Gold, often seen as a safe-haven asset, is currently facing significant headwinds. A combination of a strong U.S. dollar and rising Treasury yields weigh heavily on its price. Similar to other precious metals like silver, which also experiences fluctuations based on macroeconomic factors, gold’s role as a hedge against uncertainty is being challenged. As the global financial landscape shifts, traders and investors are closely watching gold’s key support levels for signs of further price corrections or recovery.

One of the primary forces pressuring gold prices is the strength of the U.S. dollar. Gold, like many commodities, is priced in dollars, meaning that as the dollar strengthens, gold becomes more expensive for international buyers using other currencies. This often leads to a decrease in demand.

The U.S. dollar index has recently climbed by 0.1%, nearing a two-month high. This appreciation makes gold less attractive to foreign investors and diminishes its appeal as a hedge against global instability. Historically, there is an inverse relationship between the value of the dollar and gold prices, as a stronger dollar reduces gold’s purchasing power and investment allure.

This dynamic is particularly evident during times of economic strength in the U.S., where a robust dollar is supported by high interest rates and steady economic growth. For gold, this translates into a reduced role as a safe-haven asset.

Adding to gold’s woes are high Treasury yields, which increase the opportunity cost of holding non-yielding assets like gold. When yields rise, investors are more likely to allocate funds to bonds or other financial instruments that offer returns, reducing gold’s appeal.

While some analysts caution against assuming a direct and consistent relationship between rising interest rates and falling gold prices, the current economic climate makes this correlation hard to ignore. The attractiveness of U.S. Treasuries (considered one of the safest investments) has siphoned off demand from gold, contributing to the downward pressure on its price.

Critical Levels to Watch for Gold Prices

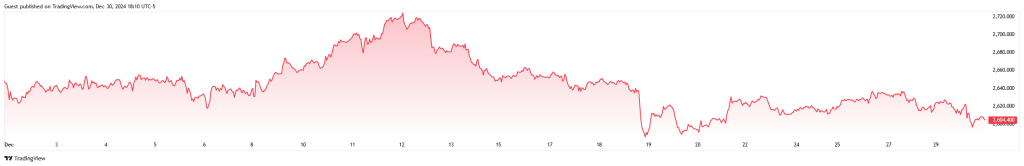

Gold’s price movements are closely tied to technical levels that indicate investor sentiment and potential trends. Gold is currently trading within a bearish pattern that suggests further price corrections could be on the horizon. Key levels to monitor include:

Support Levels

- First Support (S1): $2,615 per ounce

- Second Support (S2): $2,610 per ounce

- Third Support (S3): $2,605 per ounce

Resistance Levels:

- First Resistance (R1): $2,630 per ounce

- Second Resistance (R2): $2,635 per ounce

- Third Resistance (R3): $2,640 per ounce

For traders and investors, these levels are crucial indicators. A sustained move below support could trigger a sell-off, while a recovery above key resistance levels might restore confidence in gold’s resilience.

Gold’s current predicament is not unique. Silver, another widely traded precious metal, faces similar challenges. Like gold, silver’s price is influenced by the strength of the U.S. dollar and Treasury yields. However, silver also has a strong industrial demand component, which adds another layer of complexity to its price movements.

Interestingly, Bitcoin is emerging as a digital alternative to gold, often referred to as “digital gold.” While Bitcoin’s volatility is far higher than gold’s, its adoption as a store of value and hedge against inflation has grown significantly. Bitcoin’s decentralized nature and limited supply give it an edge among younger, tech-savvy investors who might otherwise have turned to traditional assets like gold.

Asset in Transition

Gold’s role as a safe-haven asset is being tested by a strong U.S. dollar and rising Treasury yields, factors that make holding the precious metal less attractive in the current economic environment. Traders are eyeing critical price levels to determine whether gold will rebound or face deeper corrections.

Meanwhile, Bitcoin continues to gain traction as a modern store of value, offering an alternative for investors seeking a hedge against inflation and monetary uncertainty. As the financial ecosystem evolves, gold’s longstanding position as a cornerstone asset may face increasing competition from digital assets like Bitcoin. However, for now, gold remains a crucial barometer of economic sentiment, its price movements closely tied to the macroeconomic forces shaping global markets.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class

- March 7, 2025SatoshiCraig Wright Banned from UK Courts with Civil Restraint Order