In a landmark move, President Joe Biden’s administration has announced plans to reclassify marijuana from a Schedule I to a Schedule III drug under federal law. This significant shift reflects a growing recognition of marijuana’s medical benefits and lower abuse potential compared to other substances classified under Schedule I, such as fentanyl and methamphetamine. The Justice Department’s proposal aims to align federal regulations with the evolving perspectives on marijuana use and its impact on public health and social justice.

The Announcement and Its Rationale

President Biden’s statements emphasized the administration’s commitment to rectifying the disproportionate impact of the current drug classification system on individuals and communities.

“Today, my administration took a major step to reclassify marijuana from a Schedule I drug to a Schedule III drug”

Joe Biden

He further stressed that no one should be incarcerated solely for using or possessing marijuana, highlighting the injustice of the current legal framework.

Biden’s remarks underscore the need for a reevaluation of marijuana’s classification, which currently places it in the same category as drugs with high potential for abuse and no accepted medical use. The proposed reclassification to Schedule III acknowledges marijuana’s medical applications and positions it alongside substances like ketamine and anabolic steroids, which are deemed to have moderate to low potential for physical and psychological dependence.

Impact on the Cannabis Industry

The reclassification of marijuana has profound implications for the cannabis industry in the United States and globally. By moving marijuana to Schedule III, the federal government would facilitate more robust research into its medical benefits, potentially accelerating the development of cannabis-based treatments. This change could attract increased investment into the cannabis sector, fostering innovation and expanding market opportunities.

Moreover, reclassification would likely reduce the regulatory burden on cannabis businesses, enabling them to operate more freely and access banking services that have been restricted due to federal prohibitions. This shift could lead to a more integrated and stable cannabis market, benefiting both consumers and entrepreneurs.

Globally, the U.S. decision to reclassify marijuana could influence other countries to reconsider their own drug policies. As a leading nation in the global economy, U.S. regulatory changes often set precedents that other countries follow, potentially leading to a more unified and progressive approach to cannabis regulation worldwide.

The Size of the Cannabis Industry in the USA

The cannabis industry in the United States is poised for significant growth in 2024 and beyond. According to recent projections, the U.S. cannabis market is expected to reach nearly $40 billion in total revenue in 2024. This impressive figure reflects the increasing legalization and acceptance of both medical and recreational cannabis across various states.

Furthermore, the industry’s economic impact extends far beyond direct sales. For every $10 spent at dispensaries, an additional $18 is injected into the economy, leading to a total economic contribution of $115.2 billion in 2024. This substantial economic stimulation happens predominantly at the local level, benefiting the communities where cannabis businesses operate. As the market continues to expand, it is projected to generate over $67 billion in revenue by 2028.

The cannabis industry also plays a crucial role in job creation, supporting over 400,000 full-time equivalent positions as of early 2023. This makes it one of the fastest-growing job sectors in the U.S., with new employment opportunities being added daily. This growth is driven by both the expanding market and the increasing number of states legalizing cannabis use, providing a robust foundation for sustained economic development.

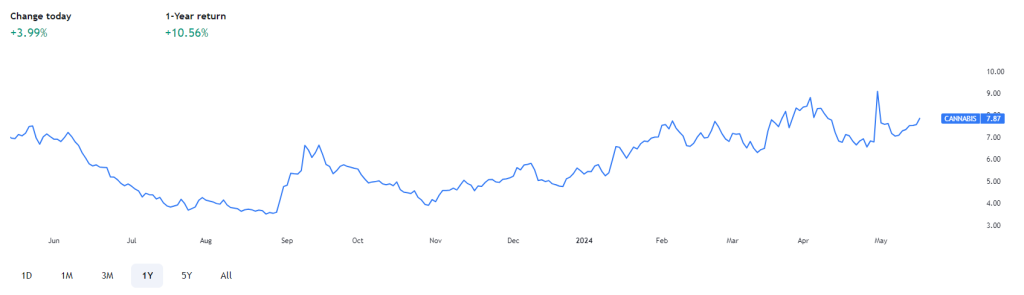

Stock Market Performance

- Performance: The sector is underperforming the broader market. The AdvisorShares Pure US Cannabis ETF is down 27% over the past year, while the S&P 500 has grown 22%.

- Reasons for the Slump: Several factors are hindering growth, including lingering operational inefficiencies, a brutal bear market in 2022, and historical market turbulence surrounding cannabis.

- Glimmer of Hope: Potential federal rescheduling of marijuana in the US could be a game-changer, allowing for easier research, taxation, and improved labor practices. Recent legalization votes in Ohio and upcoming votes in Germany add to the cautious optimism.

