Tornado Cash: Convictions and Legal Repercussions

Tornado Cash is an Ethereum-based cryptocurrency mixer designed to enhance the privacy and anonymity of transactions on the blockchain. It works by allowing users to deposit Ethereum into the mixer and then withdraw it to a different address, effectively breaking the on-chain link between the sender and the recipient. This process involves the use of zero-knowledge proofs, specifically zk-SNARKs (Zero-Knowledge Succinct Non-Interactive Arguments of Knowledge), which enable private transactions without revealing transaction details

Authorities allege that the developers facilitated extensive money laundering activities. Roman Storm and Alexey Pertsev, co-founders of Tornado Cash, have been convicted of money laundering and related charges. Pertsev, specifically, has been sentenced to 64 months in prison by a Dutch court, using a judgement with fraught reasoning.

This continues to show the legal system’s inconsistent approach towards financial privacy tools when in some cases they are indirectly implicated in illegal activities. In contrast, white collar crime in stock markets goes largely unpunished.

The charges against Storm and Pertsev stem from their alleged roles in helping the North Korean hacking group Lazarus launder over $1 billion in stolen cryptocurrencies through Tornado Cash. These legal actions have sparked a significant debate within the crypto community about the balance between regulatory enforcement and the right to privacy and open-source software development.

Samurai Wallet: Increased Scrutiny on Privacy Tools

Samurai Wallet, known for its strong emphasis on privacy features such as CoinJoin and Whirlpool, is also under increased scrutiny. Privacy-enhancing tools like Samurai Wallet are designed to protect user anonymity, but regulatory bodies view them as potential enablers of illicit activities. This growing scrutiny reflects broader regulatory efforts to clamp down on technologies that could facilitate money laundering or other financial crimes, thereby affecting the entire crypto ecosystem that values privacy and decentralization.

The Arrest of Roger Ver: Regulatory Crackdown Continues

Roger Ver, a well-known advocate for Bitcoin Cash and a prominent figure in crypto, was recently arrested on charges related to financial misconduct. This arrest is part of a broader regulatory crackdown on high-profile individuals in the crypto space, underscoring the authorities’ determination to enforce compliance and prevent financial crimes. Ver’s arrest has further heightened concerns within the crypto community about the potential for regulatory overreach and the erosion of basic freedoms.

The Bittersweet Increase in Bitcoin Price

Interestingly, amidst these regulatory and legal challenges, Bitcoin’s price has seen a notable increase of around 7% in the last 24 hours. Factors such as increased institutional interest and broader market adoption have contributed to this rise. However, this financial gain comes with a bittersweet backdrop, as the ongoing regulatory actions underscore a concerning trend towards the erosion of basic freedoms and privacy in the digital space.

While the increase in Bitcoin’s price is welcomed by investors, it also highlights the tension between financial innovation and regulatory compliance. The legal outcomes of cases involving Tornado Cash, Samurai Wallet, and Roger Ver will likely set significant precedents for the future of cryptocurrency regulation, impacting how privacy, freedom, and innovation are balanced in the digital age.

