In an event that blurred the lines between official regulation and market manipulation, the U.S. Securities and Exchange Commission (SEC) found itself at the center of a bizarre incident involving Bitcoin spot Exchange-Traded Funds (ETFs). We delve into the details of the incident, its implications, and the broader context of the SEC’s role in financial markets.

The Incident

On an otherwise unremarkable Tuesday afternoon, the financial world was abruptly disrupted by a tweet from the SEC’s official Twitter account. This tweet, significantly impactful due to the subject matter, announced the approval of a Bitcoin spot ETF. This development was eagerly awaited and widely debated within the financial community, making the tweet’s content both highly anticipated and contentious.

However, the tweet’s validity was quickly brought into question. It was exposed as false, a result of a security breach in the SEC’s Twitter account. SEC Chair Gary Gensler responded by confirming that the tweet was unauthorized, emphasizing that the SEC had not sanctioned the listing and trading of spot Bitcoin ETFs. This clarification was crucial in dispelling the confusion and misinformation that had briefly swept through the markets.

Chair @GaryGensler,

— Rep. Bill Huizenga (@RepHuizenga) January 9, 2024

Does this mean we can blame more of the @secgov’s horrible rulemaking and so-called regulation by enforcement on a “compromised account”? #askingforafriend

Sincerely,

Chairman of the House Financial Services Oversight and Investigations Subcommittee pic.twitter.com/THqZ2PlVle

Market Reaction

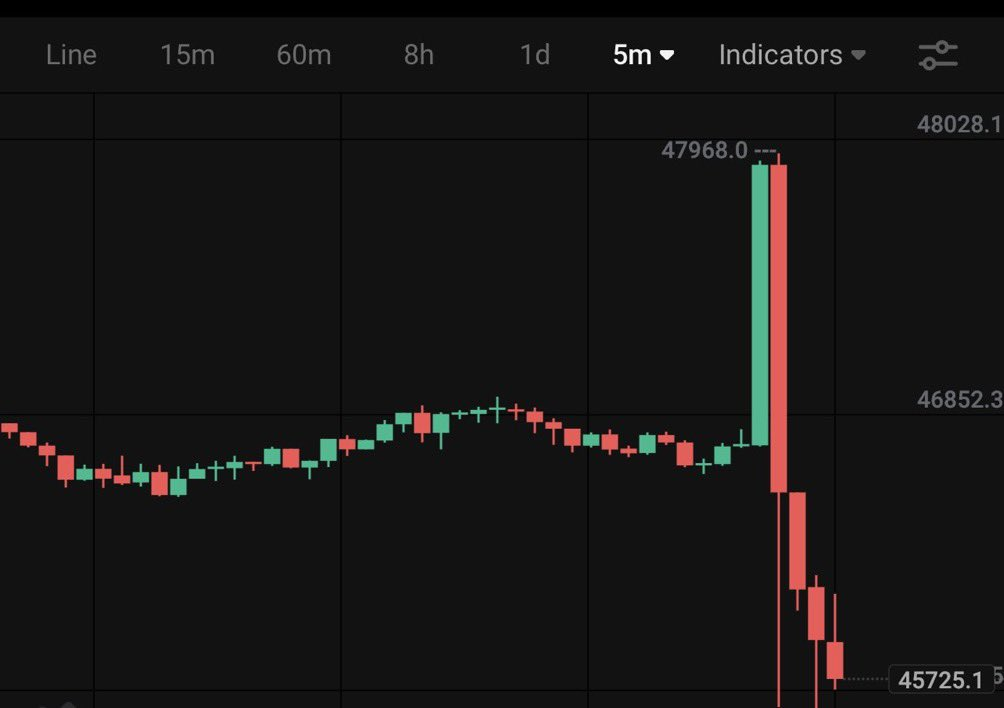

The impact of the erroneous SEC tweet on the cryptocurrency market was both immediate and substantial. Following the fake announcement claiming approval of Bitcoin spot ETFs, over $218 million in cryptocurrency trades were liquidated in just 15 minutes. This figure included over $56 million in Bitcoin trades alone, impacting a staggering 72,000 traders. The largest single liquidation involved a $6 million BTC/USD trade on the ByBit exchange.

Bitcoin’s price itself reacted sharply to the news. It spiked to $47,800 but then fell back to $45,400 as the market adjusted to the realization that the tweet was false. This incident underscores the significant influence that regulatory news can have on cryptocurrency prices and the broader market. It also highlights the vulnerabilities in digital communication channels and raises serious concerns about the potential for market manipulation through such means.

The SEC’s Role

The SEC’s primary role is to protect investors, maintain fair, orderly, and efficient markets, and facilitate capital formation. In this context, the approval of a Bitcoin spot ETF has been a subject of intense debate. Advocates argue that it would provide a regulated, accessible avenue for Bitcoin investment, while critics caution against the risks and volatility associated with cryptocurrencies.

