Komodo (KMD) is a cryptocurrency that was launched in 2017 as part of the Komodo Platform. The platform is an open-source blockchain-based project that provides users with a secure and relatively private way to transact with each other. It also offers a range of features such as atomic swaps, decentralized applications, and interoperability. KMD is the native currency of the platform and can be used to pay for transactions and services on the network.

The Komodo Platform uses a unique consensus mechanism called delayed-proof-of-work (dPoW). This allows for faster transaction times while still providing security against double-spending.

However, there has been talk from the team to abandon this model and revert to an EVM or Ethereum Virtual Machine. This is essentially a fork of Ethereum where the team can realise a lot of the capabilities of their existing blockchain technology as they have been to date using their proprietary platform “The Antara Framework“.

About Antara Smart Chains

As the foundational layer of the Antara framework, Smart Chains offer complete independence. This means that each Antara Smart Chain operates with its own consensus rules, decentralized peer-to-peer network, and currency. Transaction fees are always paid using the Smart Chain’s native coin, eliminating any reliance on the Komodo blockchain or KMD coin.

With 18 different customization options available, users can tailor their Smart Chain to their specific needs. These options include consensus rules, hashing algorithms, pre-mine supply, block time, block rewards, adjustments in block rewards, privacy settings, and more.

The full customizability and modularity of Smart Chains enable them to be crafted to suit a wide range of use cases, such as blockchain gaming, fintech solutions, global remittances, supply chain management, intellectual property protection, and tokenization of real-world assets, among many others. Additionally, there are strong privacy features such as zk-SNARKs which allow for anonymous transactions. This is a feature that a community project called Pirate Chain has adopted in its cryptocurrency ARRR.

Examples of Antara Smart Chains

- Komodo (KMD) – Komodo is a decentralized open-source cryptocurrency and blockchain platform that provides users with unique blockchain technology, and security through its Delayed Proof of Work (dPoW) consensus mechanism. Komodo’s native cryptocurrency KMD has a current market capitalization of ~$35 million USD and a 24-hour trading volume of over $1M USD.

- Pirate Chain (ARRR) – Pirate Chain (ARRR) is a privacy-focused cryptocurrency that offers unparalleled privacy and security. It uses a unique protocol to ensure that transactions are completely anonymous and untraceable. The current price of ARRR is $0.26 USD, with a 24-hour trading volume of ~$50,000 USD. Pirate Chain has a circulating supply of 196,213,797.971 ARRR and is currently 98.26% below its all-time high of $16.90. With its strong focus on privacy, Pirate Chain is an attractive option for those looking for secure and private transactions in the cryptocurrency market.

- Verus Coin (VRSC) – VerusCoin (VRSC) is a cryptocurrency that utilizes its own blockchain technology to provide fast and secure transactions. It has a unique consensus algorithm called Proof of Power, which is a 50% PoW/50% PoS hybrid system designed to address weaknesses in other PoS systems. VerusCoin has been around since 2018 and currently has a market capitalization of $40 million USD with an average 24-hour trading volume of $5,000 USD.

- Tokel (TKL) – Tokel is a blockchain-based platform that enables users to create, buy, and sell digital assets such as Non-Fungible Tokens (NFTs). Tokel’s native cryptocurrency, TKL, is used to facilitate transactions on the platform. It has its own blockchain technology which allows for faster and more secure transactions than other cryptocurrencies.

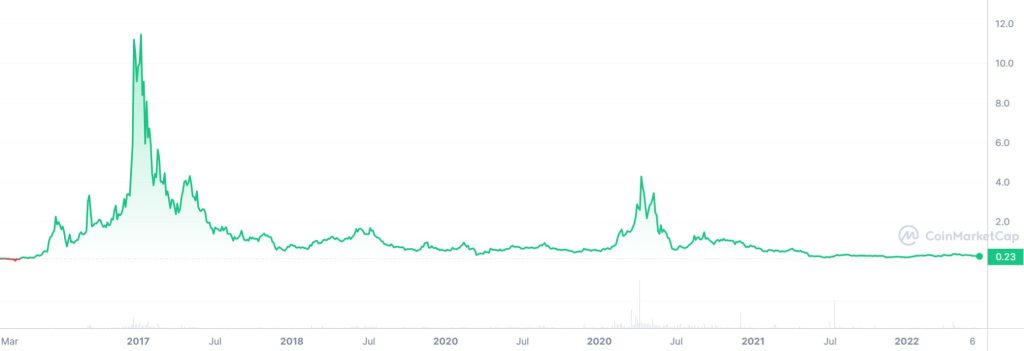

KMD Price All-Time Chart

Since its launch, KMD has seen growth in its market capitalization and price. As of June 19th, 2023, it is ranked at #448 on CoinMarketCap with a market cap of ~$32 million USD and a 24-hour trading volume of ~$1 million USD. In comparison to other cryptocurrencies, KMD’s price has been relatively stable over time with only minor fluctuations due to news or events related to the currency or the wider crypto market.

Looking ahead, there are several factors that could influence KMD’s future growth potential. The most important factor is likely to be the adoption of the AtomicDEX by businesses and individuals who recognize its value proposition as a secure way to transact online.

Decentralized Exchange AtomicDEX

This project has been at the heart of the Komodo Platform for over 5 years. The AtomicDEX is a revolutionary product that combines the convenience of a non-custodial wallet with the power of a decentralized exchange. It supports 99% of cryptocurrencies and offers the widest cross-chain trading support available on any DEX on the market.

AtomicDEX is available on desktop, mobile, and web, making it easy to access anywhere, anytime. With AtomicDEX users can send, receive, store, and trade various cryptocurrencies P2P without ever having to worry about their funds being held in a custodial account. The AtomicDEX Mobile App also offers secure multi-coin wallet functionality for added convenience. It’s mobile version is 100% open source showing the team’s dedication

Let's gooooo! 💪#cryptonews #bitcoinnews #opensource #technology #developers #github https://t.co/rBhl1sm99Z pic.twitter.com/8pBWMjukYs

— ⚛️ AtomicDEX (@AtomicDEX) March 27, 2023

Cryptic Future

Further development of the Komodo Platform could lead to increased use cases for KMD which could drive up demand for it in the long term. The EVM solution is a big change, but if it works, it could result in a number of positive developments. Any positive news related to cryptocurrency, in general, and specifically to Bitcoin could have a positive impact on KMD’s price movement going forward.

Overall, KMD appears to have strong fundamentals that make it an attractive investment option for those looking for stability mixed with risk in their portfolio with a large potential for growth in the long run. With its unique consensus mechanism and security features combined with increasing adoption by businesses and individuals alike, KMD looks set to remain an important player in the cryptocurrency space going forward.

Author Profile

- Ex-community moderator of the Banano memecoin. I have since been involved with numerous cryptocurrencies, NFT projects and DeFi organizations. I write about crypto mainly.

Latest entries

- December 9, 2024Stock MarketMaster the Time Value of Money Financial Concept

- November 18, 2024Stock MarketFinancial Ratios Guide to Measuring Business Performance

- November 11, 2024NewsWireLabour’s UK Budget: A Fiscal Smirk of Contempt for Working People

- October 25, 2024CryptoThe DAO Governance Battle Between Corporations & Blockchain Rebels