stability. In the euro area and the United States, regulators have introduced frameworks that provide clearer guidelines for the operation of crypto-asset exchanges and the issuance of digital assets, contributing to a more secure investment environment.

- Technological Advancements: Continuous advancements in blockchain technology and the proliferation of decentralized finance (DeFi) platforms have expanded the use cases and utility of crypto-assets. Innovations such as smart contracts, layer-2 scaling solutions, and cross-chain interoperability have enhanced the functionality and appeal of cryptocurrencies, driving further adoption.

- Macro-Economic Factors: The shift in monetary policy prospects, as indicated by the changes in expected policy rates over the next 12 months, has played a crucial role in shaping investor behavior. As traditional markets react to anticipated adjustments in interest rates and fiscal policies, investors are increasingly looking towards alternative assets like cryptocurrencies for higher returns and diversification benefits.

Comparative Performance

When compared to other asset classes, the performance of crypto-assets stands out. Private equity, which traditionally attracts long-term investors due to its potential for high returns, saw a notable increase but still lagged behind crypto-assets. Gold, often viewed as a safe-haven asset, also performed well, reflecting ongoing economic uncertainties and inflationary pressures.

Equities and corporate bonds (both high yield and investment grade) showed moderate gains, indicative of a balanced but cautious approach among investors. Commodities and government bonds, on the other hand, exhibited the least performance growth, likely due to their lower risk profile and the current risk-on sentiment in the market.

Macroprudential Policy Issues

The report concludes with a section on macroprudential policy issues, advocating for the preservation of banking sector resilience and the enhancement of the macroprudential framework for banks. The call for a solid institutional and policy framework for non-banks is timely and necessary. The report’s discussion on ongoing policy initiatives to support euro area financial stability is comprehensive, covering a range of measures aimed at containing risks from leverage in the non-bank financial intermediation (NBFI) sector.

The inclusion of special features on geopolitical risk, artificial intelligence, and alternative funding sources provides a broader context for understanding the evolving landscape of financial stability. These features are well-researched and add significant value to the report, offering insights into emerging trends and their potential impact on financial stability.

Where Does This Leave us?

The ECB’s Financial Stability Review for May 2024, while detailed and structured, falls short of providing a genuinely comprehensive analysis of the euro area’s financial stability. The document’s attempt to balance improvements with ongoing risks appears more superficial than substantive. Although it touches on geopolitical risks, fiscal policy concerns, and sectoral vulnerabilities, these discussions lack depth and fail to present a cohesive understanding of the underlying issues.

The report is notably deficient in offering specific policy recommendations to address the risks it identifies. This omission significantly undermines its utility for policymakers and financial professionals who need actionable insights to navigate the complex economic landscape. The lack of clear directives or robust strategies makes the review more of a descriptive account than a practical guide, limiting its effectiveness in contributing to financial stability in any meaningful way.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- June 30, 2025NewsWireBank Savings at Risk: The Dark Side of EU’s Savings Standard

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class