Michael Saylor, the CEO of MicroStrategy, has become a prominent figure in the Bitcoin community, often seen advocating for the cryptocurrency across various media platforms. However, recent revelations by Ben Bray, Founder of Deductive Capital and Partner at Wall St Beats, have shed light on Saylor’s intriguing financial maneuvers involving MicroStrategy’s stock and Bitcoin holdings.

The Dual Strategy: Issuing Convertibles and Selling Stock

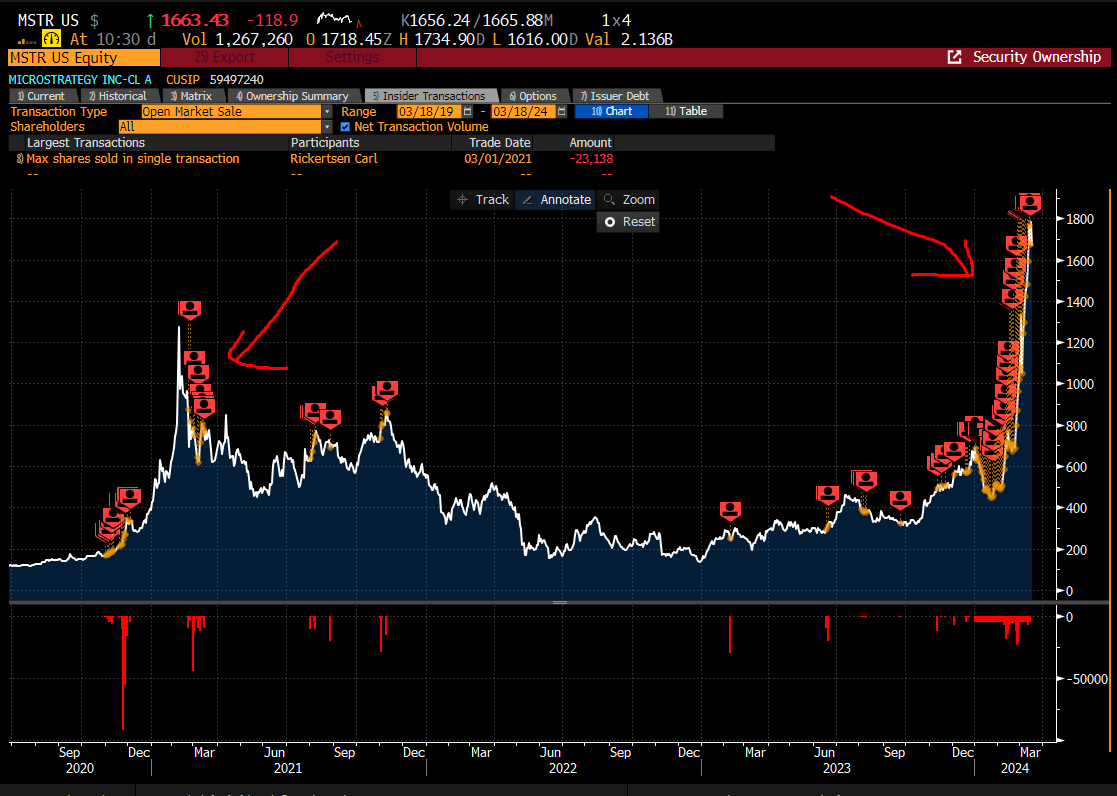

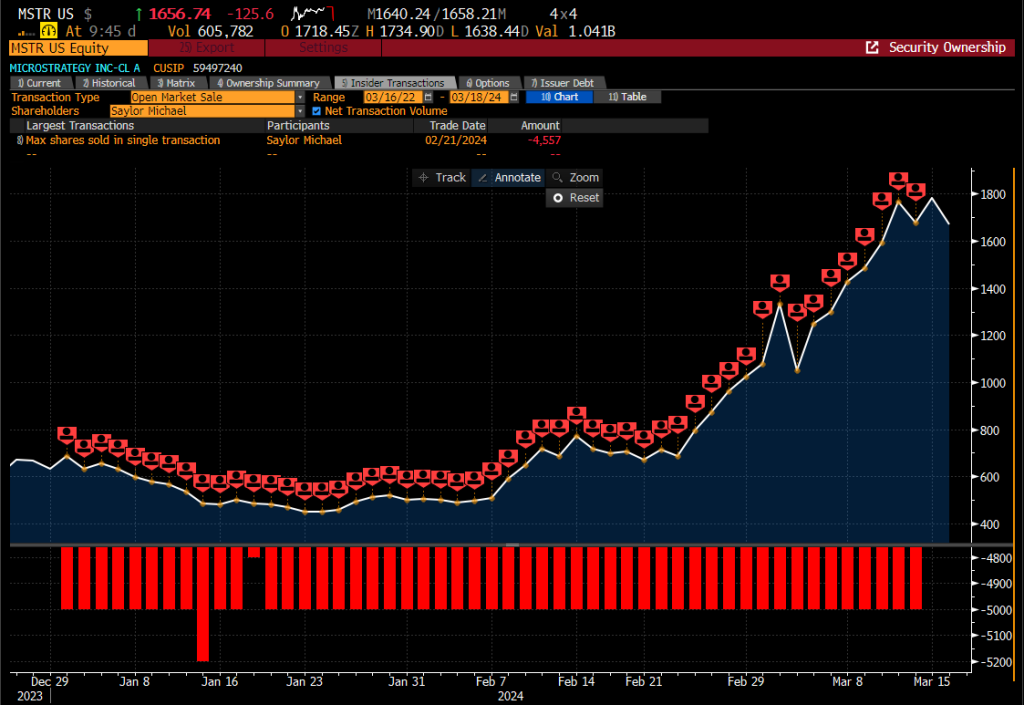

Saylor’s approach involves issuing convertible notes to acquire more Bitcoin while simultaneously selling shares of MicroStrategy (MSTR) stock. This strategy has raised eyebrows due to its complexity and the substantial amounts involved. Saylor has been selling approximately 5,000 shares of MSTR daily, amounting to $195 million in stock sold year-to-date, which projects to nearly $1 billion annually.

In September 2023, Saylor filed a 10b5-1 plan to sell his shares regularly. The chart provided in the analysis shows a pattern of consistent stock sales, which aligns with his public bullish stance on Bitcoin.

