China has continued its steady streak of increasing gold reserves for seven consecutive months, indicating a continued high demand from central banks around the world. In May alone, China added approximately 16 tons to its holdings, bringing the total to around 2,092 tons.

Central banks purchased a record amount of gold last year in response to geopolitical uncertainty and global inflation, and while there was a drop in buying during the first quarter of this year, experts expect buying to continue.

Gold demand is set to fall by 9% in 2023 due to a decrease in net official sector purchases following a record-breaking year. However, other demand sectors will experience modest growth. Despite declining demand, the total gold supply is expected to increase by 2% in response to higher mine production and recycling efforts, resulting in a market surplus of over 500 tonnes this year.

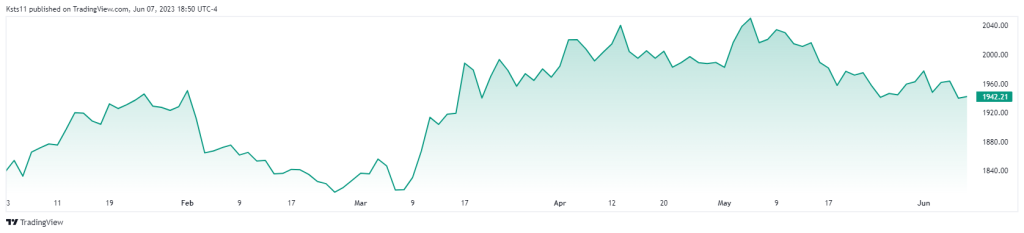

XAUUSD Chart 2023

The outlook for gold prices is mixed, with the annual average price expected to reach a new all-time high of $1,890, an increase of 5%. Nevertheless, prices will face downward pressure in the second half of 2023, with a projected low of $1,730, representing a restrained 12% drop from current levels.

The recent rally in gold prices, which rose by 7% year-to-date, has been driven by speculation that the Federal Reserve will end its tightening cycle and may even lower rates at the end of the year. However, market expectations are changing, with investors now anticipating a ‘higher-for-longer’ rate outlook, which could create challenges for gold prices in the second half of the year.

Traders warn that current expectations of imminent rate cuts in 2023 are overly optimistic, given the strength of the U.S. labour market and elevated inflation. They predict a soft landing for the U.S. economy, which could allow the Federal Reserve to maintain high interest rates for an extended period of time. Gold continues to shine despite all this, experiencing ATH this year.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- June 30, 2025NewsWireBank Savings at Risk: The Dark Side of EU’s Savings Standard

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class