The luxury fashion sector has seen a steady increase in demand and market share since 2016 with many investors seeking to capitalize on the potential of this lucrative industry. Why is it so lucrative though? What makes luxury fashion so irresistible as an investment? And for how long can it stay like that?

Market Trends and Historical Data

The luxury fashion sector has seen a steady increase in demand and market share over the past decade. This is due to a number of factors, including increased consumer spending power, changing tastes and preferences, and the emergence of new technologies that have enabled more efficient production processes.

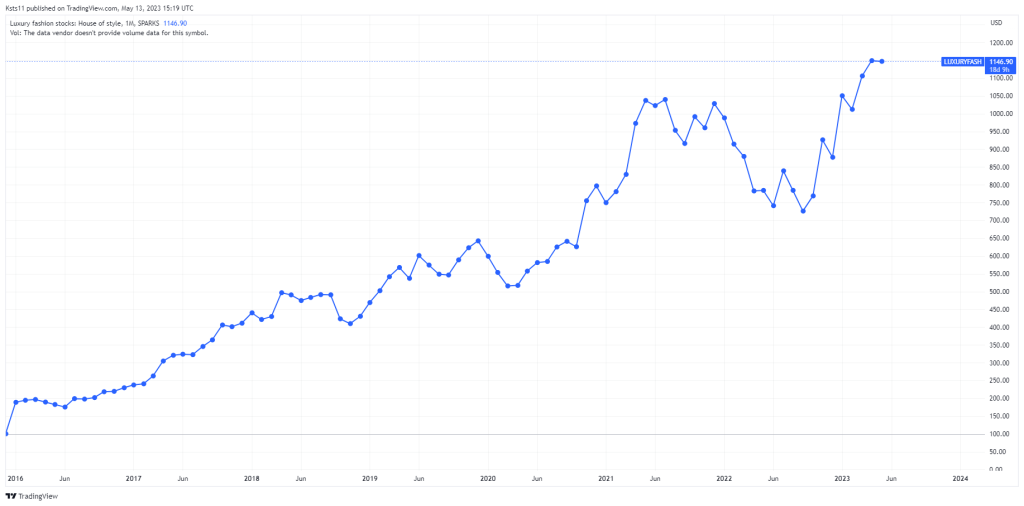

Fashion Stocks Index Chart

In terms of historical data, the Luxury Fashion Index provided by TradingView has seen an average annual return of 8.7% since its inception in 2006. This is higher than the overall S&P 500 Index which has seen an average annual return of 6.9%. Furthermore, this index has outperformed other major indices such as the Dow Jones Industrial Average (DJIA) and Nasdaq Composite Index (Nasdaq).

Weight of Trends Analysis

When analyzing current trends in the luxury fashion sector, it is important to consider both short-term trends as well as long-term trends. In terms of short-term trends, there are several factors that could affect demand for luxury goods in the upcoming months. These include changes in consumer spending habits due to economic uncertainty caused by conflict and the aftermath of COVID-19. Changes in environmental attitudes, fashion trends and preferences among consumers, and changes in technology can also have a major impact.

The China Factor

A key factor of growth in the industry has been expansion in new markets and apart from the Middle East and Russia where luxury brands were doing traditionally well, China added a whole new dimension.

The emergence of China as an economic superpower has led to the growth of the middle and upper classes in the country. Their increased spending power has benefited more luxury brands with clothing and apparel obvious winners.