Community Reaction

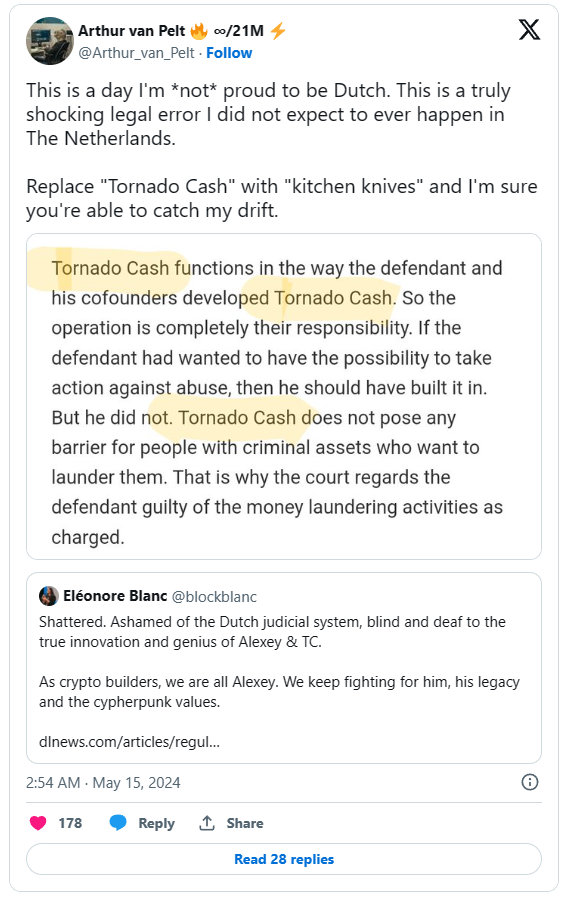

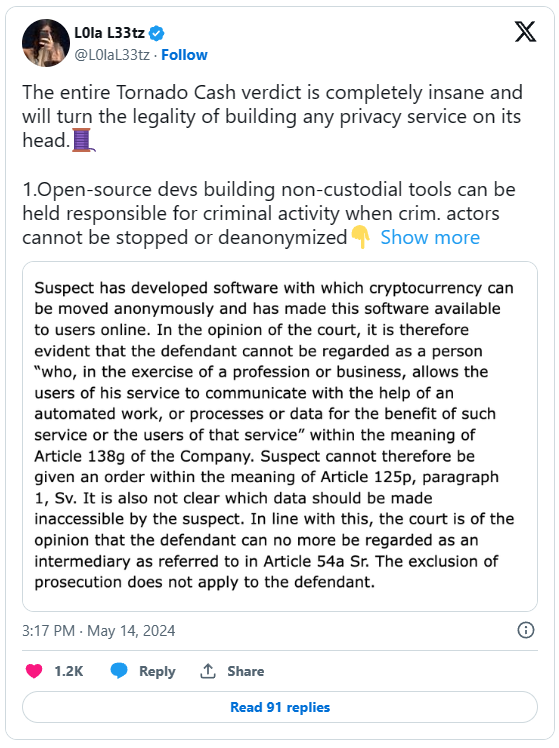

The recent conviction of Tornado Cash developers Roman Storm and Alexey Pertsev has sent shockwaves through the crypto community, igniting a big debate about privacy, regulation, and the future of open-source development. The verdict, which resulted in Pertsev being sentenced to 64 months in prison, has been met with strong reactions on social media platforms like Twitter.

L0la L33tz criticizes the verdict, highlighting its potentially chilling effect on the development of privacy tools. She underscores the court’s stance that developers of non-custodial tools can be held responsible for their use by criminals, even if those tools are intended for lawful purposes. This interpretation could set a dangerous precedent for software developers globally, who may now face legal risks for creating tools that enhance user privacy.

Arthur van Pelt echoes these concerns, comparing the situation to holding knife manufacturers accountable for crimes committed with their products. He argues that the ruling ignores the fundamental principles of tool creation and use, placing undue responsibility on developers for actions taken by others.

Autism Capital emphasizes the severity of the charges, noting that the legal actions are partly due to Tornado Cash’s alleged facilitation of money laundering for groups like the North Korean Lazarus Group. The prosecution’s success in linking the developers directly to the misuse of their software could impact the development and deployment of similar privacy-focused tools.

Aaron Day raises questions about the erosion of free speech and the shifting narrative around software development. His commentary reflects a growing concern that regulatory actions are increasingly targeting the fundamental freedoms that underpin the crypto and open-source communities.

What Now?

The convictions of Tornado Cash developers and the arrest of Roger Ver and the Samurai Wallet developers bring us to a critical moment in the relationship between regulatory authorities and the crypto community. While Bitcoin’s price rise provides a positive note for investors, the broader implications for privacy and freedom in the digital financial world are profound.

Which poses the question: Is profit more important than freedom?

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- June 30, 2025NewsWireBank Savings at Risk: The Dark Side of EU’s Savings Standard

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class