On this day, 15 years ago, the world was introduced to a groundbreaking document that would forever alter the landscape of finance, technology, and social governance. Published on October 31, 2008, the Bitcoin Whitepaper by the pseudonymous Satoshi Nakamoto laid the foundation for what would become the world’s first decentralized cryptocurrency. We pay homage to this seminal work and its mysterious creator, exploring the revolutionary ideas it introduced, its impact on the financial ecosystem, and the challenges and opportunities that lie ahead.

The Genesis: The Bitcoin Whitepaper

The Bitcoin Whitepaper, titled “Bitcoin: A Peer-to-Peer Electronic Cash System,” was a nine-page document that outlined a novel solution to the problem of digital trust. It proposed a decentralized system where transactions could be verified without the need for a central authority, such as a bank or government. The paper introduced the concept of a blockchain, a public ledger that records all transactions, and a consensus mechanism known as Proof-of-Work (PoW) to secure the network. These innovations solved the double-spending problem, a significant hurdle in digital currency systems, and paved the way for the creation of Bitcoin.

The Enigma: Satoshi Nakamoto

The anonymity of Satoshi Nakamoto serves not just as a captivating mystery but also as a strategic move that aligns with the decentralized ethos of Bitcoin.

The enigmatic figure of Satoshi Nakamoto, the pseudonymous creator of Bitcoin, has been the subject of intense speculation and intrigue since the cryptocurrency’s inception. Despite the transformative impact of Bitcoin on the financial landscape, the identity of its creator remains shrouded in mystery. Numerous theories have been posited, ranging from the possibility that Satoshi is an individual genius to the idea that the name represents a collective of tech-savvy individuals. High-profile names in the tech industry, such as Nick Szabo and Hal Finney, have been suggested as potential candidates, but none have been definitively proven to be Satoshi. The absence of concrete evidence has led to a plethora of conspiracy theories, including the notion that government agencies or major corporations could be behind the creation of Bitcoin.

The anonymity of Satoshi Nakamoto serves not just as a captivating mystery but also as a strategic move that aligns with the decentralized ethos of Bitcoin. By remaining anonymous, Satoshi ensured that the focus would remain on the technology and its potential impact, rather than on its creator. This has allowed Bitcoin to grow organically, free from the influence or control of any single entity or individual. Moreover, the anonymity adds a layer of security, as the absence of a central figure makes it difficult for authorities to target or regulate the cryptocurrency. While the saga of Satoshi Nakamoto’s true identity continues to fuel debates and investigations, it also serves as a compelling narrative that adds to the allure and mystique of the Bitcoin phenomenon.

The Impact: Disrupting the Financial Ecosystem

The introduction of Bitcoin has had a profound impact on the global financial system. It has challenged the monopoly of centralized financial institutions and introduced a new paradigm of financial sovereignty. Bitcoin has also become a store of value, often referred to as “digital gold,” providing a hedge against inflation and economic instability. Moreover, the blockchain technology that underpins Bitcoin has found applications across various sectors, including supply chain management, healthcare, and governance.

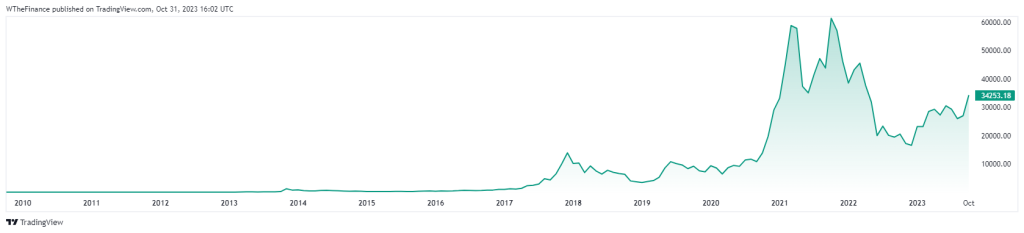

BTC vs USD All-Time Price Chart

The Challenges: Scalability, Regulation & Privacy

While Bitcoin has achieved significant milestones, it is not without its challenges. Scalability remains a pressing issue, as the current transaction throughput is limited. Regulatory hurdles also pose a significant challenge, with governments around the world grappling with how to classify and regulate digital assets. Additionally, widespread adoption is still in its nascent stages, as misconceptions and lack of understanding continue to act as barriers.

Despite its reputation for providing financial autonomy and censorship resistance, Bitcoin faces significant challenges in terms of privacy. Contrary to popular belief, Bitcoin transactions are not entirely anonymous; they are pseudonymous. This means that while transactions do not directly reveal the identity of the parties involved, they are publicly recorded on the blockchain, making it possible to trace the flow of funds through sophisticated analysis.

Various blockchain analytics firms and governmental agencies have developed tools to de-anonymize transactions, thereby compromising the privacy of users. Additionally, the use of centralized exchanges, which often require identity verification, further erodes the privacy that Bitcoin aims to offer. As a result, the quest for enhanced privacy features has led to the development of privacy-centric coins like Monero and Zcash, as well as layer-2 solutions and mixing services for Bitcoin. However, these alternatives are not without their own sets of challenges and complexities, making privacy a persistent issue in the broader adoption and utility of Bitcoin.

🔥 Are You Ready for the Truth?

— What The Finance (@WhatTheFinance9) October 31, 2023

Why the 15th Anniversary of the #Bitcoin Whitepaper is More Important Than You Think! 🎉💰 #SatoshiLegacy #cryptofutures https://t.co/8y0FB8381v

The Future: Beyond the Horizon

As we celebrate the 15th anniversary of the Bitcoin Whitepaper, it’s essential to look towards the future. With advancements in layer-2 solutions, regulatory clarity, and increased public awareness, Bitcoin is poised for greater adoption and integration into mainstream financial systems. The introduction of decentralized finance (DeFi) and non-fungible tokens (NFTs) also opens new avenues for innovation and utility.

A Tribute to a Revolutionary Idea

The publication of the Bitcoin Whitepaper 15 years ago was not just the birth of a cryptocurrency; it was the genesis of a financial and technological revolution. As we commemorate this milestone, it’s crucial to acknowledge the visionary ideas of Satoshi Nakamoto that have given rise to an entirely new ecosystem. The journey of Bitcoin from a theoretical concept in a whitepaper to a multi-billion-dollar asset class is a testament to the transformative power of innovation.

In summary, the 15th anniversary of the Bitcoin Whitepaper serves as a poignant reminder of how a simple document can ignite a revolution that challenges the status quo and opens new frontiers. It is a day to celebrate, reflect, and look forward to the untapped potential that lies ahead.

Thank you, Satoshi Nakamoto, for gifting us this revolutionary technology; your legacy is indelibly etched in the annals of history.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- June 30, 2025NewsWireBank Savings at Risk: The Dark Side of EU’s Savings Standard

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class