The Unfolding Crisis

Archer Daniels Midland (ADM), a global powerhouse in agricultural commodities trading, faced a significant setback as its shares plummeted nearly a quarter following a major internal upheaval. The company, known for its extensive operations in grain and oilseeds trading across nearly 50 countries, was rocked by the news of its Chief Financial Officer, Vikram Luthar, being placed on administrative leave amidst an ongoing investigation into the company’s accounting practices, particularly in its nutrition business.

Vikram Luthar’s Sudden Departure

Vikram Luthar, who ascended to the role of CFO in 2022, found himself at the center of this controversy. In response to the unfolding situation, ADM acted swiftly by appointing Ismael Roig as the interim CFO. This move, announced late on Sunday, was a clear indication of the seriousness with which ADM was treating the matter. Luthar’s administrative leave was not just a personal setback but also a significant development for a company that reported over $100 billion in revenue in 2022.

ADM’s Stature and Historical Context

ADM’s stature in the global market cannot be overstated. As one of the few companies dominating international trading and processing of essential agricultural commodities, its influence and reach are profound. However, this isn’t the first time ADM has found itself in troubled waters. The company’s history includes a notable incident in the 1990s involving a guilty plea to price-fixing charges of lysine and citric acid, leading to prison terms for three former executives.

The Investigation and Its Implications

The current crisis stems from a request for documents by the US Securities and Exchange Commission, prompting ADM to launch a probe into its accounting practices. The company’s board, led by Terry Crews, emphasized the gravity of the situation, stating their commitment to ensuring that ADM’s processes align with financial governance best practices. This investigation is not just a matter of internal policy but has broader implications for market confidence and regulatory compliance.

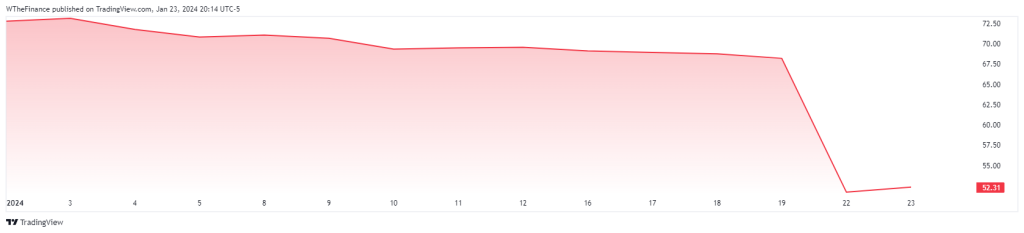

Market Reaction and Future Outlook

The immediate market reaction was stark, with ADM shares closing more than 24% lower, erasing billions from the company’s market capitalization. This sharp decline reflects the market’s sensitivity to corporate governance issues and the high stakes involved in maintaining investor trust. As ADM navigates this challenging period, the focus will be on the investigation’s findings and the company’s response to ensure robust financial practices.

What’s Next?

The situation at Archer Daniels Midland serves as a reminder of the delicate balance that large corporations must maintain in their operational and financial practices. The swift action taken by ADM in response to the SEC’s request and the subsequent market reaction underscores the importance of transparency and adherence to regulatory standards in today’s corporate world.

As the investigation unfolds, the financial community will be watching closely, not just for the impact on ADM but for the lessons that can be learned about corporate governance and accountability in the complex world of global trade.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- June 30, 2025NewsWireBank Savings at Risk: The Dark Side of EU’s Savings Standard

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class