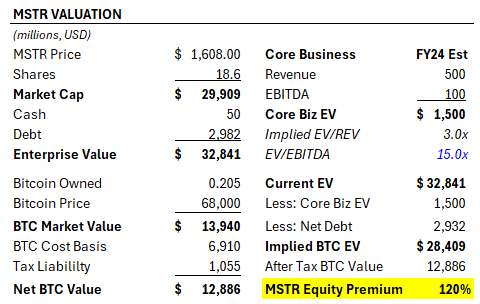

The Valuation Premium

MicroStrategy’s equity trades at a significant premium to its underlying software business and after-tax Bitcoin holdings. As of the analysis, this premium stands at 120%. To put this into perspective, for MSTR to trade at no premium to its Bitcoin holdings (valued at $68,000 per Bitcoin), the price of Bitcoin would need to be approximately $157,000—130% higher than recent levels.

This premium raises questions about why investors are buying MSTR stock at such inflated values when they could purchase Bitcoin directly at net asset value (NAV) through the spot market or a low-cost ETF. The premium suggests speculative behavior, likely driven by the perceived added value of Saylor’s aggressive Bitcoin accumulation strategy.

Convertible Arbitrage and Market Dynamics

The strategy of issuing convertibles to buy Bitcoin, driving up Bitcoin’s price, which in turn inflates MSTR’s stock price, exhibits a reflexive, almost flywheel dynamic. This approach appears to have elements of a Ponzi scheme, as each step reinforces the previous one, creating a cycle of rising valuations.

