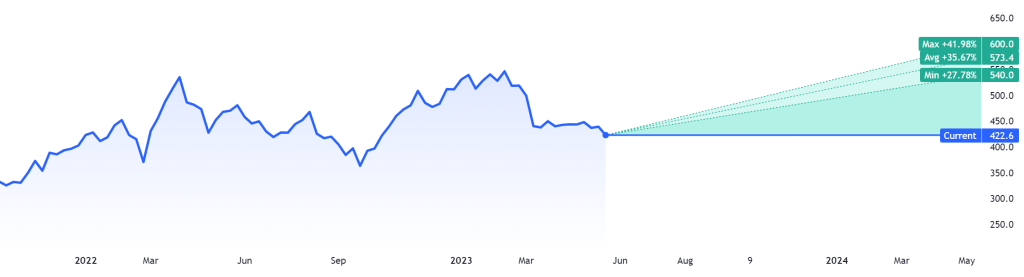

This is a company that many traders and analysts are talking about right now. With a strong buy signal and solid growth, since March 2020 (+205%) Invested is a promising stock in the FTSE 250, potentially about to break through to even higher levels. Find out why.

Investec is a leading international banking and asset management group, providing a wide range of financial services to clients in the UK, Europe, South Africa, Asia, Australia, and other parts of the world. The company’s stock market performance has been strong over the past few years, with its share price increasing by more than 20% since 2018.

Analysis

Investec has seen significant growth in its core markets over the last few years. In particular, it has seen an increase in demand for its financial planning services due to the growing number of people looking to invest their money for long-term growth. Furthermore, Investec has also benefited from increased investment in technology and digital transformation initiatives which have enabled them to offer more efficient and customer-centric services.

Investec’s profits were up in 2023 due to rising interest rates with the adjusted operating profit rising 21.6% to £835.9m. In the UK growth was 30% whilst it was 15% in South Africa. Added profit was generated via higher interest rates and growth in loans. Interest income was up 37.1%. You can check out their latest financial results.

A recent partnership was announced with Rathbones that will create a $123 Billion money manager. This is one of the factors making the analysts bullish about this stock.

Investec Bolsters M&A Ambitions with Capitalmind Stake Increase

Investec is ramping up its presence in the investment banking sector with a significant stake increase in a boutique firm, Capitalmind. Having acquired a 60% majority stake in the company, Investec has effectively rebranded the firm as Investec Capitalmind and is set to expand its M&A unit across continental Europe. With a team of 129 experienced dealmakers, the move is a clear bid to gain market share in the highly lucrative M&A space.

Investec made a strategic move by taking a 30% ownership in Capitalmind in 2021. The two banks have been working closely since then and have successfully executed over 230 transactions worth more than €25 billion. This acquisition is a clear indication of larger investment banks acquiring smaller firms to consolidate their position in the industry, which is experiencing a lull in deals.

Other notable examples of recent acquisitions include Deutsche Bank’s £410m acquisition of City investment bank Numis in April, which is set to become a powerful force in UK dealmaking, and Japanese bank Mizuho’s $550m purchase of boutique advisor Greenhill & Co. The industry has witnessed significant consolidation recently and Investec’s move is a clear indication of the direction the market is heading towards.

Despite these positive developments, Investec faces some challenges in the current market environment. Funds under management fell by 4.5% to $75.3 Billion as the global economy is still recovering from the effects of the COVID-19 pandemic and this could impact Investec’s ability to generate profits in the long term. Additionally, there are concerns about rising inflation levels which could lead to higher interest rates and reduce demand for Investec’s services.

Overall, Investec is well-positioned to benefit from future economic growth as it continues to expand its presence in new markets and invest in new technologies that will enable it to provide better services to its customers. However, investors should be aware of potential risks associated with investing in Investec such as rising inflation levels or a prolonged period of economic stagnation that could negatively affect their investments.

Forecast

For those looking to invest in Investec (INVP), it is important to consider both the potential benefits as well as any risks associated with investing in this segment before making any decisions. It is also advisable for investors to diversify their portfolios by investing across different sectors so that they can spread out their risk exposure while still taking advantage of potential returns from Investec stocks.

The financial industry is poised for more consolidation as dealmakers brace for the impact of a severe drought in mergers and acquisitions. This has led to a drastic 31% drop in fees, totalling a mere $27.4 billion in earnings so far this year.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- June 30, 2025NewsWireBank Savings at Risk: The Dark Side of EU’s Savings Standard

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class