In the rapidly evolving world of blockchain and smart contracts, there’s a critical aspect often overlooked or not widely understood: the limitations of smart contracts in executing autonomous actions and the vital role of automation networks in augmenting their capabilities. This article delves into the nuances of smart contracts and highlights the importance of automation networks like PowerAgent, which serve as essential cogs in the blockchain ecosystem.

Understanding Smart Contracts: The Basics

At their core, smart contracts are self-executing contracts with the terms of the agreement between buyer and seller directly written into lines of code. They are deployed on blockchain platforms and run exactly as programmed without any possibility of downtime, censorship, fraud, or third-party interference.

The Limitation: Lack of Autonomous Execution

However, there’s a significant limitation to these digital contracts: they cannot initiate actions on their own. Smart contracts are reactive, not proactive. They don’t “do” things in the conventional sense; they merely change entries in ledgers when certain conditions are met. This means they cannot be protagonists in their execution process. For instance, they cannot autonomously respond to time-based events or external data changes without an external trigger.

The Need for Automation Networks

This is where automation networks come into play, serving as an indispensable component in the blockchain ecosystem. These networks, functioning as Ancillary Services Networks (ASNs), provide the necessary external impetus for smart contracts to execute tasks based on on-chain or off-chain data and computations.

PowerAgent: A Case Study in Automation Networks

PowerAgent exemplifies an autonomous, decentralized, randomized, and trustworthy network of Keeper nodes. These nodes have “skin-in-the-game,” meaning they have a vested interest in the accuracy and reliability of their operations. The network’s decentralized nature ensures that it is not prone to single points of failure, making it a robust solution for smart contract execution.

Keeper nodes in networks like PowerAgent play a pivotal role. They monitor events and conditions specified in smart contracts and trigger actions when those conditions are met. This could include time-sensitive tasks or responses to real-world events captured through oracles.

Ancillary Services Networks: Beyond Automation

Ancillary Services Networks (ASNs) like oracle networks are another form of support system for blockchain platforms. Oracle networks provide external data to smart contracts, enabling them to interact with and respond to real-world events. This external data feed is crucial for many blockchain applications, particularly those that require accurate and timely information from outside their native blockchain.

The Secret of EVM Chains

This aspect of blockchain functionality is especially pertinent in Ethereum Virtual Machine (EVM) chains. EVM chains are widely used but their inherent limitations regarding autonomous actions are not widely recognized. This knowledge gap sometimes leads to misunderstandings about what can and cannot be achieved directly through smart contracts on these platforms.

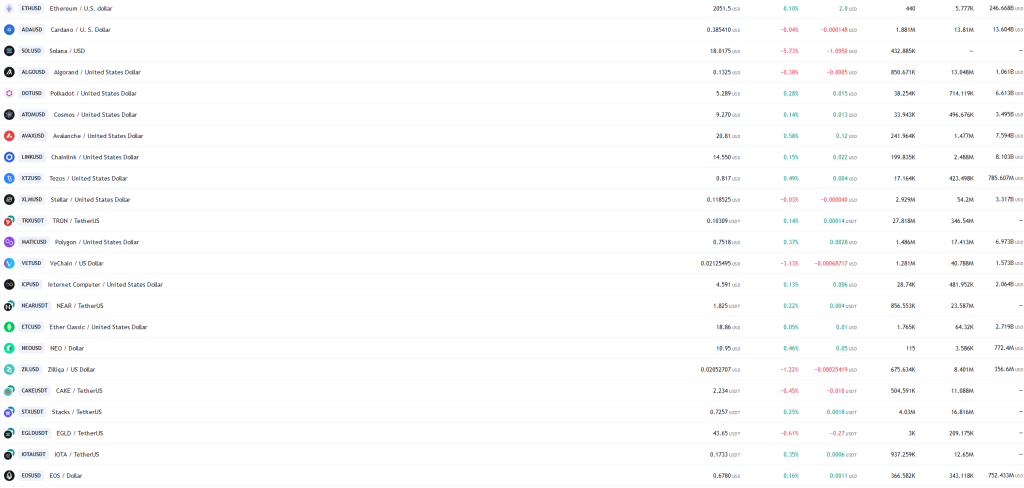

10 Largest Smart Contract Networks

- Ethereum: Known as the original smart contract platform, Ethereum boasts the largest user and developer base in the industry. It introduced the Ethereum Virtual Machine (EVM) and popularized the Initial Coin Offering (ICO) method for fundraising.

- Hyperledger: Created by The Linux Foundation and supported by major industry players. It’s a permissioned blockchain, making it attractive for enterprise use due to its focus on security, trust, and GDPR compliance.