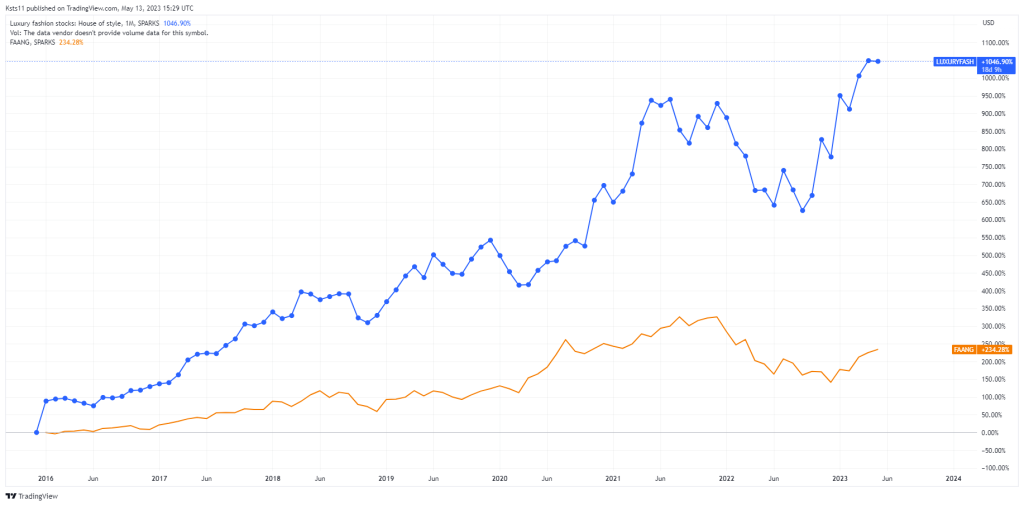

Fashion Stocks vs Big Tech Stocks

In terms of long-term trends, it is important to consider how macroeconomic conditions such as GDP growth rates or inflation levels may affect consumer spending on luxury goods over time. Additionally, it is important to consider how technological advancements such as artificial intelligence or blockchain may impact production processes or product offerings within this sector over time. It is also important to consider how changing tastes and preferences among consumers may affect demand for certain types of luxury goods over time.

Major Fashion Stocks

- Moet Hennessy Louis Vuitton LVHM – MC

- Christian Dior – CDI

- Richemont N – CFR

- Prada Spa – 1913

- Moncler – MONC

- Burberry – BRBY

- Ralph Lauren – RL

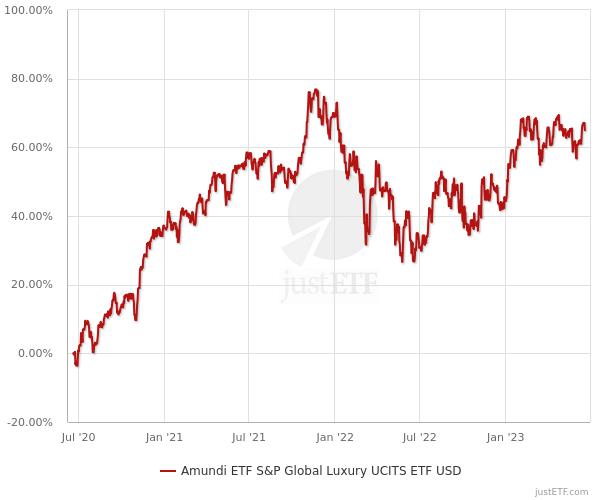

Luxury Fashion ETFs

For investors seeking a convenient method to gain access to a diverse selection of luxury stocks, an ETF (Exchange-Traded Fund) is the most effective solution. Although the luxury sector has demonstrated robust performance over the past ten years, it remains vulnerable to market downturns and economic recessions. During challenging periods, consumer spending on luxury goods typically declines as wealth diminishes.

The Amundi S&P Global Luxury ETF (GLUX.MI) tracks the S&P Global Luxury Index (INDEXSP:SPGLGUN) with an AUM of ~$360 million and it is available in many European exchanges.

Other ETFs Containing Fashion Stocks

- PowerShares S&P SmallCap Consumer Discretionary Portfolio – PSCD

- SPDR S&P Retail ETF – XRT

- PowerShares Dynamic Consumer Discretionary – PEZ

- Amplify Online Retail ETF – IBUY

- VanEck Retail ETF – RTH

- Direxion Daily Retail Bull 3X Shares ETF – RETL

- First Trust Consumer Discret. AlphaDEX – FXD

- Direxion Daily AMZN Bear 1X Shares ETF – AMZD

- Guggenheim S&P Smallcap 600 Pure Value ETF – RZV

Forecasted Performance & Investor Strategy

Based on our analysis of current market trends and historical data for luxury fashion stocks, we believe that these stocks have strong potential for growth in both the short-term and long-term future. We anticipate that these stocks will continue to outperform other major indices such as DJIA or Nasdaq given their relatively low volatility compared to other sectors within the stock market.

Furthermore, we believe that investors should focus on companies with strong brand recognition such as LVMH or Estee Lauder when investing in this sector given their proven track record for success within this industry.

When developing an investment strategy for these stocks it is important to consider both short-term gains from trading activities as well as long-term gains from holding positions for extended periods of time.

Investors should also be sure to diversify their portfolios across different sectors within this industry so they can benefit from any potential upside while mitigating any potential downside risk associated with investing solely in one particular company or sector within this industry. This is not financial advice so please do your own research before parting with any money.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- June 30, 2025NewsWireBank Savings at Risk: The Dark Side of EU’s Savings Standard

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class