Bray points out the risks inherent in this strategy. The arbitrage could break down, leading to unwinding positions and potential significant losses. Monitoring the options market might provide clues about when these protections might unwind, indicating possible turbulence ahead for MSTR stock.

Historical Context and Saylor’s Timing

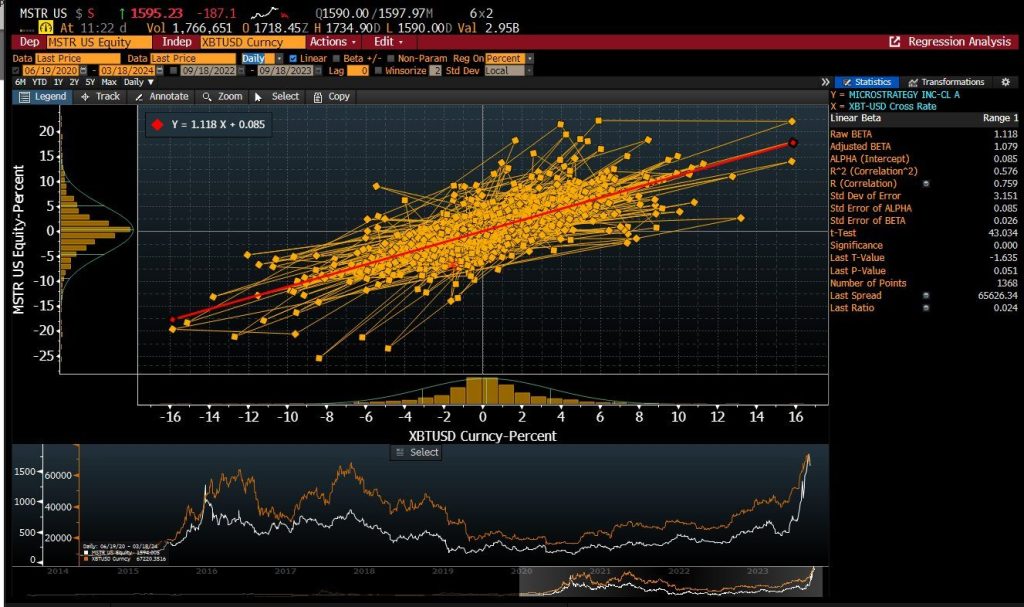

Historically, Saylor has demonstrated adept timing in selling equity. Since June 2020, MSTR has shown a beta of 1.11 to Bitcoin and a correlation of 0.76, suggesting a strong alignment with Bitcoin’s price movements. Bray argues that a more straightforward strategy might be to go long on Bitcoin and short on MSTR, betting on the convergence of MSTR’s inflated premium to a more reasonable valuation.

Strategic Implications

Saylor’s selling of convertibles at the company level and his stock sales to the public can be seen as strategic, exploiting the overvaluation of MSTR’s stock to accumulate more Bitcoin. This maneuvering allows him to maintain personal liquidity while increasing the company’s Bitcoin holdings, which he publicly advocates for as a long-term store of value.

However, such strategies also hint at potential market manipulation, where public advocacy and personal financial decisions might be intertwined to create favorable market conditions for one’s investments.

Bold Moves

Michael Saylor’s financial strategies involving MicroStrategy’s stock and Bitcoin holdings are complex and controversial. While they have certainly drawn attention and significant investment into Bitcoin, they also raise critical questions about market dynamics, investor behavior, and the sustainability of such approaches.

As Bray suggests, the market should remain cautious of the potential for unwinds and the inherent risks in these reflexive financial strategies. The lessons from Saylor’s approach underscore the importance of understanding the underlying value and avoiding speculative bubbles in the investment landscape.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- June 30, 2025NewsWireBank Savings at Risk: The Dark Side of EU’s Savings Standard

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class