Fraudulent announcements, like the one that was made on the SEC’s social media, can manipulate markets. We need transparency on what happened.

— Senator Cynthia Lummis (@SenLummis) January 9, 2024

The incident involving the compromised SEC Twitter account and the subsequent false announcement of Bitcoin ETF approval has led to significant uproar and calls for an internal investigation of the SEC itself. Lawmakers and cryptocurrency enthusiasts have raised serious questions about how the SEC’s account was compromised, leading to misinformation that impacted the market. This scenario has led to a demand for transparency and clarity about the events that unfolded.

Senator Cynthia Lummis (R-Wy.) was particularly vocal, emphasizing the potential for such fraudulent announcements to manipulate markets. She stressed the need for transparency regarding the incident, highlighting the importance of maintaining the integrity of official communication channels in the financial sector.

In response to these very serious concerns, the SEC announced that it would collaborate with law enforcement and governmental partners to investigate the matter thoroughly. This includes probing the unauthorized access to its account and any related misconduct, in an effort to underline the SEC’s self-proclaimed commitment to maintaining its mandate to protect investors and the integrity of financial markets.

These developments suggest a growing awareness and concern about the security of digital platforms used by regulatory bodies and the potential consequences of their compromise on market stability and investor confidence.

The compromised tweet incident serves as a stark reminder of the fragility of market sentiment and the paramount importance of secure, reliable communication from regulatory bodies. It also highlights the evolving challenges faced by the SEC in the digital age, where the lines between information and influence are increasingly blurred. As the financial world continues to grapple with the integration of cryptocurrencies and traditional finance, the role of regulators like the SEC becomes ever more critical in ensuring market stability and investor protection.

If the SEC can't even protect their 𝕏 account, how are they supposed to protect investors? @GaryGensler pic.twitter.com/jyrobG0S2B

— Bitcoin Magazine (@BitcoinMagazine) January 9, 2024

Twitter Confirms “Breach”

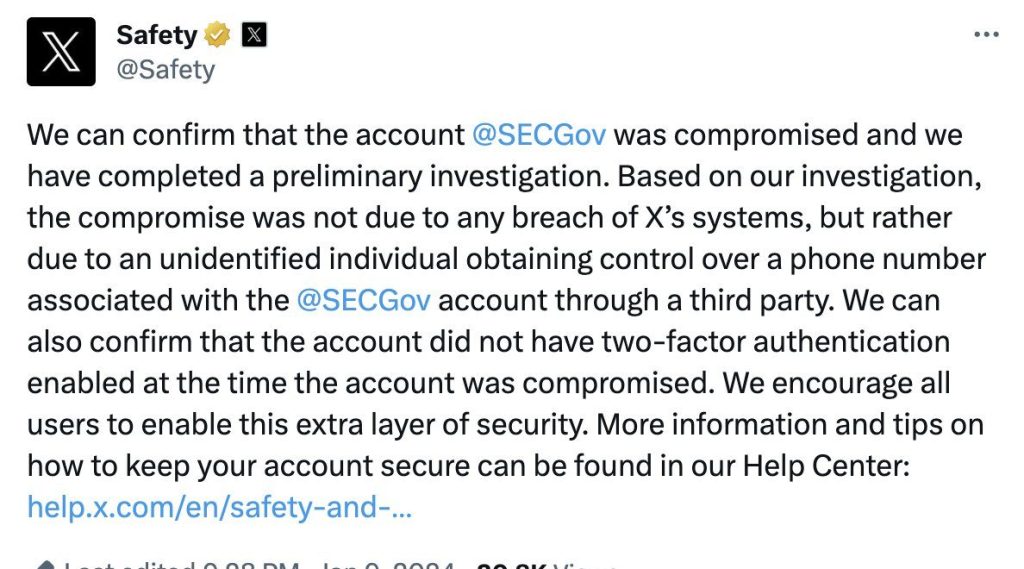

The official account of the U.S. Securities and Exchange Commission (@SECGov) Twitter security breach was confirmed by the platform’s safety team. Upon completing a preliminary investigation, it was revealed that the compromise did not stem from a direct breach of Twitter’s systems. Instead, an unidentified individual gained control over the SEC’s account through a third-party service linked to a phone number associated with the account. Notably, two-factor authentication (2FA) — a critical layer of account security — was not enabled at the time of the compromise.

This incident serves as a cautionary tale about the importance of robust security measures for sensitive accounts, especially those belonging to significant regulatory bodies. The absence of 2FA, a basic security practice, left the account vulnerable to unauthorized access, leading to the false announcement about Bitcoin spot ETFs. The platform urges all users to activate 2FA to bolster their account’s defense against such intrusions. Further advice and security tips are available in the platform’s Help Center, providing users with resources to safeguard their accounts effectively.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- June 30, 2025NewsWireBank Savings at Risk: The Dark Side of EU’s Savings Standard

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class