In its latest effort to bypass the dollar and promote the internationalization of the yuan, China plans to price several Hong Kong-listed stocks of its companies in its domestic currency.

Starting Monday, shares of Alibaba and Tencent will be among 24 stocks priced and traded in both the yuan and the Hong Kong dollar under the Dual Counter Model on the Hong Kong stock exchange (HKEX).

Initially targeting overseas investors with yuan holdings, the scheme will later encompass mainland investors via the Hong Kong-China Stock Connect link-up. Offshore yuan deposits in Hong Kong alone are estimated at approximately 833 billion yuan ($117 billion).

The stock exchange is introducing the HKD-RMB Dual Counter Model, providing traders with the option to buy and sell some of the financial hub’s largest-listed stocks using the yuan. This includes Tencent Holdings Ltd., Alibaba Group Holding Ltd., and China Mobile Ltd. The 24 companies on the list have a combined market value of $1.9 trillion, representing over a third of the city’s total.

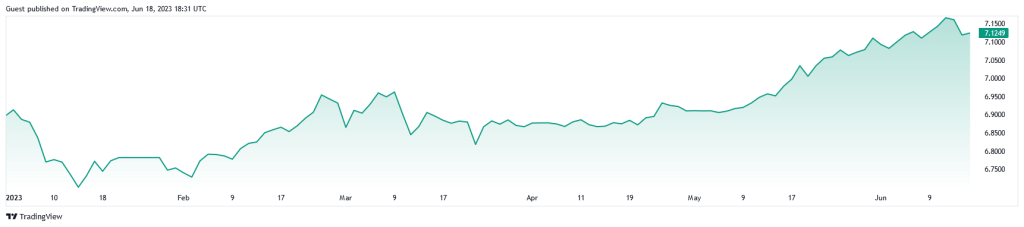

USD/CNY Chart

Investors with yuan holdings in countries like Russia, which has heavily relied on China’s currency due to being largely excluded from the global financial system by Western sanctions, could also be potential participants. HKEX will launch a market-maker program designed to minimize the price differences between the two currencies.

Investors can opt to trade using Hong Kong dollars or yuan, which has experienced significant volatility recently. Thus, investors trading with the yuan could reduce conversion and hedging costs.

In fact, the yuan is currently at its lowest against the US dollar since November, amid a disappointing post-COVID economic recovery. Based on the real effective exchange rate against another currency basket from the Bank of International Settlements, the yuan is at its lowest since 2014.

The new Hong Kong trading program emerges as Beijing seeks to internationalize the yuan and challenge the US dollar’s dominance on the world stage.

Earlier this year, China and Brazil reached an agreement to conduct trade using their own currencies, effectively bypassing the US dollar – the predominant currency in international trade, particularly for commodities.

In a similar move, Argentina announced its intention to pay for imports from China in yuan rather than US dollars. Additionally, Beijing has been actively pursuing countries in the Middle East to price oil in yuan instead of dollars, further extending its efforts to reduce the reliance on the US dollar in global trade.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class

- March 7, 2025SatoshiCraig Wright Banned from UK Courts with Civil Restraint Order