- Tezos: A second-generation blockchain emphasizing scalability and upgrades. It uses on-chain administration to avoid hard forks and runs on a proof-of-stake consensus algorithm.

- EOS: Launched in 2018, it’s known for near-zero transaction fees and high scalability. EOS uses a delegated proof-of-stake consensus mechanism and is coded in C++.

- Stellar: Developed in 2014, Stellar is recognized for its speed and cost-effectiveness in money transfers. It’s not Turing complete, focusing mainly on basic smart contracts like ICOs and escrow accounts.

- Algorand: Gaining traction in the DeFi space, Algorand offers scalable, low-cost, fast, and secure smart contract creation. It uses the Pure Proof of Stake (PPoS) consensus mechanism.

- Solana: Founded in 2017 and known for its high transaction speed (65,000 TPS), Solana uses a proof-of-history consensus algorithm to achieve this speed.

- Polkadot: A layer-zero blockchain allowing interoperable parallel blockchains. Developed by Ethereum co-founder Gavin Woods, it’s known for its fast transaction processing and interoperability.

- Cosmos: Known for its innovative approach to achieving interoperability, security, and speed. It operates on a hub and spoke model and hosts key blockchains like Osmosis, Akash, and Persistence.

- Cardano: Founded by Ethereum co-founder Charles Hoskinson, Cardano uses a proof-of-stake consensus algorithm. It introduced smart contract functionality in 2021 with its Alonzo fork, focusing on industries like mortgage, gaming, legal, and cross-border payments.

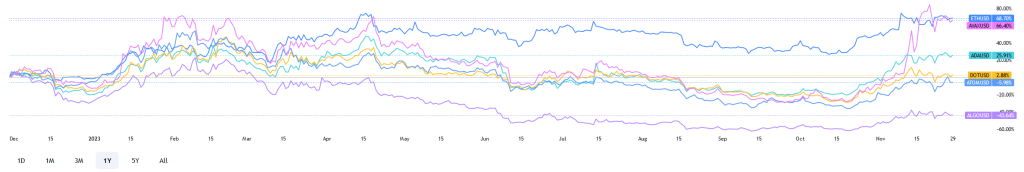

Smart Contracts Index

Market Dynamics

The smart contracts market, valued at USD 684.3 million in 2022, is poised for significant growth, with forecasts suggesting it could reach USD 1460.3 million by 2029, expanding at a compound annual growth rate (CAGR) of 24.2% during the forecast period 2023-2029. This surge is primarily fueled by the increasing adoption of blockchain technology, spurred by its promise of enhanced efficiency, cost savings, and the burgeoning demand within the Decentralized Finance (DeFi) sector. The COVID-19 pandemic and geopolitical events like the Russia-Ukraine war have been influential in shaping the market’s trajectory, accelerating the adoption of digital technologies and increasing the demand for secure, automated business processes.

The integration of smart contract technology with existing financial systems by fintech companies has significantly enhanced transactional efficiency and transparency. Additionally, compliance with regulatory standards like GDPR in the EU and CCPA in the U.S. plays a crucial role in the enforceability and acceptance of smart contracts. Despite their growing popularity, the smart contracts market faces challenges, including a lack of widespread understanding and a shortage of skilled professionals capable of developing and implementing these technologies.

Contracting of the Future?

While smart contracts are a groundbreaking technology in the blockchain space, their functionality is inherently limited to modifying ledger entries based on pre-set conditions. The real power and versatility of these contracts are unleashed through the integration with automation networks like PowerAgent and other ancillary services networks.

These networks provide the necessary external triggers and data, allowing smart contracts to effectively interact with and respond to a dynamic world. Understanding this symbiotic relationship between smart contracts and ancillary services is crucial for anyone looking to fully grasp or leverage blockchain technology’s potential.

Author Profile

- Lucy Walker covers finance, health and beauty since 2014. She has been writing for various online publications.

Latest entries

- June 30, 2025NewsWireBank Savings at Risk: The Dark Side of EU’s Savings Standard

- April 25, 2025Global EconomicsWhistleblowers Unmask Schwab’s Toxic WEF Secrets

- April 9, 2025Global EconomicsTariff Tensions Drive Market Volatility

- March 18, 2025Global EconomicsRed in Name Only: Labour’s War on the UK Working Class

1 Comment

Peter Williamson

December 15, 2023Absolutely! Smart contracts, while revolutionary, indeed have limitations when it comes to autonomous execution. The integration with automation networks like PowerAgent is the missing link that amplifies their potential, enabling proactive actions based on real-time triggers.