- Investor Sentiment: Some investors are losing patience, while others see this as a buying opportunity for long-term gains, considering the potential size of the legal cannabis market.

- Focus on M&A: Mergers and acquisitions might be a trend to watch, with established companies potentially acquiring smaller players to expand their reach.

- Canadian Market: Canadian cannabis producers, once high-flyers, are struggling with profitability and oversupply.

Social Justice and Historical Injustices

Reclassifying marijuana also holds significant social justice implications, particularly for those who have suffered under stringent drug laws. The current classification has led to the incarceration of countless individuals for non-violent marijuana offenses, disproportionately affecting marginalized communities. By reclassifying marijuana, the Biden administration is taking a step toward rectifying some of these injustices.

The announcement builds on previous efforts by the administration to address the consequences of the war on drugs. Last year, Biden pardoned a record number of individuals convicted of simple marijuana possession at the federal level. Reclassifying marijuana would further support these efforts by removing barriers to critical research and potentially paving the way for broader legislative reforms that prioritize rehabilitation over punishment.

A Little Irony

Whilst the administration is now talking about reclassification, during Kamala Harris’s tenure as California’s Attorney General, her office prosecuted over 1,500 people for cannabis-related offenses. This aggressive stance on marijuana was part of a broader approach to law enforcement and criminal justice that focused on stringent measures against drug-related crimes.

As San Francisco’s District Attorney, Harris secured over 1,900 convictions for cannabis-related offenses. This period saw significant efforts to clamp down on drug use and distribution, reflecting the era’s broader “War on Drugs” mentality.

Kamala Harris’s recent assertion that “nobody should have to go to jail for smoking weed” marks a stark departure from her previous policies. This change could be perceived as politically motivated, aimed at aligning with the growing public and political support for cannabis decriminalization and legalization.

The War on Drugs, particularly its focus on cannabis, has had a disproportionately negative impact on minority communities. The aggressive prosecution policies contributed to significant social and economic consequences for individuals and families affected by these convictions.

Critics argue that Harris’s past actions contributed to the perpetuation of systemic issues within the criminal justice system. The high number of cannabis-related convictions under her leadership highlights the punitive approach that dominated the era, which many now view as outdated and unjust.

Harris’s change in stance could be seen as an attempt to adapt to the evolving political landscape, where there is increasing support for cannabis legalization and criminal justice reform. However, this shift may also be viewed with skepticism by those who remember her previous policies.

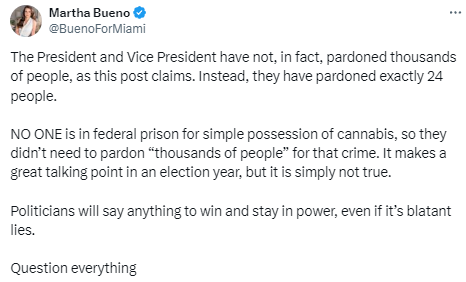

In a recent Twitter exchange, Martha Bueno challenged claims made by Vice President Kamala Harris regarding the pardoning of individuals with federal convictions for simple marijuana possession. Bueno pointed out that contrary to Harris’s statement, the President and Vice President have not pardoned “tens of thousands” of people, but rather exactly 24 individuals. Bueno emphasized that no one is currently in federal prison for simple possession of cannabis, thereby questioning the necessity and truthfulness of such claims.

Vice President Kamala Harris tweeted, “No one should go to jail for smoking weed. We have pardoned tens of thousands of people with federal convictions for simple marijuana possession.” This statement suggests a broad and impactful move by the administration to rectify past injustices related to marijuana possession.

Martha Bueno, a proponent of freedom and liberty, countered this claim by highlighting the factual discrepancy. According to Bueno, the actual number of people pardoned is only 24. She argued that the rhetoric used by Harris and the administration is misleading and primarily serves as a political tool during election periods. Bueno’s criticism is rooted in the assertion that the narrative of mass pardons for simple possession does not align with reality.

A New Era

The Biden administration’s proposal to reclassify marijuana from a Schedule I to a Schedule III drug marks a significant moment in the evolution of U.S. drug policy. This move not only acknowledges the medical benefits of marijuana but also addresses the long-standing injustices perpetuated by the current classification system.

As the U.S. leads this change, the ripple effects could be felt worldwide, fostering a more progressive and just approach to cannabis regulation. By balancing innovation with social justice, the administration aims to create a future where marijuana’s potential is fully realized, and past wrongs are righted.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- June 30, 2025NewsWireBank Savings at Risk: The Dark Side of EU’s Savings Standard

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class