Recent data from the UBS Family Office Report 2024 highlights the key risks that ultra-high-net-worth individuals (UHNWI) are concerned about. These family offices, managing an average of $2.6 billion in wealth, view major geopolitical conflicts and higher inflation as the top risks over the next five years. Prominent Bitcoin analyst Willy Woo shared this report on Twitter, suggesting that Bitcoin could be a viable solution to these top concerns.

Key Risk Factors

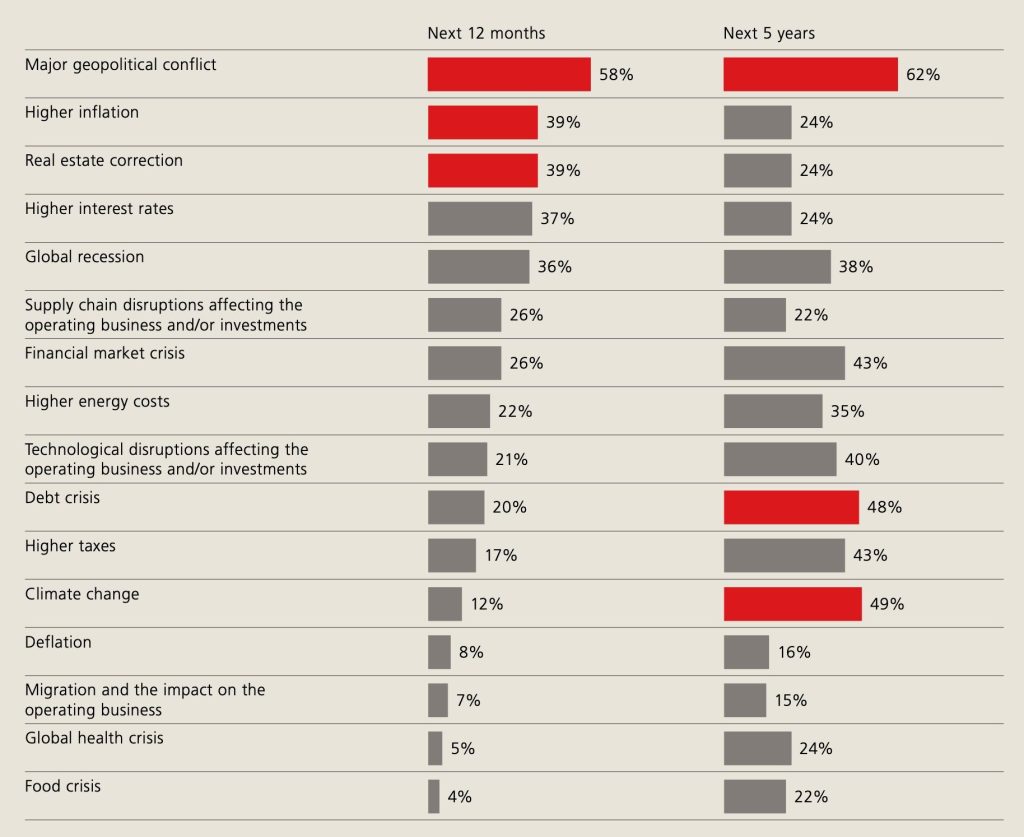

The UBS report identified several significant risks:

- Major Geopolitical Conflict: 58% of respondents see this as a major risk in the next 12 months, rising to 62% over the next five years.

- Higher Inflation: Viewed as a risk by 39% in the next year and 24% in the next five years.

- Real Estate Correction: Cited by 39% for the next year, with a slight decrease in concern over five years.

- Higher Interest Rates: A concern for 37% in the next year, dropping to 24% over five years.

- Global Recession: Seen as a risk by 36% in the next year and 38% over five years.

Other risks include supply chain disruptions, financial market crises, higher energy costs, technological disruptions, debt crises, higher taxes, climate change, deflation, migration impacts, global health crises, and food crises.

Bitcoin as a Solution

Bitcoin, according to Woo, offers solutions to the top two risks: geopolitical conflicts and inflation. Here’s how Bitcoin addresses these concerns:

- Geopolitical Conflict: In times of geopolitical strife, transferring large sums of money can become problematic. Traditional financial systems might seize up, making it difficult to move or secure assets. Bitcoin’s decentralized nature and the ability to store large amounts in a small, secure digital format make it an attractive option. For instance, $1 billion in Bitcoin can be stored on a single, secure USB drive, offering unparalleled mobility and security.

- Higher Inflation: Bitcoin’s programmed halvings every four years reduce the rate at which new Bitcoins are created, contrasting sharply with fiat currencies, which can be inflated at will by governments. This feature makes Bitcoin a hedge against inflation, preserving value over time.

Reactions from the Community

The discussion sparked by Woo’s tweet elicited a variety of responses from the cryptocurrency community and beyond. The discussion sparked by Woo’s tweet elicited a variety of responses from the cryptocurrency community and beyond. Neel Nanda (@NeelNanda5), the Mechanistic Interpretability Lead at DeepMind, criticized the reliance on threats rather than payment to enforce non-disparagement agreements at OpenAI. He emphasized the importance of ethical practices and transparency, hinting at the broader implications for trust in AI and tech companies.

Arnold TwtUser (@Arnold_Twtuser) lauded Hilton as a brave whistleblower, noting the increasing reputational damage to OpenAI. His comments underscore the critical need for ethical conduct and the protection of whistleblowers in maintaining public trust. Jackie (@chanman2087) expressed skepticism about the metrics used by family offices to gauge risk, suggesting they might be overlooking crucial factors that could impact their wealth preservation strategies.

Michael Crush (@MichaelCrush73) highlighted the paradox of wealthy individuals considering climate change a major threat while many in the same demographic deny its existence. This comment points to the complex and sometimes contradictory attitudes towards global risks among the wealthy. MinedWealth (@WealthMined) thanked Woo for sharing the insights, noting the surprising role Bitcoin could play in mitigating wealth risks from the perspective of the ultra-wealthy.

SSJ Shid (@arbitrage_goku) pointed out the debt crisis as another significant risk, which Bitcoin could potentially hedge against by offering an alternative store of value and medium of exchange. Crypto Signals (@CryptoSignalsU) noted that Bitcoin is becoming a go-to solution for mega-rich family offices to manage risks and secure wealth, reflecting a growing trend of cryptocurrency adoption among the elite. Lastly, The Contrarian Desk (@contrariandesk) expressed frustration over the lack of direct references to cryptocurrencies in the UBS report, highlighting the nascent stage of mainstream crypto adoption and awareness.

Price of Bitcoin

Broader Implications

The growing interest in Bitcoin among ultra-high-net-worth individuals underscores its potential as a hedge against significant financial risks. However, the broader implications of this trend extend beyond wealth preservation. As more influential investors adopt Bitcoin, it could drive greater acceptance and integration of cryptocurrencies into the mainstream financial system. This shift might also spur further regulatory scrutiny and innovation in digital asset management.

In conclusion, the UBS Family Office Report 2024 and the subsequent discussions highlight a pivotal moment for Bitcoin and cryptocurrencies. As traditional financial risks intensify, the appeal of decentralized, digital assets like Bitcoin is becoming increasingly apparent. This development not only underscores the evolving landscape of wealth management but also the transformative potential of blockchain technology in securing and preserving value in an uncertain world.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- June 30, 2025NewsWireBank Savings at Risk: The Dark Side of EU’s Savings Standard

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class